Need Help

If you need help setting up services or accessing your accounts, please call our Customer Care Team at 866.552.9172 during business hours (7 a.m. — 5 p.m. PST, M-F) or email us at CustomerCare@AgWestFC.com.

Location

If you need help setting up services or accessing your accounts, please call our Customer Care Team at 866.552.9172 during business hours (7 a.m. — 5 p.m. PST, M-F) or email us at CustomerCare@AgWestFC.com.

Location

If you need help setting up services or accessing your accounts, please call our Customer Care Team at 866.552.9172 during business hours (7 a.m. — 5 p.m. PST, M-F) or email us at CustomerCare@AgWestFC.com.

Securely update and exchange balance sheet information with your AgWest team.

Put your idle cash to work with a suite of banking services that sweeps funds between accounts. Fees apply.

AgWest Farm Credit’s 12-month outlook sees pear growers as breakeven to slightly profitable.

Drivers include softening prices and declining export growth.

12-Month Profitability Outlook

for 2023 Crop

Prices soften

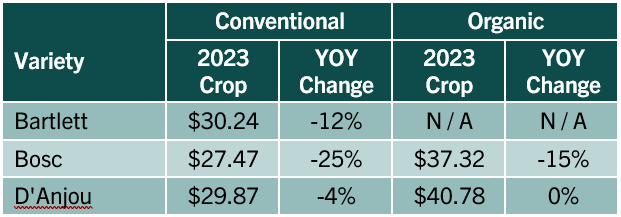

Average pear prices fell moderately for Bosc and D’Anjou varieties in the first quarter, largely due to the oversupplied apple market and to a lesser extent, mixed fruit quality. Pear prices often follow apple prices and Bosc pears didn’t sufficiently russet or develop rough, reddish-brown skin. Producers who sold early in the season benefited from higher prices and will fare better than their counterparts. With that said, average sentiment among producers is moderately favorable.

Season-to-date prices by variety

Source: WSTFA March 13, Weekly Summary Bulletin Report. N/A: Not Available. YOY: Year-over-year.

Export growth slows

Pear export growth is declining due to rising shipping costs and season-to-date levels are flat year over year. Low water levels on the Panama Canal, escalating conflict on the Red Sea and rising energy prices are impacting global shipping costs. Lower international demand could further soften prices. See our Crop Inputs Snapshot for more information.

Pear producers will likely see break-even to slightly profitable conditions over the next 12 months. Prices have softened; however, they remain high enough for many producers to achieve profitability. Export growth is slowing due to higher shipping costs and this may further soften prices.

For more information or to share your thoughts and opinions, contact the Business Management Center at 866.552.9193 or bmc@AgWestFC.com.

To receive email notifications about western and global agricultural and economic perspectives, trends, programs, events, webinars and articles, visit www.AgWestFC.com/subscribe or contact the Business Management Center.

.jpg?sfvrsn=a9df32fb_1)

.jpg?Status=Master&sfvrsn=ba5fe18_1)

AgWest supports customers with a wide range of industry and business management resources

Learn more