Need Help

If you need help setting up services or accessing your accounts, please call our Customer Care Team at 866.552.9172 during business hours (7 a.m. — 5 p.m. PST, M-F) or email us at CustomerCare@AgWestFC.com.

Location

If you need help setting up services or accessing your accounts, please call our Customer Care Team at 866.552.9172 during business hours (7 a.m. — 5 p.m. PST, M-F) or email us at CustomerCare@AgWestFC.com.

Location

If you need help setting up services or accessing your accounts, please call our Customer Care Team at 866.552.9172 during business hours (7 a.m. — 5 p.m. PST, M-F) or email us at CustomerCare@AgWestFC.com.

Securely update and exchange balance sheet information with your AgWest team.

Put your idle cash to work with a suite of banking services that sweeps funds between accounts. Fees apply.

AgWest Farm Credit’s 12-month outlook sees Northwest cherry growers as slightly profitable for the 2024 crop.

12-Month Profitability Outlook

Northern orchards damaged by cold weather

Anecdotal reports suggest freeze events in January caused damage to cherry trees and buds in northern Washington and British Columbia. The full extent is not yet clear. Crop insurance should help growers to a degree; however, benefits may be limited given multiple years of below-average returns. Benefits are calculated based on average returns for the previous five years. Lower supply from northern Washington and British Columbia could support prices.

Industry optimistic for 2024, but uncertainties remain

While orchards in northern Washington face winter damage, growers in other regions are cautiously optimistic heading into the 2024 season due to the following:

Consumer demand remains uncertain as persistently high inflation may discourage consumers from purchasing luxury food items such as cherries.

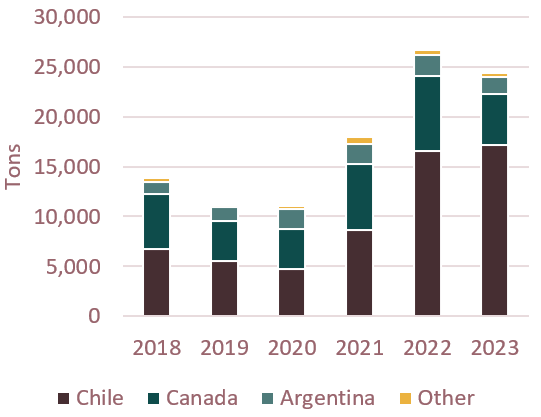

Imports from Chile increase

Imports from Chile increased slightly in 2023, which were nearly double the five-year average (see chart below). Chilean cherries do not compete with West Coast producers as they enter the U.S. between November and March. Some speculate increased supply during the offseason may shift consumers’ view of cherries from a luxury to a staple food item, which could ultimately increase demand in the long term.

Cherry imports

Source: U.S. Census Bureau.

Disaster declaration for Washington’s and Oregon’s 2023 cherry crop

Cherry producers throughout eleven counties in Washington and nine counties in Oregon are eligible to apply for U.S. Department of Agriculture loans following disaster declarations in each state. Cool, wet weather during the spring, followed by rapid heating and drought conditions, reduced yields on the 2023 crop.

Northwest cherry growers will likely see slightly profitable conditions in 2024. Cold weather damaged orchards in northern Washington and British Columbia, which could support prices. The industry is generally optimistic for the 2024 crop, given limited overlap with California and good growing conditions; however, high inflation remains a challenge and could reduce consumer demand. Rising imports from Chile may acclimate consumers to consuming cherries on a year-round basis. Disaster declarations in Washington and Oregon may help growers who were negatively impacted by weather events on the 2023 crop.

For more information or to share your thoughts and opinions, contact the Business Management Center at 866.552.9193 or bmc@AgWestFC.com.

To receive email notifications about western and global agricultural and economic perspectives, trends, programs, events, webinars and articles, visit www.AgWestFC.com/subscribe or contact the Business Management Center.

.jpg?Status=Master&sfvrsn=ba5fe18_1)

AgWest supports customers with a wide range of industry and business management resources

Learn more