Need Help

If you need help setting up services or accessing your accounts, please call our Customer Care Team at 866.552.9172 during business hours (7 a.m. — 5 p.m. PST, M-F) or email us at CustomerCare@AgWestFC.com.

Location

If you need help setting up services or accessing your accounts, please call our Customer Care Team at 866.552.9172 during business hours (7 a.m. — 5 p.m. PST, M-F) or email us at CustomerCare@AgWestFC.com.

Location

If you need help setting up services or accessing your accounts, please call our Customer Care Team at 866.552.9172 during business hours (7 a.m. — 5 p.m. PST, M-F) or email us at CustomerCare@AgWestFC.com.

Securely update and exchange balance sheet information with your AgWest team.

Put your idle cash to work with a suite of banking services that sweeps funds between accounts. Fees apply.

AgWest Farm Credit’s 12-month outlook sees the nursery/greenhouse industry as profitable.

12-Month Profitability Outlook

Purchase orders strong

Purchase orders are coming in strong, reflecting optimism among retailers. Most producers are optimistic about the 2024 season; however, some are concerned that persistently high inflation, among other economic headwinds, may lower demand later in the year.

Economic concerns grow

While 2023 has been a strong year, the industry is increasingly concerned that a weakening economy and housing market could lower 2024 sales. Rising delinquency rates on consumer loans and a falling savings rate suggest many consumers are financially stressed. Housing data is mixed, and while single-family home starts remain relatively strong, it is unclear how long this can last given persistently high interest rates. Further, existing home sales, an important source of nursery-greenhouse product demand, are falling. See the Quarterly Economic Update for more information on the economy and interest rates. Despite these headwinds, growers are generally well positioned for a downturn.

University of Michigan Consumer Sentiment Index

Source: University of Michigan

Consumer sentiment has gradually improved since mid-2022 and this may be supporting plant sales.

Plant growth strong

Nursery-greenhouse plants benefited from warm, sunny weather in March. A strong start to the growing season widens the timeframe for both plant growth and retail sales; however, it increases the risk of frost damage if cold weather returns.

Rising prices offset input costs

Input costs continue to rise across all categories, especially labor (see Crop Inputs Snapshot for more information). However, producers have been able to increase prices proportionally without experiencing pullback in consumer demand.

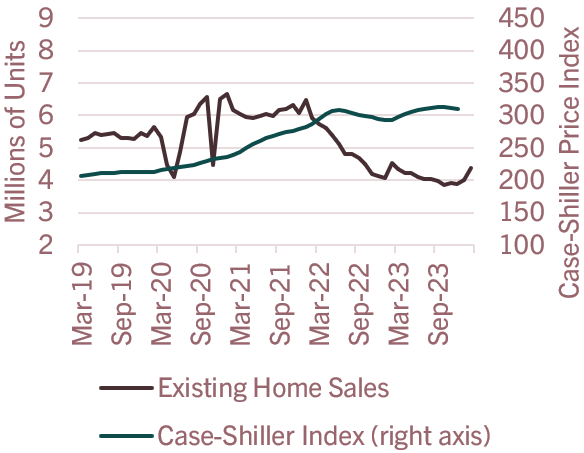

Existing home sales increase

Existing home sales have started to rebound (see chart below), suggesting strength in the housing market despite persistently high interest rates. Existing home sales are an important driver of nursery-plant sales.

Existing Home Sales and Price Index

Source: National Association of Realtors. Standard and Poor CoreLogic.

Existing home prices have started to flatten, potentially driving sales.

The nursery/greenhouse industry should be profitable over the next 12 months. Strong purchase orders and plant growth to date signal a favorable start to the season. Rising prices are offsetting increases in input costs. Existing home sales, a significant demand driver, appear to be rebounding.

For more information or to share your thoughts and opinions, contact the Business Management Center at 866.552.9193 or bmc@AgWestFC.com.

To receive email notifications about western and global agricultural and economic perspectives, trends, programs, events, webinars and articles, visit www.AgWestFC.com/subscribe or contact the Business Management Center.

View the latest AgWest Nursery/Greenhouse Industry Perspective

Learn more.jpg?sfvrsn=ba5fe18_1)

AgWest supports customers with a wide range of industry and business management resources

Learn more