Meeting Date: December 12-13, 2023

Federal Open Market Committee (FOMC) Meeting Results

FOMC meeting highlights:

- The Fed maintained its Target Fed Funds rate at the current rate of 5.25%–5.50%. This meeting’s vote was unanimous!

- The FOMC, which began to shrink its securities portfolio on June 1, 2022, announced it will continue reducing its holdings of Treasury securities agency debt and agency mortgage-backed securities, as described in the Plans for Reducing the Size of the Federal Reserve's Balance Sheet that it announced at the May 2022 FOMC meeting.

- The Committee emphasized that it is strongly committed to returning inflation to its 2% objective.

- The committee emphasized that the US commercial banking system is safe and sound.

Economic highlights:

Economic activity has slowed considerably since the 3rd quarter, job gains have moderated, but unemployment remains low.

- “Recent indicators suggest that growth of economic activity has slowed from its strong pace in the third quarter. Job gains have moderated since earlier in the year but remain strong, and the unemployment rate has remained low.

- Inflation has eased over the past year but remains elevated.

- The U.S. banking system is sound and resilient.

- Tighter financial and credit conditions for households and businesses are likely to weigh on economic activity, hiring and inflation.

- The extent of these effects remains uncertain. The Committee remains highly attentive to inflation risks."

Announcements:

Fed funds rate remains unchanged at a range of 5.25%–5.50%, and balance sheet reductions continue.

- “The Committee seeks to achieve maximum employment and inflation at the rate of 2% over the longer run. In support of these goals, the Committee decided to maintain the target range for the federal funds rate at 5.25% to 5.50%.

- The Committee will continue to assess additional information and its implications for monetary policy.

- In determining the extent of any additional policy firming that may be appropriate to return inflation to 2% over time, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.

- In addition, the Committee will continue reducing its holdings of Treasury securities, agency debt and agency mortgage-backed securities, as described in its previously announced plans.

- The Committee is strongly committed to returning inflation to its 2% objective."

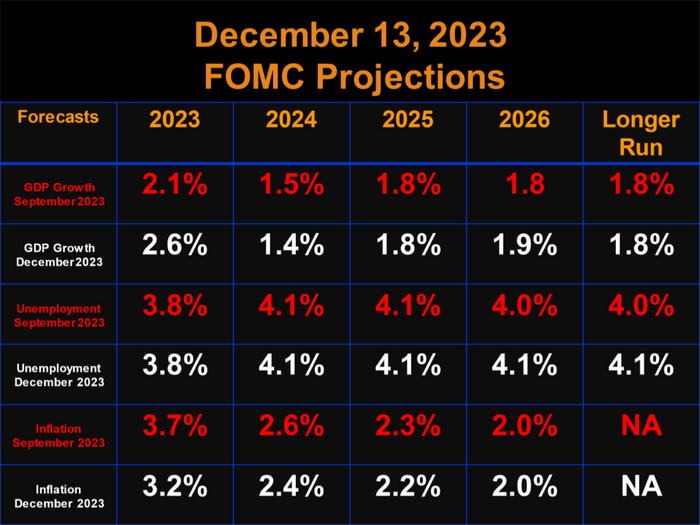

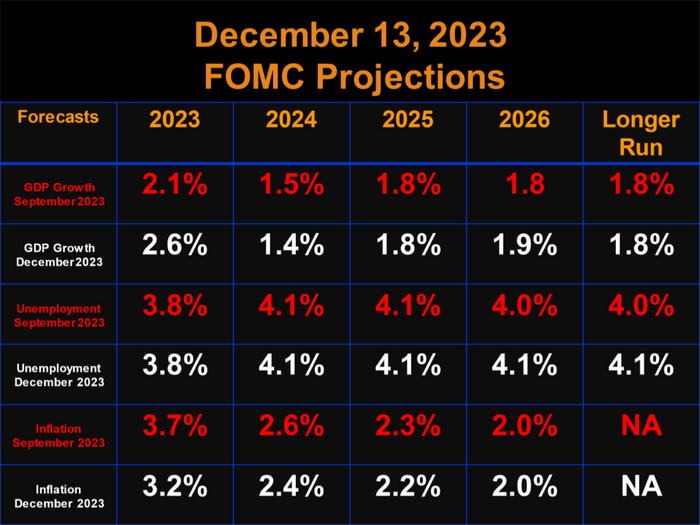

Summary of economic projections:

Economic projections from December 13, 2023, are shown in chart form below.

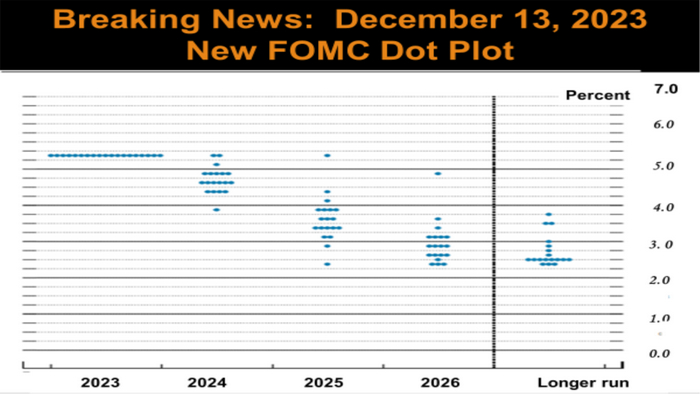

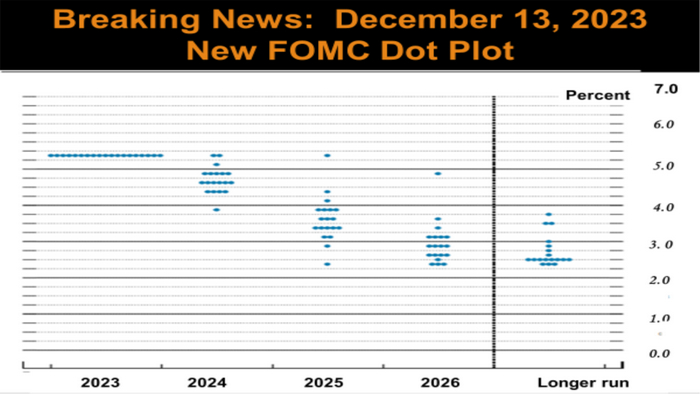

Interest rate forecasts:

The new dot plot from the December 13, 2023, FOMC meeting is shown below.

Implementation note:

The FOMC issued the following statement at the December 13, 2023, meeting.

The Board of Governors of the Federal Reserve System voted unanimously to maintain the interest rate paid on reserve balances at 5.4%

Voting results:

No dissenting votes

Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Michael S. Barr; Michelle W. Bowman; Lisa D. Cook; Austan D. Goolsbee; Patrick Harker; Philip N. Jefferson; Neel Kashkari; Adriana D. Kugler; Lorie K. Logan; and Christopher J. Waller.

Next meeting:

January 30-31, 2024