Returning profits to customers

As a stockholder of AgWest Farm Credit, you may be eligible to share in the profits of the cooperative through our patronage program.

AgWest’s profits are returned to the customer-owners we serve—farmers, ranchers, timber producers and commercial fishermen—as patronage dividends, significantly reducing total borrowing costs.

At each fiscal year-end, the Board of Directors evaluates whether to retain AgWest’s net income to strengthen our capital position or to distribute a portion of the net income to customers by declaring a qualified/cash patronage dividend.

Cash patronage is allocated among stockholders based on their eligible average daily loan balance and paid out during the first quarter of the new year for the previous calendar year. Assuming the association meets its financial goals and other factors do not adversely impact the association, the board’s objective is to annually declare cash patronage of 1.25% of a customer's eligible average daily loan balance.

The total amount of cash patronage declared is a direct reflection of the financial strength of the association. Prior to being established as AgWest Farm Credit on January 1, 2023, the two associations that merged, Farm Credit West and Northwest Farm Credit Services, each distributed cash patronage to customers equal to 1.25% of eligible average outstanding loan balances in 2021. Qualified/cash patronage distributions are intended to reduce our customers’ interest costs. It’s an extension of our commitment to the food, fiber, timber and fishing industries we serve and a significant financial advantage for our customers.

If you’d like more information about our patronage program, visit our financial highlights page to view annual reports for Northwest FCS and Farm Credit West. You can also review annual reports for the Federal Farm Credit Banks Funding Corporation, the disclosure agent for the Farm Credit System.

If you have questions about our patronage program, contact your local branch or a member of your lending team.

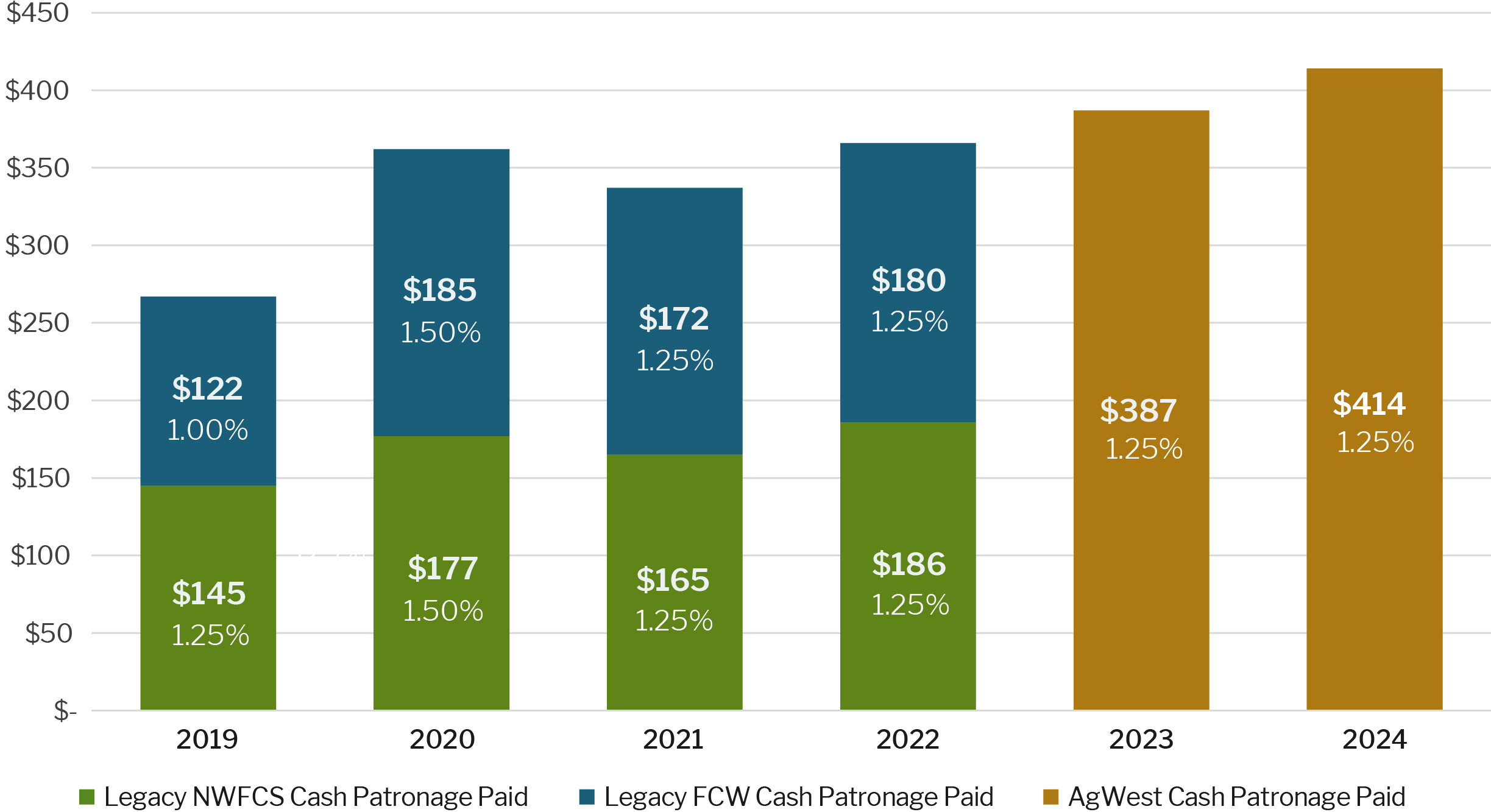

Patronage history ($ in millions)

In 2020, the legacy NWFCS Board approved a special increase in cash patronage from 1.25% to 1.50% to assist in the challenges customer-members faced.

In 2020, the legacy FCW Board approved a special relief payment in cash patronage of 0.50% to assist in the challenges customer-members faced.

In 2021 and 2022, the legacy FCW Board approved a supplemental payment in cash patronage of 0.25%.

FAQ:

A patronage dividend is a way of allocating AgWest's net income to its customer-members. Customer patronage allocation is based on the proportion of the average annual balance of the customer’s eligible account(s) as a percentage of the total average balances of all patronage-eligible account(s) at AgWest.

Each year’s patronage distribution is comprised of two components: (1) a cash payment to the customer (a “qualified” distribution) and (2) a non-cash (“nonqualified”) portion that is retained by AgWest and becomes a part of the association’s retained earnings. A qualified/cash patronage dividend is a way to reward you for contributing to the association’s financial success.

Since AgWest allocates patronage based on the average annual balance of the customer’s loans/leases, the more you have financed with AgWest, the larger your potential patronage dividend.

Your qualified/cash patronage distribution reduces the cost of doing business with AgWest, a member-owned cooperative. You’re able to borrow at a competitive interest rate, plus you may be able to receive a qualified/cash patronage dividend. Indirectly, the cash dividend lowers your effective interest rate.

Customers are obligated to make an investment in the association. Depending on a customer's eligibility, they will be issued voting stock or participation certificates.

Yes. In January of the year following your receipt of a cash patronage distribution, AgWest will send you IRS Form 1099, showing the total of all qualified/cash patronage distributions issued to you during the previous year. The nonqualified portion of the patronage allocation will not be reported as taxable income.

If the Board of Directors approves payment of a qualified/cash patronage dividend from a particular year’s earnings, the qualified/cash portion of your patronage dividend is paid to you, typically in February of the following year.

No. Because AgWest operates very efficiently as a member-owned cooperative, we are able to offer very competitive interest rates and a patronage dividend.

AgWest offers competitive rates while ensuring the long-term financial health of the cooperative. With the cyclical nature of the ag economy, AgWest is committed to generating reliable earnings to build capital and fund loss reserves, which enables us to support our customers through both prosperous and more challenging times. Our solid financial strength – built with earnings, reserves and capital – also helps lower our funding costs, and these savings are passed on to our customers. Cash patronage is a key cooperative principle, allowing us to maintain a strong financial profile, minimize funding costs and return a healthy portion of net earnings to our customer-members.

The long-term viability of AgWest depends on building capital to fund growth or other credit services needed by customers. By maintaining nonqualified patronage distributions in its retained earnings account, AgWest is building the necessary capital to enhance its ability to continue as a dependable and reliable provider of credit to agriculture.

Patronage distributions issued in the form of nonqualified notices can only be retired, or paid to members, upon approval of the board. The board has no plans to pay/revolve these nonqualified amounts.

No. Loans for home mortgages and leases are based on different market forces and are not eligible for the program.

Cash Patronage dividends are paid in accordance with cooperative principles and on an equitable and non-discriminatory basis in following the requirements of the Bylaws, the Act, applicable FCA regulations, and applicable terms of the Internal Revenue Code.

IN THIS SECTION

![]()