Farm Credit continued strong support of ag-related organizations in 2023

In 2023, Farm Credit was again the largest provider of credit to U.S. agriculture from coast to coast, but its support for the farming and ranching community went much deeper than that. Because Farm Credit is also committed to the long-term viability of agriculture and rural communities, the farmer-owned cooperative is proud to support nonprofits working to preserve and protect California agriculture.

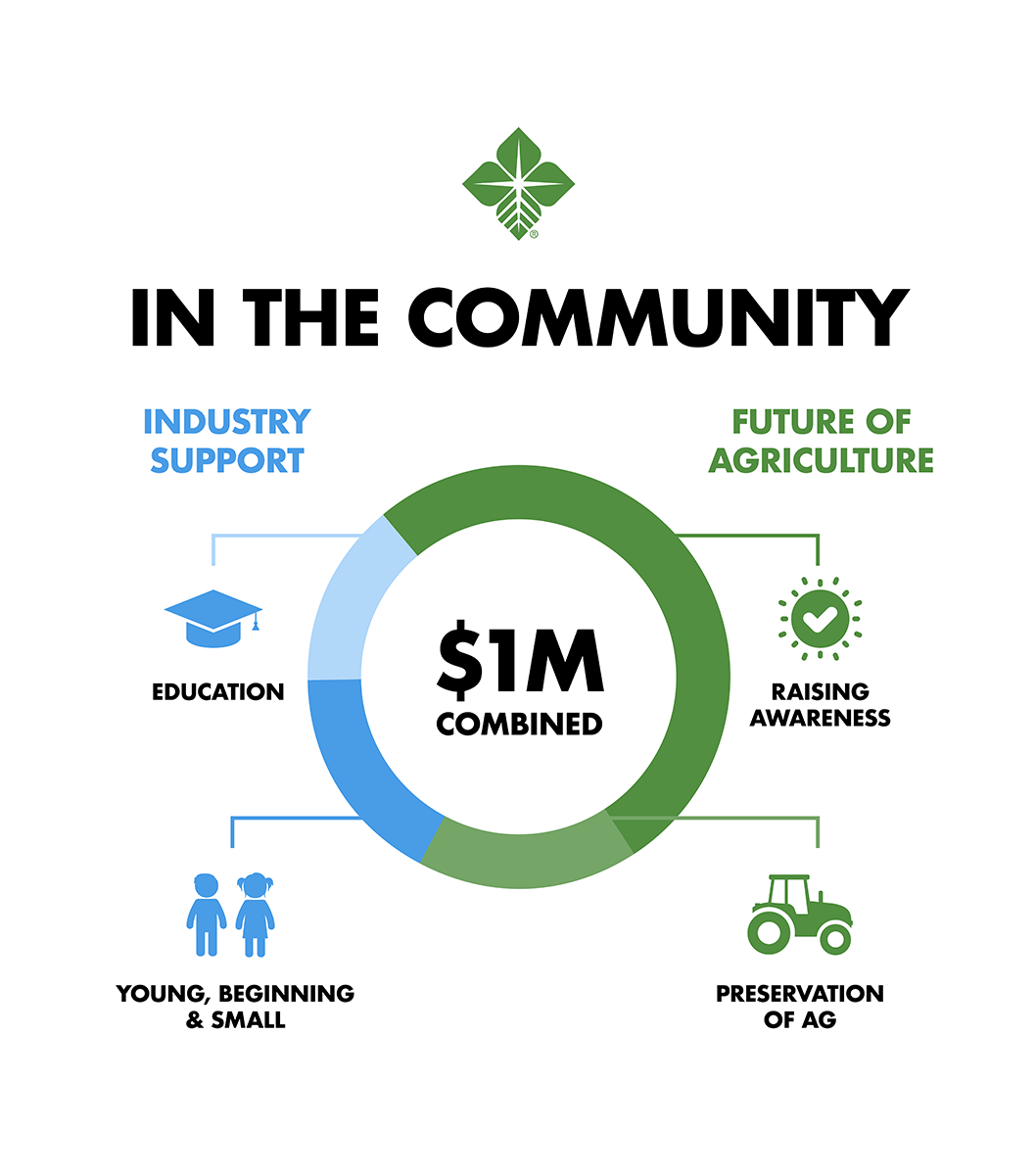

Last year, all seven Farm Credit associations operating in California – AgWest Farm Credit, American AgCredit, CoBank, Colusa-Glenn Farm Credit, Fresno Madera Farm Credit, Golden State Farm Credit and Yosemite Farm Credit – collaborated to contribute more than $900,000 to over 130 agricultural-oriented organizations around the state.

The funding supports farming and ranching in four main areas – raising awareness of agriculture, preservation of agriculture, education and research, and support for young, beginning and small farmers.

“Farm-related organizations such as the ones Farm Credit supports are doing a great job advocating for and supporting farmers and ranchers,” said Kevin Ralph, California State President for AgWest Farm Credit. “Investing in their work is helping the industry thrive today and will ensure it can continue providing food for the nation and the world in the years to come.”

Jacob DeBoer, Regional Marketing Manager with American AgCredit agreed.

“Farm Credit is proud to support these organizations which, like Farm Credit itself, are working to ensure current and future producers are able to achieve their goals, protect their legacies and grow the industry’s next generation,” DeBoer said.

The bulk of the contributions – nearly $500,000 – was directed to organizations that raise awareness through a variety of methods. Two of those nonprofits were Western United Dairies and the Almond Alliance.

Western United Dairies is the trade organization representing more than 75% of the milk produced in California. Farm Credit supports the group’s Dairy Leaders Program, which selects dairy professionals to participate in a months-long program to learn about the state and federal legislative and regulatory processes, how milk products are marketed, and ways they can communicate effective messages about the industry.

The Almond Alliance, meanwhile, is the advocacy voice for the $5.62 billion almond industry, which in 2023 focused on issues vitally important to almond growers, including supply chain breakdowns that limited exports to Asia and efforts to upgrade the state’s aging water infrastructure and how it is managed.

Farm Credit is also a strong supporter of groups seeking to preserve agriculture in the Golden State, donating over $150,000 to organizations involved in that cause. Two organizations that benefitted were the Farmland Trust and the Rangeland Trust, which both purchase conservation easements to allow farms and ranches to continue in operation without fear of future development. Farm Credit sponsors major fundraising efforts for each organization, which helps them stem the loss of an average of 50,000 acres of ag land every year in the state.

Education and research is a third Farm Credit priority, receiving over $150,000 in 2023. Organizations receiving support included the Small Farm Conference, organized by the Community Alliance with Family Farmers, and the Latino Farmer Conference, sponsored by the National Center for Appropriate Technology and the USDA’s Natural Resources Conservation Service.

The Small Farm Conference provides an invaluable opportunity for smaller operators to network and receive advice and formal training in issues specifically affecting them, while the Latino Farmer Conference, conducted entirely in Spanish, provides a wide range of information for beginning and seasoned small farmers.

Finally, Farm Credit continues to strongly support programs to nurture the next generation of farmers and ranchers to ensure the future of agriculture in California, donating over $125,000 to organizations such as the Center for Land-Based Learning and the California Farm Bureau’s Young Farmers and Ranchers program.

The Young Farmers and Ranchers program is designed to identify, grow and develop young Farm Bureau members and provide them with opportunities and experiences to help them become effective leaders in the agriculture community.

The Center for Land-Based Learning’s FARMS Leadership program is designed to introduce, train and recruit about 200 high school students from major farming regions for college and career opportunities in agriculture and environmental science.

About Farm Credit:

Farm Credit, American AgCredit, CoBank, Colusa-Glenn Farm Credit, Fresno Madera Farm Credit, Golden State Farm Credit and Yosemite Farm Credit are cooperatively owned lending institutions providing agriculture and rural communities with a dependable source of credit. For more than 100 years, the Farm Credit System has specialized in financing farmers, ranchers, farmer-owned cooperatives, rural utilities and agribusinesses. Farm Credit offers a broad range of loan products and financial services, including long-term real estate loans, operating lines of credit, equipment and facility loans, cash management and appraisal and leasing services…everything a “growing” business needs. For more information, visit www.farmcreditalliance.com.