Shipping disruptions ease

Agriculture exports out of West Coast ports totaled $61.7 billion in 2024. This time last year the shipping industry faced massive disruptions that led to reduced capacity, long delays and higher costs. Conditions have improved in both the Panama Canal and Red Sea, which has led to greater shipping availability and reduced costs for West Coast producers.

Background on 2024 shipping

The Panama Canal faced severe drought conditions in the first half of 2024, which led to shipping being limited by one-third. Attacks in the Red Sea forced shipping companies to reroute to the Cape of Good Hope along the southern coast of Africa, which went from transiting less than 15% of ocean shipping to 85%. This led to the average price of a 40-foot container increasing by over 100% compared to 2023, with the Baltic Dry Index up 25%.

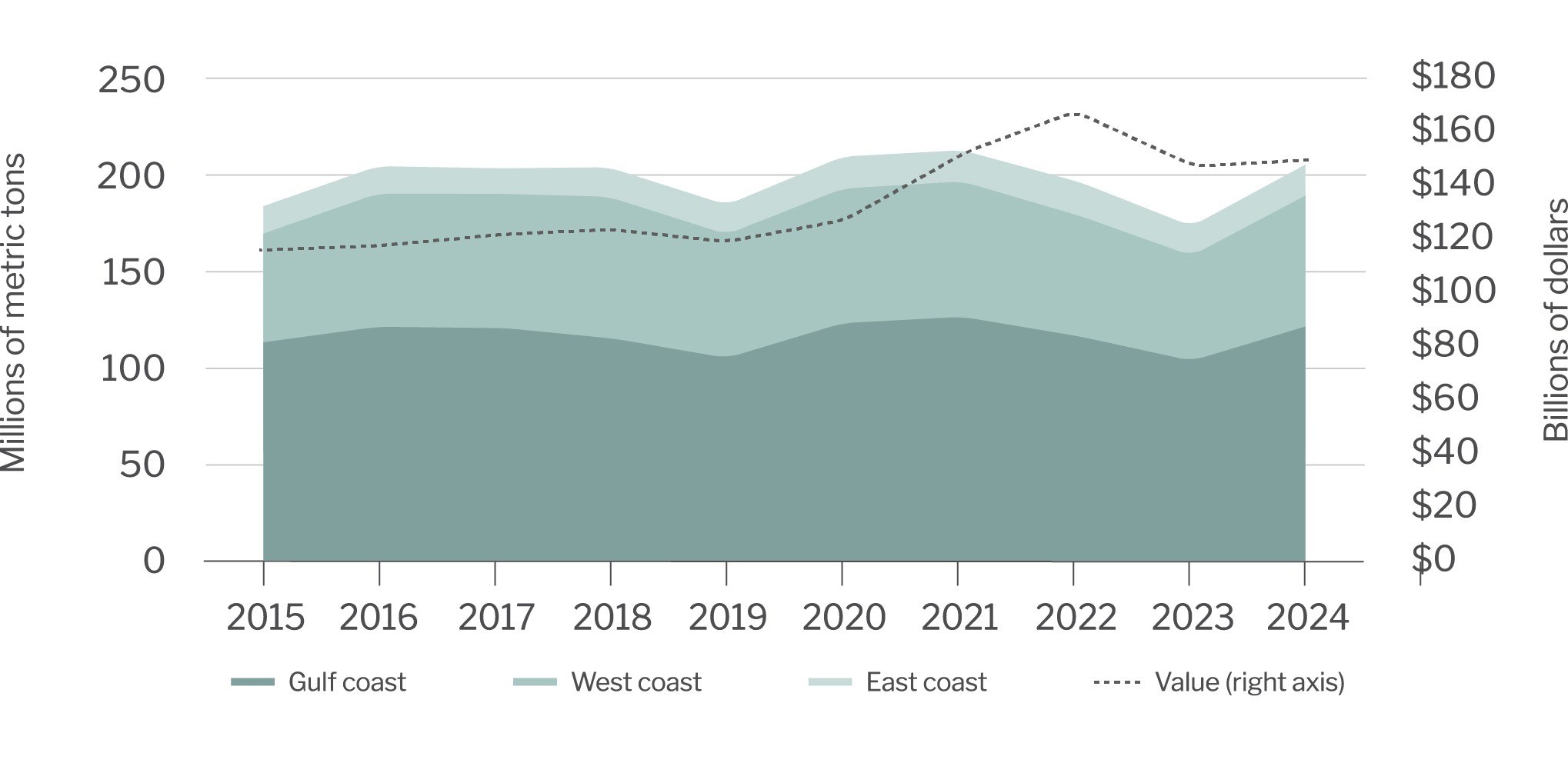

Agricultural exports by port district region

Source: U.S. Census Bureau. Data does not include Great Lakes region.

The state of ocean shipping in 2025

Drought in the Panama Canal has eased due to heavier rains over the past few months and conditions should remain stable with more precipitation anticipated going forward. In the Middle East, Israel and Hamas have agreed to a six-month ceasefire, leading the rebel Houthi group to stop attacks on non-Israeli shipping vessels. While this could eventually return shipping volumes to normal in the Red Sea, the top three container shipping companies indicated they will wait until the situation becomes more stable.

Looking to the future

Export markets are important to U.S. producers, as U.S. agriculture exports totaled $197.4 billion in 2022 with over 70% transported through ocean ports. Improving shipping conditions may lower transportation costs and improve export capacity for producers at a time when low commodity prices and elevated input costs are compressing margins. However, there are still risks on the horizon including the following:

- Geopolitics in the Middle East: Despite the ceasefire, the impact on prices and delays will last as long as shipowners are wary of sending vessels through the Red Sea. With limited capacity, prices will continue to linger higher. If the situation continues to improve, traffic through the Red Sea will likely increase and lower shipping costs for exporters.

- Economic uncertainties: Forecasts vary, but most expect some level of global economic deceleration in 2025. While this may challenge many businesses, it may also improve shipping availability for agriculture producers.

- Workforce shortages: Like many industries, shipping is facing a shortage of labor with an expected 89,000 positions to be open in 2026. Shortages are amplified in skilled positions such as IT specialists and engineers. Recent labor strikes are also a concern.

Return to Community Stories home page.