Market Update Q2 2023

Executive summary

The Federal Open Market Committee left the Fed Funds target rate unchanged in June but signaled additional tightening may be appropriate later in the year. Expectations for a mild recession in 2024 are rising, as the federal government avoided a budget crisis, stress within the commercial real estate sector is increasing, foreign central banks continue to raise interest rates and the global economy is decelerating.

Federal Reserve pauses rate hikes

The Fed followed the 25-basis point rate hike in May with a “hawkish pause” on June 14. The Fed’s dot plot indicates the new median forecast for the Fed Funds rate in 2023 is 5.625%, an upward revision of 50-basis points. This revision likely leads to two more 25-basis point rate hikes, which will most likely be spread out over the remainder of 2023. This is in sharp contrast to the pace of previous Fed decisions, where rate hikes occurred at almost every meeting. Pauses are set to become the new norm and will drive rate volatility as markets position themselves for changes in the Fed Funds rate. Markets are beginning to show a high probability of a hike at the July 25-26 meeting and an expected pause at the following meeting on September 19-20. A tight labor sector coupled with elevated core inflation (see sections below) are fueling hawkish comments (indications of future rate hikes) by the Fed. Policymakers believe supply and demand imbalances could threaten the Fed’s mandate to bring down inflation. The Fed expects credit conditions to tighten for households and businesses, which will weigh on economic activity, hiring and inflation. There is no clear indication what the extent of the credit tightening may be, but the Fed is determined to meet its goal of maximum employment and 2% inflation. To achieve this, the Fed weighs inflation against labor market data to guide monetary policy decisions while also continuing to reduce the Fed’s balance sheet (quantitative tightening) at a rate of about $95 billion per month.

Mild recession expected

Most economists believe a mild recession will now occur in 2024 which is in line with market expectations as futures contracts point to the first-rate cut occurring at that time. A recession coupled with declining inflation, rising unemployment and banking sector stress may pressure the Fed to adjust course to avoid overtightening. The Fed may keep rates higher for longer if inflation lingers, unemployment remains sticky and/or economic activity continues to advance. The Fed forecasts unemployment rising to 4.1%, GDP expanding by 1.0% and inflation increasing by 3.9% for 2023.

U.S. government avoids budget crisis

The Fiscal Responsibility Act of 2023 suspended the debt ceiling through 2024 and set statutory caps on discretionary spending through fiscal year 2025. Other components of the Act include preserving climate provisions of the Inflation Reduction Act, rescinding unused COVID relief funds, modestly expanding work requirements for some government assistance programs, and terminating student loan forbearance on August 30. In addition, setting budget totals through 2025 significantly reduces the likelihood of a government shutdown. However, Congress must still pass a budget to fund the government for fiscal year 2024 which begins on October 1.

Commercial real estate sector stressed

The office space segment within the commercial real estate sector is under pressure due to elevated interest rates and reduced occupancy rates. Valuations are down and lenders with significant exposure in this space may suffer losses. Many economists believe the sector has strong fundamentals outside the office space segment.

Foreign central banks raise interest rates

Persistently high inflation has renewed global central banks’ appetite for increasing interest rates. The European Central Bank raised interest rates by another 25 basis points to 3.5% this month. Canada and Australia surprised markets by raising rates 25 basis points this month, signaling further increases may be necessary. On June 22, the Bank of England unexpectedly raised rates by 50 basis points to the highest level since 2008. In contrast, the Bank of Japan (BOJ) maintained its ultra-loose monetary policy and yield curve control program. BOJ’s view is that inflation will slow over the coming months and tightening financial conditions could cause unwanted economic damage.

Global economy decelerates

Global growth is decelerating, with estimates between 2.8 – 3.0% for 2023 (approximately 15 – 20% below 2022). In Europe, a sharp rise in interest rates and persistently high inflation have led to banking stress and lower economic activity. The war in Ukraine continues to escalate, which has several implications. Trade patterns and geopolitical alliances are shifting, energy supply will remain tight in Europe and critical resources within North Atlantic Treaty Organization (NATO) countries may be diverted towards military purposes. These trends all support higher inflation and regional instability. Russia’s capacity to withstand a prolonged conflict appears high as economic growth is better than initially estimated (the International Monetary Fund predicts growth of 0.7% for Russia in 2023). The ruble has also strengthened beyond prewar levels and polls suggest strong internal support for President Putin.

Economic activity in China is underperforming expectations following its reemergence from COVID-19 lockdowns, but China’s economy remains strong relative to most countries. China’s economic growth accelerated to 4.5% in the first three months of 2023 compared to the same period in 2022. While exports were strong to start 2023, they fell 7.5% in May as demand from the U.S., Japan, France, Italy and Southeast Asia declined. This is a challenge for Chinese manufacturers trying to make up for the weak domestic demand.

Interest rates review

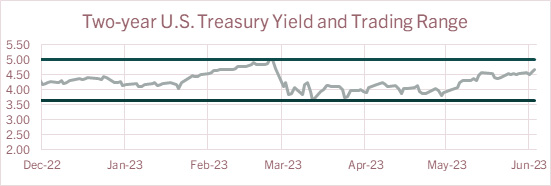

| U.S. Treasury Yields | The two-year U.S. Treasury yield has steadily climbed over the last quarter and is now trading toward the March highs. Shorter-term yields will remain sensitive to expected monetary policy action (or in-action). The spread between the 2-year and 10-year Treasury yield moved to around 91 basis points, just 16 basis points shy of the historical March levels. The Fed’s rapid increase in front-end rates is mainly driving an inversion of the yield curve, which is unlikely to normalize until the next rate-cutting cycle.

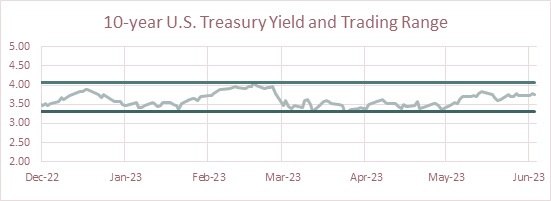

The six-month trading range for the 10-year Treasury yield is 3.30%-4.07%. There is upward pressure on the 10-year yield as inflation remains elevated and data suggests a robust economy. The 10-year Treasury yield is forecasted to be around 3.39% by year end, just above the lower trading range. Market forces are more impactful than Fed policy for treasuries with longer maturity dates. It's widely expected these rates to move in line with future economic expectations.  |

Economic highlights

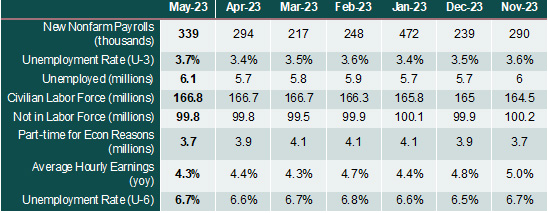

| Employment | Nonfarm payrolls continue to grow and exceed survey expectations for 14 consecutive months. Payrolls increased 339k in May. There were also upward revisions of 93k over the previous two months. Education and health services hiring led the gains with 145k new jobs in May. Year-to-date, these sectors have added a total of 707k new positions, or 45% of total new jobs. Professional and business services and the government sectors were also notably robust. Despite gains in payrolls, unemployment numbers edged higher in May. The unemployment rate and the number of unemployed persons increased by 0.3% (to 3.7%) and 440k (to 6.1 million), respectively. The uptick was due to a 310k decline in household employment while the labor force increased by 130k. The labor force participation rate was unchanged at 62.6%. The broader measure of unemployment that encompasses discouraged workers and those holding part-time jobs for economic reasons edged higher to 6.7%. Average hourly earnings increased to $33.44 in May, representing a 4.3% year-over-year increase in nominal terms. However, the average number of hours worked fell from 34.4 hours to 34.3 hours which resulted in weekly earnings ticking lower. The slight decline in labor hours coupled with the surge in hiring may indicate labor hoarding as businesses may opt to cut hours rather than lay off employees. Aggregate wage growth (a major focus for the Fed) cooled in May. Leading indicators suggest the labor market remains tight with only hints of cooling. Initial and continuing weekly jobless claims are steady but trending slowly higher. The spike earlier this month subsided after one state cleaned up fraudulent claims while other states may be looking into potentially fraudulent claims. Job openings have trended lower from peak levels reached in March 2022. Overall, the continued resilience of the labor market provides the Fed the ability to consider additional rate hikes later in the year.

|

| Economic Growth | Gross Domestic Product: The second estimate for 2023 Q1 real GDP showed the U.S. economy expanded 1.3%, a slightly higher revision from the preliminary estimate. Stronger consumption readings late in the quarter drove the upward revision. Increases in consumer spending, exports, federal government spending, state and local government spending, and nonresidential fixed investment were partly offset by decreases in private inventory investment and residential fixed investment. Corporate profit was one of the factors that weighed on income in Q1 2023. Profits came in modestly weaker than expected, declining 5.1% or by $151 billion. The level of corporate profits is still 15% ahead of pre-pandemic levels, but profit growth has slowed since peaking in the second quarter of last year. Weaker profit readings were broad based. Domestic financial profits decreased $25.4 billion in the first quarter while domestic nonfinancial profits decreased $109.3 billion. Rest-of-the-world profits (net) decreased $16.4 billion. Lower profits and heightened economic uncertainty may leave businesses with less means and desire to make new investments. In addition, elevated inflation may continue to pressure profitability if businesses find it more challenging to pass costs on to consumers. Overall, the upward revision to Q1 GDP does not change the narrative for the current state of the economy as incoming data continue to show the U.S. economy is expanding at a sub-trend rate of growth.

|

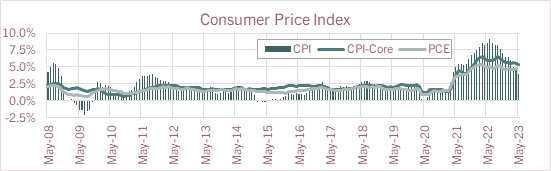

| Consumer Inflation | Consumer Price Index (CPI): Compared to the prior month, consumer inflation eased in May, rising 0.1% after a 0.4% gain in April. Gasoline prices fell 5.6% on a seasonally adjusted basis, while energy services fell for a fourth consecutive month. After holding steady for the last two months, food prices rose 0.2% with increases for both food away and at home (0.5% and 0.1%, respectively). Over the past 12 months, grocery prices have increased 5.8%, still lofty by the past decade's standards, but not as rampant as last summer when price gains were north of 13%. Excluding food and energy, the core CPI rose a much stronger 0.4% compared to the CPI. An increase in used auto prices and steady inflation for core services propped up the core CPI. Prices for used cars and trucks rose 4.4%, matching April's gain. Excluding this category, core goods prices were flat for the month. Household furnishings and supplies were down 0.4% in May and prices for recreation commodities were flat. Over the past year, core goods, excluding used vehicles, are up 3.7%, the smallest 12-month gain since the summer of 2021. Core services inflation was 0.4% with owner’s equivalent rent, the largest component of core, also up 0.5% month over month.

|

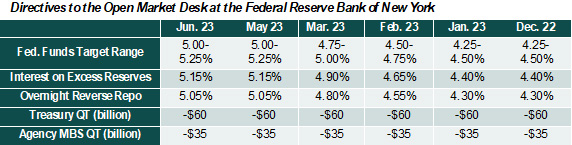

| Monetary Policy | The table below summarizes recent decisions regarding monetary policy action by the Federal Open Market Committee. The next FOMC meeting is July 26-27. Federal funds futures indicate a 75% chance for another 25-basis point rate increase and then hold for the remainder of 2023.

|

The above commentary is a summary of select economic conditions prepared for AgWest Farm Credit management. It is being shared as a courtesy. As with any economic analysis, it is based upon assumptions, personal views and experiences of those who provided the source material as well as those who prepared this summary. These assumptions, conclusions and opinions may prove to be incomplete or incorrect. Economic conditions may also change at any time based on unforeseeable events. AgWest assumes no liability for the accuracy or completeness of the summary or of any of the source material upon which it is based. AgWest does not undertake any obligation to update or correct any statement it makes in the above summary. Any person reading this summary is responsible to do appropriate due diligence without reliance on AgWest. No commitment to lend, or provide any financial service, express or implied, is made by posting this information.

.jpg?sfvrsn=e8bfac6b_0)