Market Update Q4 2023

Executive summary

In 2023, the U.S. economy proved to be much more resilient than forecasters expected. While some economists predicted a recession during the second half of the year, the economy grew by 4.9% during Q3 2023, which was the strongest quarter since Q4 2021. Consumer spending fueled this growth, which reflected solid employment and wage growth. Meanwhile, consumer inflation stabilized at a level below the federal funds rate, which allowed the Federal Reserve (Fed) to stop tightening monetary policy. While the market expects GDP in Q4 2023 to slow to 1%-2%, most economists are not concerned as the Q3 growth rate was not sustainable.

Tight monetary policy weighs on growth

Higher interest rates and quantitative tightening (the process of reducing market liquidity by allowing Fed bond holdings to mature) weighed on both the service and manufacturing sectors in 2023. The housing market faced significant headwinds with the average 30-year fixed rate hitting 8.1% in October. As 2024 gets underway, the market outlook calls for the economy to expand by 1.5%-2.0%, which is weaker compared to the projected growth rate of 2.4% for 2023 (the advanced estimate for 2023 GDP growth will be released January 25, 2023). Many analysts expect consumer and government spending to remain the primary contributor to growth; however, rising unemployment (forecasted to reach 4.1% by mid 2024) is a headwind. Consumer loan delinquencies, while low relative to historical averages, are rising and may reflect financial stress. The housing market may strengthen if mortgage rates, which recently dropped below 7%, continue to decline. Economic growth could be negatively impacted if monetary policy remains restrictive for too long.

Monetary policy likely to ease in 2024

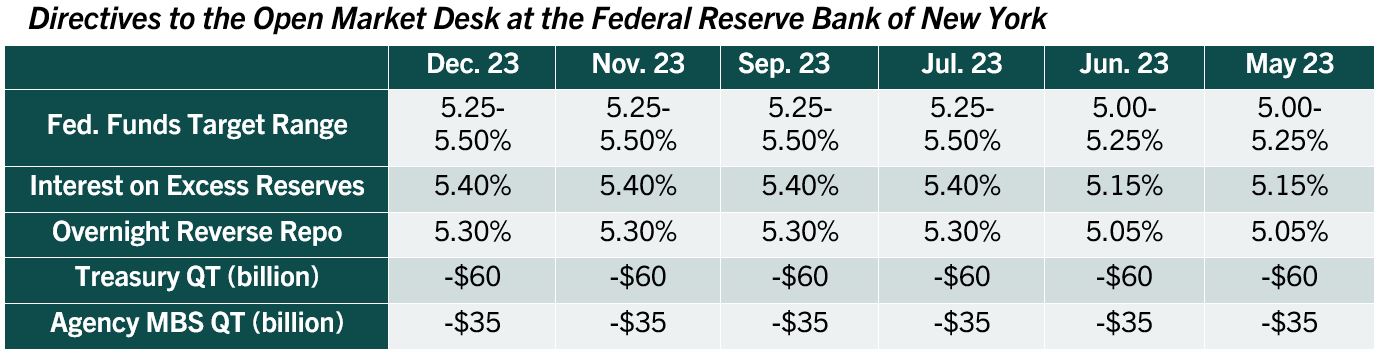

Inflation, employment and economic growth appear to be cooling (see tables below), leading investors and traders to expect an easing of monetary policy by the Fed in 2024. The last rate hike occurred in July 2023, when the federal funds rate rose by 25 basis points to the target range of 5.25% to 5.50%. Recent federal funds futures are forecasting cuts totaling 125 to 150 basis points, with the first one occurring at the March FOMC meeting. The Fed is less aggressive in their guidance, projecting 75 basis points in rate cuts with the first one likely a mid-year event. Since September 2022, the Fed has reduced its bond holdings by up to $95 billion per month (currently valued at $7.25 trillion). Policymakers may slow this rate to improve market liquidity. If the economy remains stronger than forecasted and inflation turns higher (upward pressure in service sector prices remains a factor), the Fed could keep policy rates higher for longer.

Lack of an approved federal budget creates uncertainty

Congress is actively working to craft legislation on a full-year budget to avoid a federal government shutdown, which is looming. A lack of progress could result in a budget crisis and more stop-gap solutions as leaders struggle with spending levels and market uncertainty increases.

Global economic growth faces headwinds

Global growth may struggle as central banks for the Eurozone and United Kingdom remain focused on driving inflation down by holding rates higher for longer. Geopolitically, disruptions in the Red Sea shipping lanes due to attacks on cargo ships by Houthi rebels are forcing shippers to find alternate, more expensive and longer routes to deliver goods to market. Their actions also work to destabilize the region. So far, oil prices have been relatively stable despite unrest. Furthermore, a severe drought hitting Central America has reduced ship crossings through the Panama Canal by about a third. The increased delay in international shipping is renewing fears of supply chain shortages and higher goods costs. The Russia-Ukraine war remains active, but global markets have developed strategies to deal with the natural resource shortages and uncertainty.

Interest rates review

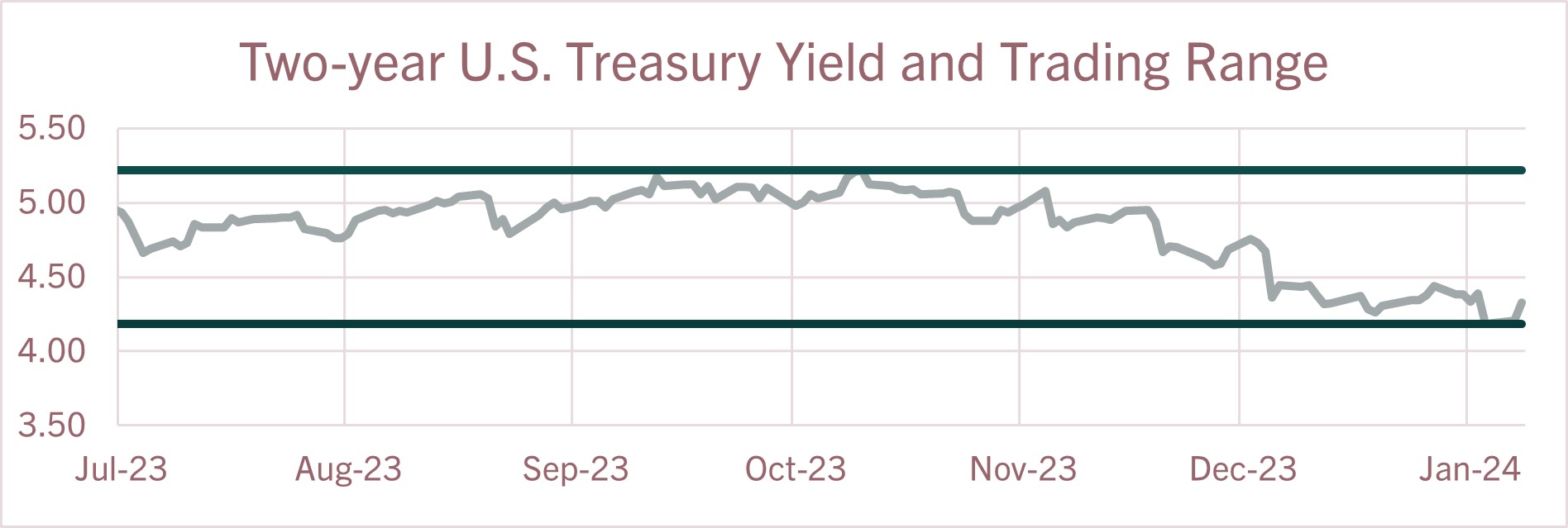

| U.S. Treasury Yields | The recent trading range for the 2-year Treasury yield is 4.18% to 5.22%. The two-year yield started trending lower in November as data suggested monetary policymakers had done enough to bring inflation under control and the federal funds rate had reached its terminal rate for this policy tightening cycle. Anticipation of five to six 25 basis point rate cuts in 2024, possibly starting in March, helped push yields lower. It is possible the market is getting ahead of the Fed’s timeframe so policy rates may not move down as fast as the market expects. As short-term yields move lower look for the yield curve to move positive as the Fed begins executing a policy shift.

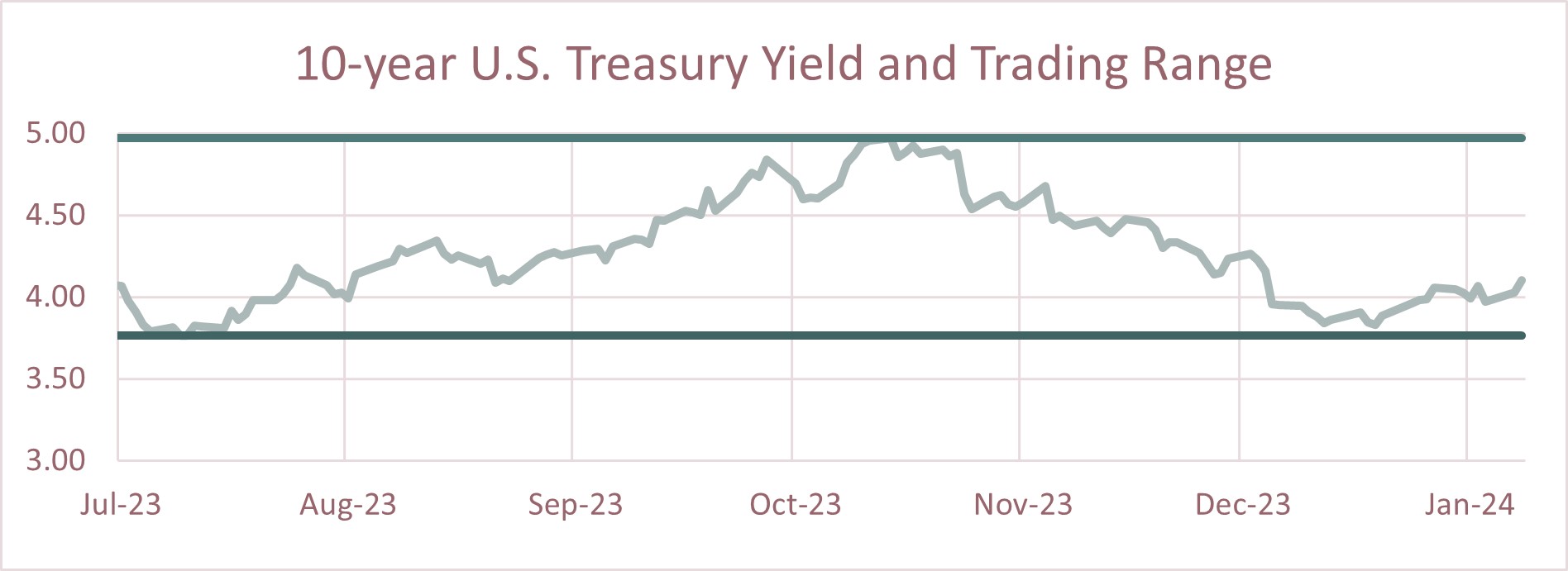

The trading range for the 10-year Treasury yield is 3.77% to 4.97%. The run-up in yields from July to October reflected the perception that inflation was going to be much more difficult to bring down as the U.S. economy expanded by 4.9% during Q3 2023. The economy appeared to be losing momentum in Q4 and the rate of inflation subsided, which caused investors to reconsider their outlook and the yield dropped to a low of 3.77%. The slope of the yield curve may steepen as yields are slower to descend as the market contends with the reality of a $1.5 trillion Federal budget deficit, $10 trillion in U.S. Treasuries maturing over the next one to two years and $95 billion in monthly quantitative tightening by the Fed.  |

Economic highlights

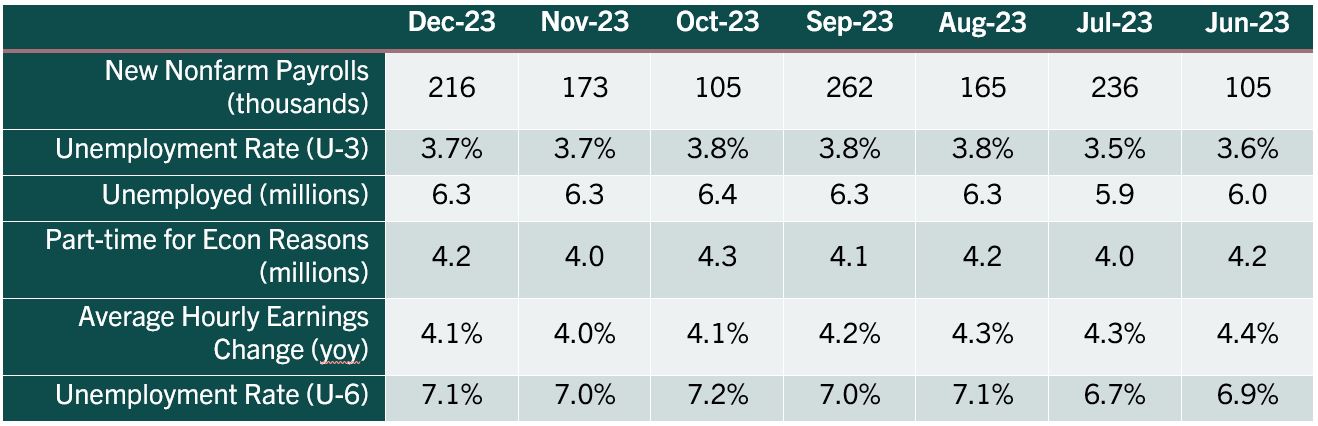

| Employment | Nonfarm payrolls expanded by 216,000 for December, which exceeded market expectations. The new jobs level is sufficient to support the current rate of unemployment. The labor sector has been much more resilient than economists expected given 525 basis points in monetary tightening. However, nonfarm payrolls have been on a gradual downtrend as the 12-month rolling average has decreased every month since February 2022, except for January 2023. Education and health services, government employment, and leisure and hospitality sectors continue to lead job growth. The unemployment rate for December was steady at 3.7% as the household survey indicated total employment fell by 683,000 compared to a labor force decline of 676,000, resulting in 7,000 more unemployed, which was not enough to move the jobless rate. The labor force participation rate, which includes those working or actively looking, dropped 0.3 percentage points to 62.5%. It was the largest single month decline in nearly three years. The broader measure of unemployment that encompasses discouraged workers and those holding part-time jobs for economic reasons rose 0.1 percentage points to 7.1%. Average hourly earnings increased to $34.27 in December from $32.92 a year ago, representing a 4.1% year-over-year increase in nominal terms. Adjusting for inflation, so-called real average hourly earnings increased 0.9% compared to a year ago. Leading indicators suggest the labor market has softened somewhat but remains relatively stable as the four-week average for initial jobless benefits claims has ranged between 200,000 and 253,000 for the past year. Furthermore, job openings declined in November to 8.8 million, which is down from 9.6 million six months ago and 10.8 million in November 2022. There are also fewer voluntary quits and new hires. Despite modest weakness, the continued resilience of the labor market provides the Fed support to maintain rates at higher levels until there is meaningful weakness in the labor market. A lower inflation backdrop may allow the Fed to notch rates lower, as they deem appropriate.

|

| Economic Growth | Gross Domestic Product: (GDP) The final estimate for Q3 2023 real GDP (inflation adjusted) showed the U.S. economy expanded by 4.9%, a slightly slower revision from the second estimate noted in the table below. The accumulation of more complete data from prior updates showed consumer spending may have been losing momentum into quarter end. Upward revisions to business spending and housing (residential investment) helped offset some of the weakness in personal consumption. The lower GDP price index reading indicated inflation was less of a drag on nominal growth. Overall, Q3 GDP was surprisingly strong led by decent consumer spending which accounted for 2.1 points of the 4.9% gain while government spending added 1.0 points. Looking ahead to the advance report on Q4 2023 growth, forecasters are projecting the economy expanded by 1.5%-2.5%.

|

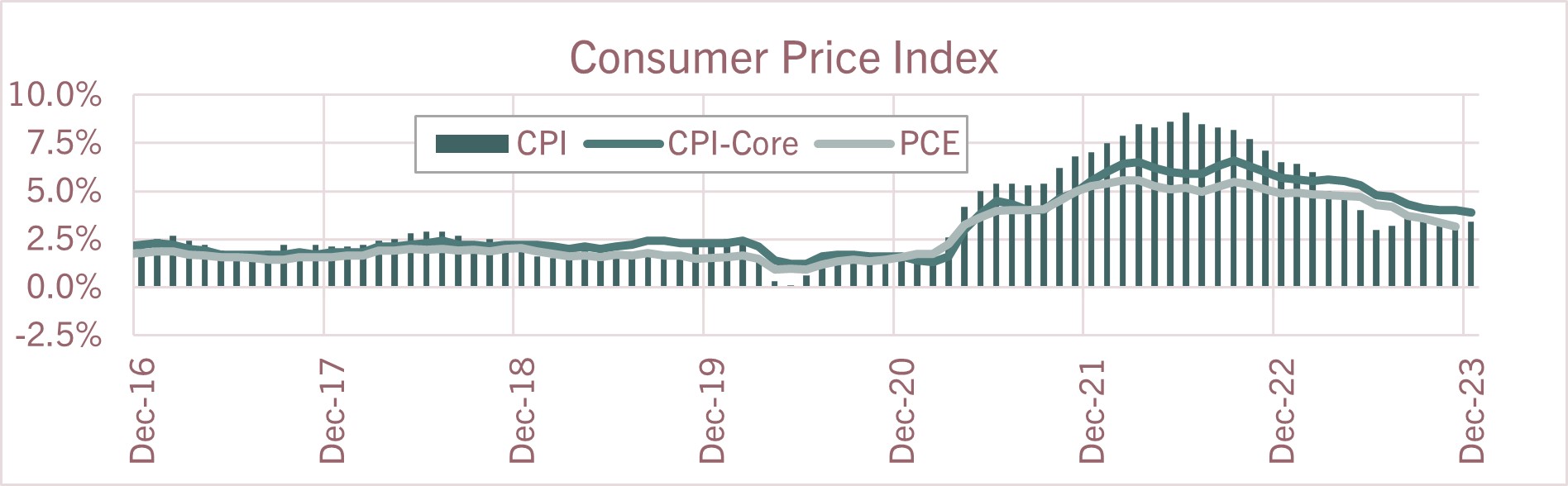

| Consumer Inflation | Consumer Price Index (CPI): Despite consumer inflation slowing from the June 2022 peak, it remains elevated with year-over-year U.S. inflation at 3.4% for December 2023. Shelter prices, which account for about a third of overall CPI, are running at 6.2%. A deeper look into the data indicates food prices were up 2.7% year over year while gas prices are down 1.9%. Stripping out food and energy, the so-called core rate of inflation was 3.9%, which is largely being held higher by services-based inflation (+5.3%) while commodity-based inflation is much tamer at +0.2% compared to a year ago. The Fed’s preferred measure for inflation, the core PCE (Personal Consumption Expenditure), increased by 3.2% year over year as of November. The Fed’s target for core PCE is 2.0%.

|

| Monetary Policy | The table below summarizes recent decisions regarding monetary policy action by the Federal Open Market Committee. The next FOMC meeting is January 30-31. Federal funds futures indicate a strong likelihood the funds rate will be unchanged at the January 2024 meeting with the potential for 125-150 basis points in monetary easing this year with the first 25 basis point rate cut in March. Projections by Fed officials forecast 75 basis points in rate cuts, likely starting around midyear.  |

The above commentary is a summary of select economic conditions prepared for AgWest Farm Credit management. It is being shared as a courtesy. As with any economic analysis, it is based upon assumptions, personal views and experiences of those who provided the source material as well as those who prepared this summary. These assumptions, conclusions and opinions may prove to be incomplete or incorrect. Economic conditions may also change at any time based on unforeseeable events. AgWest assumes no liability for the accuracy or completeness of the summary or of any of the source material upon which it is based. AgWest does not undertake any obligation to update or correct any statement it makes in the above summary. Any person reading this summary is responsible to do appropriate due diligence without reliance on AgWest. No commitment to lend, or provide any financial service, express or implied, is made by posting this information.

Explore our loan calculators

Curious what your monthly cost will be? Use our loan calculators for additional information.

Learn more.jpg?sfvrsn=e8bfac6b_0)