- Compressed lumber mill margins

- Tight log supply

- Declining demand from Japan

- Higher estimated taxes on Canadian lumber imports

- Strong timberland values

Executive summary

Profitability

Forest products manufacturers and timberland owners should be slightly profitable over the next 12 months. The combination of low prices and high costs is pressuring mills; however, a slight increase in demand could have an outsized impact on prices and profitability. Import taxes on Canadian lumber should support lumber prices. Regulations are reducing the flow of logs from state and private forests. Demand from Japan, a significant buyer of high-value Douglas-fir, has declined. Timberland values remain strong.

Industry drivers

Lumber mill margins compressed

Two material mill closures were recently announced in Oregon. Another mill will stop operations while it converts to a different product offering. Lumber mills face depressed lumber prices and relatively high interest, labor, repair and maintenance and machinery costs (see the Crop Inputs Snapshot and Quarterly Economic Update for more information). Log supply has also tightened (see driver below). Profitability may improve in the spring as housing construction increases. Lumber inventories are tight across the supply chain and a small increase in demand could have an outsized impact on prices.

Random Lengths Framing Lumber Composite Index

Source: RISI Random Lengths

Prices are near break-even levels, and a slight increase could greatly improve mill profitability.

Log supply tight

Despite multiple mill closures, log supply is generally tight in Oregon. The Oregon Board of Forestry recently passed the Western Oregon State Forests Habitat Conservation Plan and will reduce log volumes produced/harvested from state forests by approximately 20%. The Private Forest Accord went into full effect in January 2024 and estimates suggest a 5% decline in harvestable acreage on private timberland of all sizes.

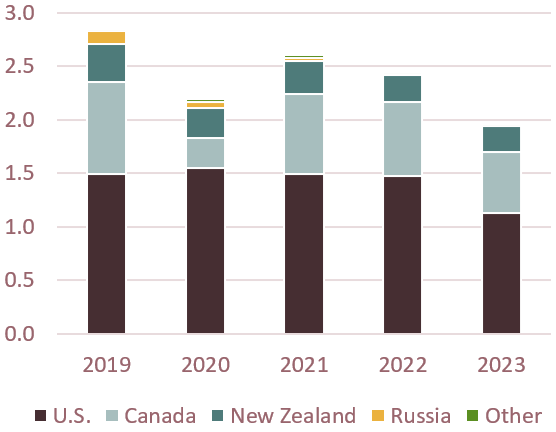

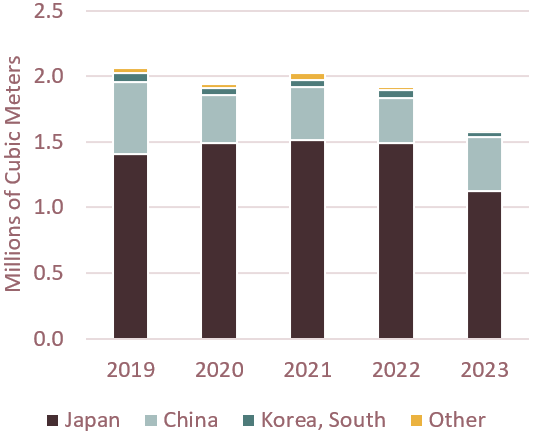

Douglas-fir log exports to Japan fall

Douglas-fir log exports to Japan fell 23% in 2023. Japan faces significant economic headwinds, including a currency that depreciated 13% against the U.S. dollar in 2023 (import costs increase with a depreciating currency). It is unclear whether demand will rebound in 2024.

Softwood log imports to Japan

Source: e-Stat, Statistics of Japan.

Japan is among the largest global consumers of high-value softwood logs.

Canada and New Zealand are the biggest competitors to the U.S.

Japan is importing less softwood from each country.

Douglas-fir exports from the U.S.

Source: Foreign Agriculture Service GATS Trade Database.

Japan is the largest export market for Douglas-fir logs.

Import taxes to increase on Canadian lumber

The U.S. Department of Commerce signaled its intent to increase import taxes on Canadian lumber from 8.05% to 14% later this summer or fall, which is supportive of higher domestic prices.

Timberland values strong

Values for high-grade timberland properties are strong relative to current log prices as buyers anticipate stronger markets.

Spokane, WA | April 4, 2024

A complex landscape for Northwest agriculture

posted by AgWest Farm Credit

Spokane, WA | January 24, 2024

Challenging conditions for many ag industries in the Northwest

posted by AgWest Farm Credit

Spokane, WA | October 4, 2023

Outlook mixed for ag industries in the Northwest

posted by AgWest Farm Credit