- Decline in domestic demand due to a shrinking cattle population

- Warmer winter weather

- Financial challenges in the dairy sector, leading to lower hay prices

- Hay exports dropped by 22% in 2023, with major international buyers reducing purchases significantly, further depressing hay prices

Executive summary

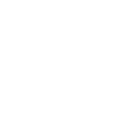

Profitability

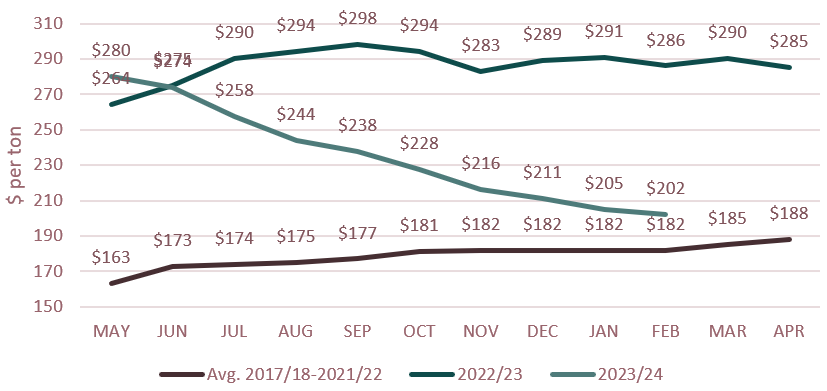

The profitability of Northwest hay growers has been impacted by a sharp decline in hay prices. In February, the average price per ton for Northwest hay growers was $202, marking a 29% decrease compared to the previous year. While hay prices have come down, expenses remain elevated and sticky. Anecdotally, Northwest producers are selling at breakeven levels and still struggling to find buyers.

Industry drivers

Domestic demand wanes

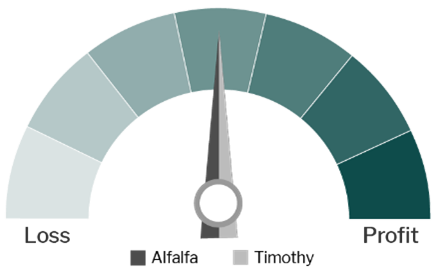

Hay demand domestically is faltering due to a combination of factors: a diminishing cattle population, unseasonably warm conditions and economic strains within the dairy sector, all exerting downward pressure on hay prices. The mild winter experienced in the West has reduced the need for hay among ranchers, as cattle have been able to graze on range pastures for extended periods. Although extended grazing could potentially lead to a greater need for hay in the fall, pasture conditions are currently thriving across most of the West. However, grasshopper infestation poses a risk to pasture conditions and could support greater hay demand in affected areas (refer to the map below for high-risk zones).

2024 rangeland grasshopper hazard

Source: USDA Animal and Plant Health Inspection Service.

Grasshoppers could greatly impact range conditions across eastern Montana increasing hay demand.

Contrary to the expected decrease in hay production from lessening demand, analysts are mixed in their projections for 2024 timothy and alfalfa acres. This is because the need to plant alternative crop acres has been limited by processor cutbacks, prompting farmers to continue growing or even increasing hay acres. However, the latest USDA report projects a 1.3% decrease in Northwest hay acres. While acreage estimations are a mixed bag, weather conditions will be decisive in shaping hay market dynamics and production.

Exports fell by 22% in 2023, uncertainty persists in 2024

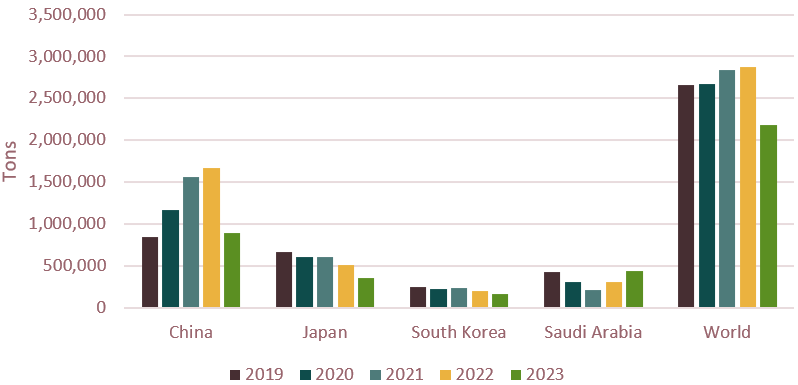

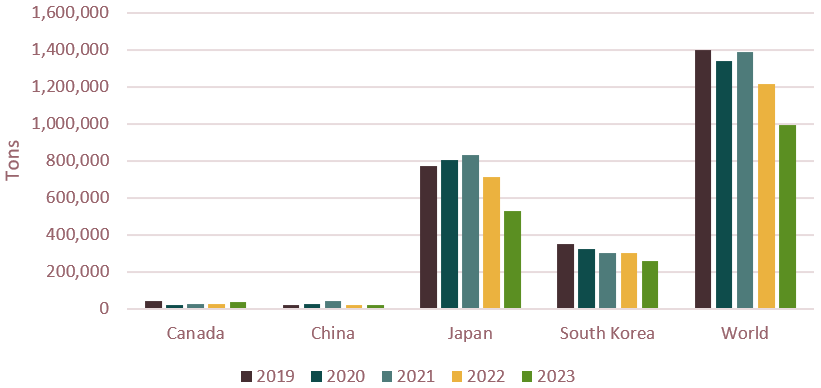

Hay exporters are navigating a downturn in demand and the resulting financial losses from 2023. In 2023, U.S. hay exports fell by 22%, driven by unfavorable exchange rates as the strong U.S. dollar increased costs for foreign buyers, while low global milk prices led importers to seek more affordable feed options. China, the top alfalfa hay importer, cut purchases by 47% due to economic challenges and low milk prices. U.S. grass hay exports reached a 10-year low, with less than one million tons shipped. Japan and South Korea, major importers of U.S. grass hay, reduced their purchases by 26% and 13%, respectively. This decrease in export demand put significant downward price pressure on hay.

U.S. alfalfa exports, 2019-2023

In 2023, alfalfa exports saw a significant decline of 22%, primarily due to a substantial 47% drop in the volume imported by China.

U.S. all other hay exports, 2019-2023

Source: USDA GATS, compiled by AgWest.

Exports for all other hay has diminished, reaching the lowest levels in ten years.

In 2024, global economic uncertainty, especially in major Asian importing countries, could create headwinds for hay exports. Japan (which ranks among the top three importers) experienced economic turbulence with initial reports of a recession in early March. However, this was later corrected to show economic growth. For the first time in 17 years, Japan's central bank has increased interest rates. This change could strengthen the value of the Japanese Yen, which could benefit U.S. hay imports, lowering the cost. However, if key international buyers face economic downturns, it could lead to a decrease in export demand, keeping hay prices depressed. Hay exporters should pay close attention as this situation develops.

Average alfalfa price for Northwest producers (ID, MT, OR, WA)

Source: USDA NASS, compiled by AgWest.

Hay prices have fallen 29% year over year.

Spokane, WA | April 4, 2024

A complex landscape for Northwest agriculture

posted by AgWest Farm Credit

Spokane, WA | January 24, 2024

Challenging conditions for many ag industries in the Northwest

posted by AgWest Farm Credit

Spokane, WA | October 4, 2023

Outlook mixed for ag industries in the Northwest

posted by AgWest Farm Credit