- Global price drops and favorable U.S. weather have further depressed wheat prices.

- Producers will have to diligently manage elevated operational costs with lower wheat prices.

Executive summary

Profitability

Small grain producers are in a tight financial position and profitability will hinge on diligently managing production costs. Prices for Portland freight on board wheat have softened nearly 25% year over year while elevated operational costs remain sticky. Futures prices for new crop wheat contracts have softened substantially. There is still a significant amount of wheat in storage left to sell. Wheat prices may decline further in 2024 to compete globally, impacting producer margins that are already tight as lower commodity prices and sticky input expenses weigh on profitability.

Despite the many headwinds, producers are navigating the recent challenges better than expected. Some fallow rotation producers have seen slight erosion of their working capital and are looking at break-even returns or slight losses. However, producers in continuous cropping regions remain profitable, mainly due to pulse crops. Canola profits are marginal. Current canola prices are above $0.22 per lb, indicating potential profitability for the upcoming season. While the current outlook is a mixed bag, concerns are rising for the 2025 growing season. Producers are anxious about their debt and uncertainties in crop insurance valuations. Working with crop insurance agents and creating a grain marketing strategy may alleviate some of the challenges ahead for small grain producers.

Industry drivers

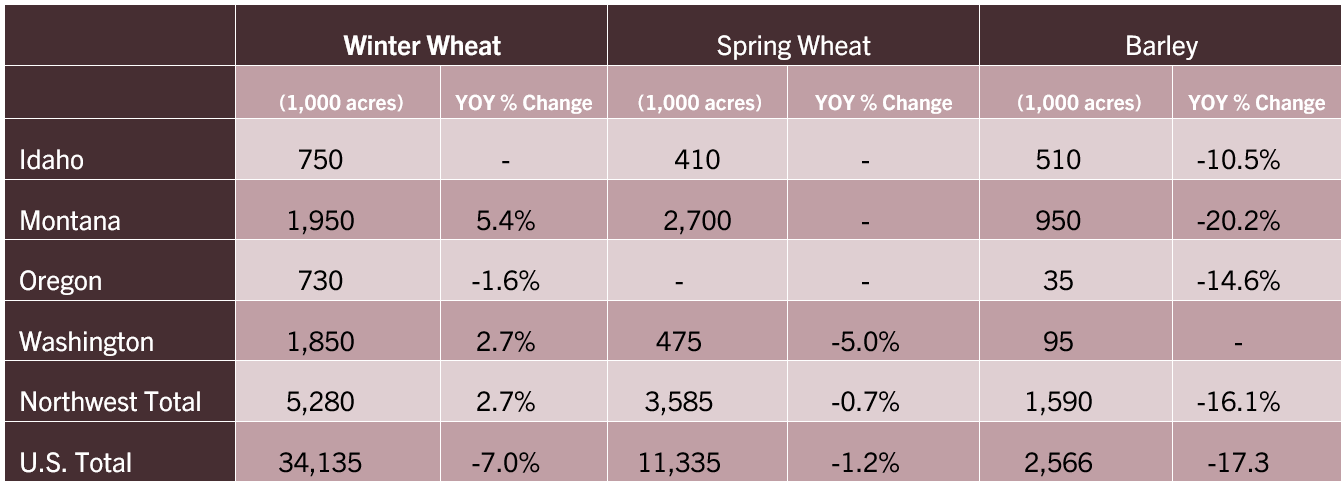

2024 Northwest planting decisions

Northwest growers are planning to plant more wheat acres than last year, driven by increased winter wheat acres in Montana and Washington. Durum wheat production in Montana is also expected to see modest growth. Despite lower prices, Northwest spring wheat acres remain largely unchanged. The barley market is currently saturated, discouraging producers from additional planned acres. The USDA anticipates a reduction in national pulse crop acres, including fewer garbanzo beans, dry beans, dry peas, lentils and canola plantings in 2024.

Rotation plans remain largely unchanged for Northwest producers. There could be a possible shift from canola to garbanzo beans driven by price trends. Yet, chemical residues in wheat rotations limit some growers from planting canola or garbanzo beans in the Palouse region. Snowpack improvements in western Montana and northern Idaho have reduced moisture deficits and will help increase groundwater reserves for irrigation during the later part of the growing season.

Prospective planting: acres and year-over-year change

Source: USDA NASS, Prospective Plantings. March 28, 2024.

Grain in storage decisions

Producers are currently holding onto a larger quantity of grain in storage, anticipating a rise in market prices. However, this increase seems improbable. Forecasts of larger wheat supplies in 2024 due to increases in production in Australia, Russia and Argentina do not support higher wheat prices. Many producers will need to sell their stored grain before September to make room for the new crop. Although storage costs have not risen sharply, they accumulate over time. Excess stock poses challenges for both producers and grain cooperatives. Producers should critically assess their market strategies and storage decisions.

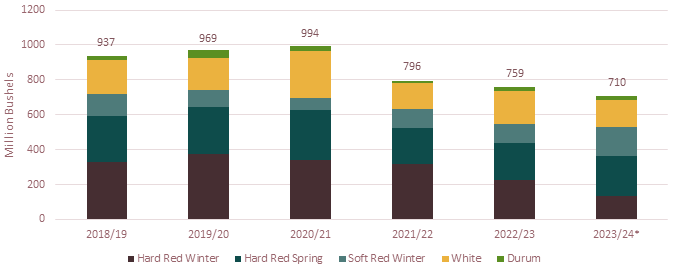

Wheat exports at historic lows

Drought and global competition have caused U.S. wheat exports to decline dramatically, reaching the lowest levels in 50 years. Among U.S. wheat exports, Hard Red Winter (HRW) wheat usually dominates. Unfortunately, drought conditions in the Midwest have slashed HRW wheat production. A widening price gap between HRW wheat in the U.S. and its global counterparts has further hindered export demand. Subsequent HRW export quantities are projected to decrease by 40% year over year. Exports of all other wheat classes are expected to decrease with durum being the exception. Durum experienced a production increase after the drought provided relief in Montana and North Dakota.

In March, Russian wheat traded for nearly $2 less per bushel than U.S. wheat. As of March 6, U.S. wheat export prices averaged $7.40 per bushel, while the European Union’s average stands at $5.69 per bushel. Lower global prices create a challenge for U.S. wheat exports, exerting downward pressure on domestic prices. The USDA foresees subdued U.S. wheat exports in 2024. A larger global crop will only add to downward price pressure.

U.S. wheat exports by class, 2018/19 -2023/24*

Source: USDA, World Agricultural Outlook Board.

*Forecasted

The 2024-2025 wheat crop faces two contrasting factors: lower global stocks but a large crop. Currently, global ending stocks are at a 15-year low, which could potentially support higher global prices. However, the USDA predicts increased global wheat production in 2024. Forecasts indicate larger wheat supplies due to production increases in Australia, Russia and Argentina. Unfortunately, this situation does not bode well for higher prices or U.S. wheat producers.

Spokane, WA | April 4, 2024

A complex landscape for Northwest agriculture

posted by AgWest Farm Credit

Spokane, WA | January 24, 2024

Challenging conditions for many ag industries in the Northwest

posted by AgWest Farm Credit

Spokane, WA | October 4, 2023

Outlook mixed for ag industries in the Northwest

posted by AgWest Farm Credit