- Timely plantings and favorable weather which will benefit sugar beet production

- Strong sugar prices have producers optimistic about the upcoming season

Executive summary

Profitability

Beet growers anticipate a profitable year due to strong sugar prices, increased demand and timely plantings. They expect strong contract prices, with sugar prices exceeding $70 per ton in Idaho. Cost reductions in fertilizer and diesel will further enhance grower margins. Producers face challenges due to higher wages, labor shortages and rising interest expenses. Nevertheless, producers are optimistic with near-record profits forecasted from this year’s sugar beet crop.

Industry drivers

Planting is on schedule

In the Treasure Valley of Idaho and Oregon, sugar beet planting commenced on schedule. In recent years, drought conditions have compelled irrigation districts to impose water restrictions which can adversely affect beet production. This year, Idaho sugar beet growers expect to have full water allotments, which should encourage strong production.

2024 is forecasted to have fewer sugar acres

In February 2024, Texas witnessed the closure of its last sugar beet processing plant, marking an end to its 50-year operation. As a result, the USDA forecasts 2024 beet acres to decrease by 10,000 acres. There was a notable decrease in total U.S. sugar cultivation in 2023, with beet acreage diminishing following the shutdown of a processing plant in Sidney, Montana, leading to 16,000 fewer acres. Concurrently, sugar cane acres in the South saw a drastic 50% decrease compared to 2022, hitting the lowest production in over four decades. Fewer acres and shifting weather patterns will lower production and create tailwinds for stronger domestic prices.

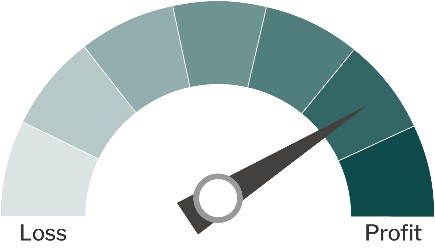

Sugar prices are reactive to global supply changes, but remain at profitable levels

Global sugar prices have been sensitive to changes in worldwide supply forecasts yet remain at profitable levels. Raw sugar futures reached a 12-year peak in 2023 due to tight global supplies. The top two producers, India and Brazil, are facing supply shortages, pushing up global prices. India, the world's leading sugar exporter, has imposed a 50% export tax on refined sugar and molasses amid drought concerns. Conversely, Brazil's 2024 sugar production looks promising, which could lower prices. Price volatility was evident as global sugar prices fell from $0.24 per lb to $0.20 per lb over five days in late February due to updated production forecasts. High global prices are favorable for domestic producers, with a bullish domestic price forecast due to expected reductions in sugar beet and cane acreage limiting supply and supporting higher prices.

U.S. raw sugar prices

Source: Sugar No. 11 Futures, compiled by AgWest.

In September, sugar prices rose to a 12-year high. Following this peak, prices have stabilized, fluctuating between 20 cents and 24 cents per pound.

Trade winds impact sugar production

As meteorologists forecast a shift away from the current El Niño weather pattern towards La Niña conditions, sugar prices will experience headwinds from increased global production. La Niña is associated with cooler, wetter conditions leading to improved sugar yields in major growing regions such as Brazil and India. If these predictions hold true, the current sugar price surge could ease.

Spokane, WA | April 4, 2024

A complex landscape for Northwest agriculture

posted by AgWest Farm Credit

Spokane, WA | January 24, 2024

Challenging conditions for many ag industries in the Northwest

posted by AgWest Farm Credit

Spokane, WA | October 4, 2023

Outlook mixed for ag industries in the Northwest

posted by AgWest Farm Credit