- The U.S. cattle industry is experiencing a significant decline, with the smallest herd since 1951, leading to tighter beef supplies and higher prices

- Cattle producers are poised to see advantageous pricing and strong returns due to a reduced beef supply

- Strong domestic and export demand

Executive summary

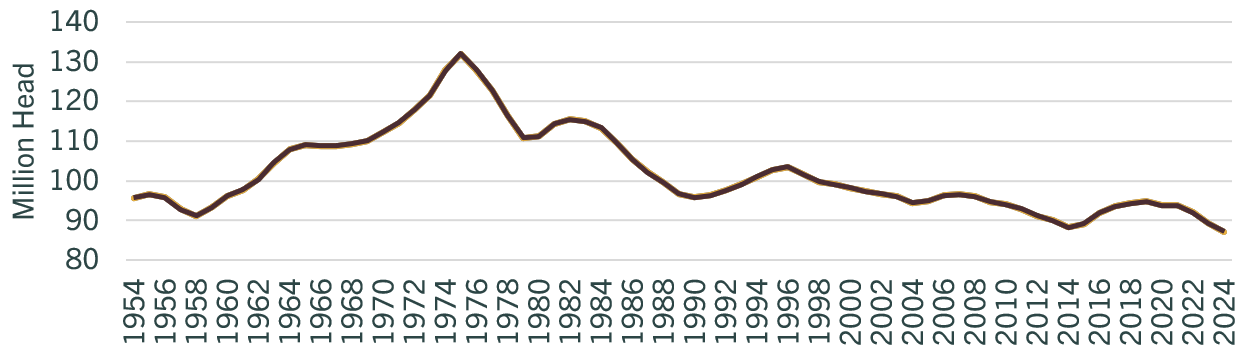

Profitability

AgWest cattle producers are poised to see advantageous pricing and strong returns. With the current market conditions, cow-calf producers are presented with a favorable dilemma: retain their cows to benefit from strong calf prices or opt for culling to take advantage of the significant value of cull cows. Additionally, cow-calf operations will benefit from lower feed costs and improvements in pasture conditions. While higher interest rates, almost double those of the last expansion period (2013-2015), do pose a challenge, revenues will surpass the rise in input costs. Cow-calf operations are projected to see margins surpassing $500 per head in 2024. As the cattle cycle replenishes the national herd, cow-calf producers should benefit from sustained high prices until at least 2025.

Industry drivers

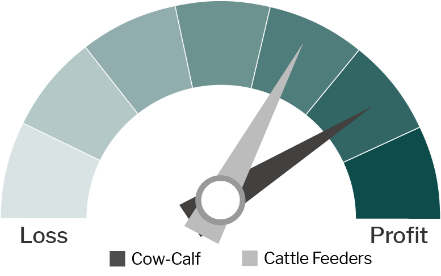

National cattle herd smallest since 1951

The U.S. cattle industry is currently experiencing a significant decline, with the smallest herd in 70 years. On January 1, 2024, the national cattle herd had 87.15 million head, marking a 1.9% decrease from 2023. This decline has persisted for five consecutive years, resulting in a total reduction of 7.65 million head, or 8.1%, since the peak in 2019. Today’s beef production is not the same as 1951 (with an average yield of over 650 lbs per cow compared to just 250 lbs in 1951). Herd size fluctuates cyclically, and historical patterns can tell us how a smaller herd will affect cow-calf returns and beef prices.

The impact of the cattle contraction in recent years has mostly centered on the Central and Southern Plains due to ongoing drought that started in the west and moved east. Northwest cattle producers in Idaho, Oregon and Washington were some of the first in the nation to see recovery, with an increase in their cattle herds of 2% year over year. This national reduction is expected to tighten beef supply and elevate prices. With beef replacement heifers at a historic low of 4.86 million, rebuilding the herd will be challenging, creating tailwinds for further spikes in cattle returns and beef prices. As prices approach record highs, there is uncertainty about how long the market can sustain these levels before consumer demand starts to decline.

Jan. 1 U.S. cattle inventory

Source: USDA NASS.

Strong calf sale prices

Calf prices have surged, driven by robust demand and a tightening calf supply after two consecutive years of a reduction of more than 12% in the bred heifer herd. In Montana, steer calf prices have increased by 35% year over year. This trend is contrasted by more modest increases in Washington, suggesting regional variations in market conditions. However, most major calf sales had an increase of almost $100 per hundredweight (cwt) compared to last year. Stocker calf prices, specifically steers, also saw a large boost, with the average price for western producers at $318 per cwt on March 15, 2024, up 36% from a year ago.

Canadian cattle herd also shrinks

The Canadian cattle population is expected to shrink further, leading to a reduced number of calves. While higher cattle prices could encourage the retention of female calves if conditions for pasture improve, some producers might opt to leave the industry. Traditionally, a decrease in Canadian cattle leads to an increased U.S. export opportunity for feeder and live cattle into Canada. However, increases in domestic U.S. demand will decrease the amount of U.S. cattle available for export. This scenario could lead to a more insular market, with Canadian producers facing increased competition from imported beef (primarily from South America and Australia), particularly low-cost options, which Canadian consumers have shown a preference for.

Avian Influenza found in cattle herds

The emergence of a strain of highly pathogenic avian influenza (HPAI) affecting dairy cows in the Central and Southwest Plains has the cattle industry on alert. This disease has been causing flu-like symptoms in cattle, leading to a substantial decrease in milk production in about 5-10% of cows and financial repercussions for dairy operations. There have not yet been reported cases in cow-calf herds as of March 28, 2024. The situation could impact cattle producers’ profits if there were potential restrictions on livestock movement and any increased costs associated with verifying the health of the herds. The impact of HPAI is not only a concern for animal health but also poses a threat to the stability of cattle production and market dynamics. Cattle producers should pay close attention to this issue as it continues to evolve and consider implementing biosecurity protocols.

Estimated average cow-calf returns

Source: USDA and LMIC.

Projected 2024 cow-calf profits are expected to exceed $600 per head.

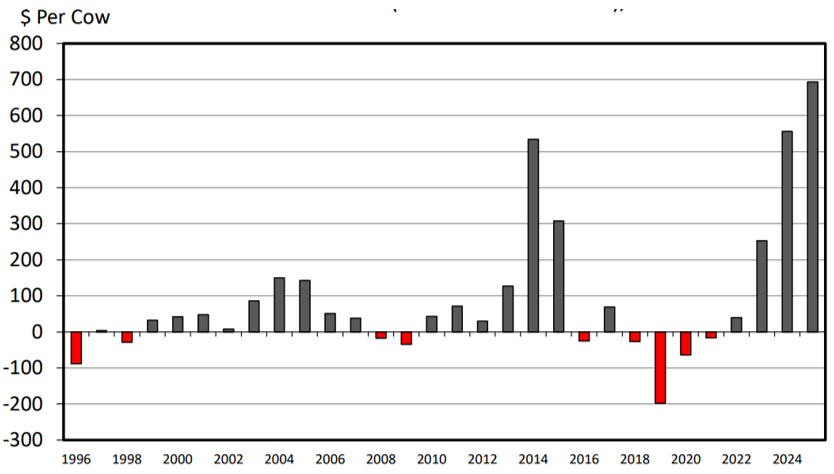

Feedlot and packer margins hinge on sustained strong beef prices. Cattle feeding returns declined in Q1 2024 due to high feeder cattle costs. However, their profits could rebound by late summer. The Livestock Marketing Information Center (LMIC) forecasts a 20% annual increase in 700-800 lb feeder cattle prices for 2024, with an additional 7% rise in 2025. Meanwhile, packers face margin compression due to record cattle prices, prompting a cutback in slaughter rates. This uncertainty, coupled with high beef prices, discourages long-term contracts and contributes to market volatility, affecting negotiated cattle prices. Despite thin margins for packers and rising fed cattle prices, strong retail beef prices allow both packers and feedlots to remain profitable in the current market, provided prices stay elevated. A dip in beef demand could erode profits for both feeders and packers. Despite fears of a global economic downturn, industry analysts remain confident about the enduring strength of cattle industry profits.

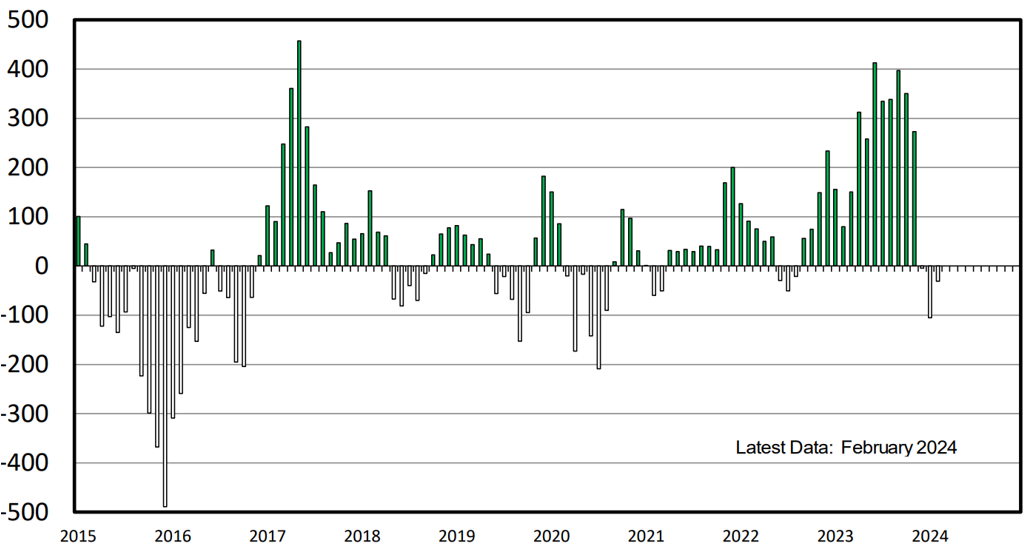

Average returns to cattle feeders

Source: USDA and LMIC.

Spokane, WA | April 4, 2024

A complex landscape for Northwest agriculture

posted by AgWest Farm Credit

Spokane, WA | January 24, 2024

Challenging conditions for many ag industries in the Northwest

posted by AgWest Farm Credit

Spokane, WA | October 4, 2023

Outlook mixed for ag industries in the Northwest

posted by AgWest Farm Credit

California | October 4, 2023

Rangeland Trust successfully preserving California’s ranching legacy

posted by AgWest Farm Credit