- Land values are reportedly stable to slightly increasing, with demand frequently outpacing the available inventory.

- Market participants for land include a combination of local operators, absentee operators and institutional investors.

- Developers remain a player in the market, but acquisitions for development have decreased due to ongoing elevated interest rates.

- Some areas are reporting slightly longer listing times for properties.

Executive summary

Land value trends

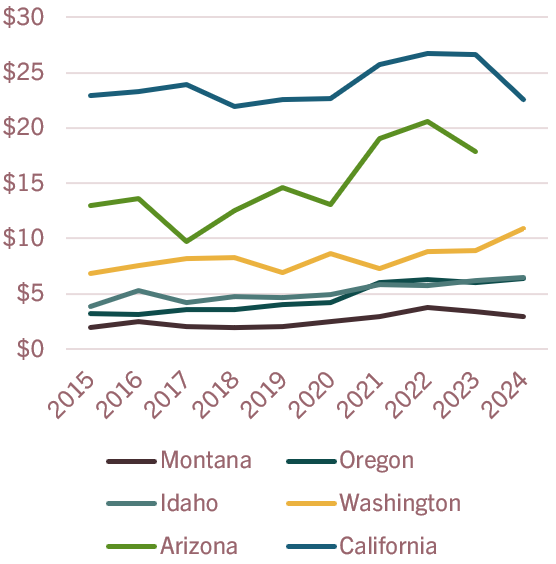

Overall, land values remain relatively stable to slightly increasing across Washington, Oregon, Montana and Idaho (see charts below). The slight decrease in Montana is more indicative of fewer high-quality or high-amenity properties being sold rather than a decline in property values. Land value trends are mixed in California. Central Coast premium vineyards and high-quality vegetable/strawberry land values appear to be increasing and offsetting declines in the Central Valley, where falling commodity prices have led to a decline in values for walnut and table grape acres. In Arizona, sales activity has slowed (no new sales noted since Q4, 2023) and marketing times are extended due to high interest rates, softening commodity prices and decreasing irrigation water supply in some regions.

Average land values, thousands of dollars per acre

Land Values Box Plot, thousands of dollars per acre

Source: AgWest’s propriety sales database. Industrial, commercial, and site sales excluded. Data represents a 12-month rolling average. Data collection lags about six months and is subject to change.

Land value considerations

Interest rates – During Q1 2024, high interest rates were one of the most frequently reported deterrents to land acquisition. Greater instances of creative financing such as owner-carried notes have been reported. See our Quarterly Economic Update for a more in-depth analysis of interest rates.

Residential – The housing market in most areas continues to cool, largely due to high interest rates. A cooling market may lead to fewer developments and alleviate upward price pressure on agricultural lands, particularly those surrounding population centers. Lower prices have yet to be seen as agricultural lands remain in high demand.

Availability – Inventories of agricultural land are low in much of AgWest’s territory, which continues to bolster values despite elevated interest rates. The exception is California, where reports indicate that supply is outpacing demand.

Farm income/commodity prices – USDA forecasts average 2024 net farm income on a national level will fall 25% year over year to $116 billion. While this may disincentivize prospective buyers, the relationship between land values and commodity prices in recent years has been weak as many perceive land as a stable, long-term investment. The outlook for commodities is mixed. Little if any negative impacts on agricultural land values have been seen by verified sales, except in certain isolated regions. Visit our Industry Insights Webpage for more information and market updates.

Water Supply – CA and AZ – California Central Valley growers banked millions of acre-feet of water in 2023, replenishing over-drafted aquifers (when groundwater use exceeds recharge). The Sustainable Groundwater Management Act may lead to strict pumping restrictions and hefty fees in certain regions. Falling water levels at Lake Mead and limited flow on the Colorado River led to severe shortage declarations in 2023. All Colorado River user states and Native American tribes continue with contentious negotiations over water rights and use cutbacks under pressure of looming federal intervention by the U.S. Bureau of Reclamation. Water supply uncertainty and rising interest rates are reducing activity in the speculative/investment market for agricultural land, although the full effect cannot be determined yet.

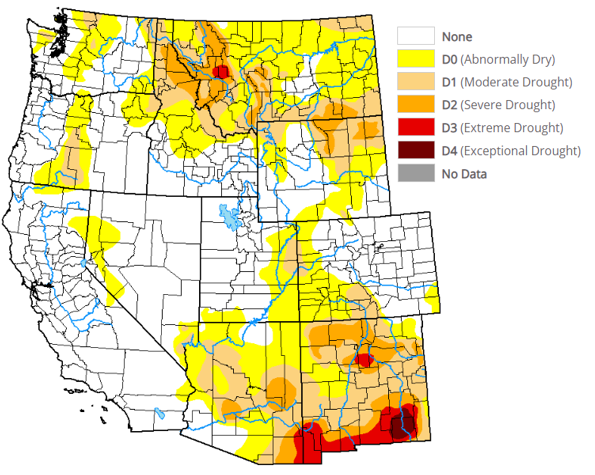

Drought – Snowpack and precipitation levels in the West are mixed. Most states show fewer areas under abnormally dry, moderate, severe and extreme drought conditions compared with a year ago (see map below). While strong winter storms alleviated drought concerns throughout much of AgWest’s territory, year-to-date precipitation is well below average across Washington, northern Idaho, Montana and parts of Arizona. As of March 14, 2024, California’s snowpack reached 100% of its April 1 average, although there is some concern about premature melting due to a shorter winter and rising average temperatures. Extended drought conditions have the potential to negatively impact land values as farm profitability is challenged.

Drought Map, Western States

Source: University of Nebraska, U.S. Drought Monitor. Data as of March 19, 2024.

Year to Date Snow Water Equivalent, Western States

Source: NRCS National Water and Climate Center. Data as of March 11, 2024

Current considerations for agricultural land by state

Arizona

- In the Yuma area, agricultural cropland prices are stable to slightly increasing. Farmers are not actively seeking land to purchase, although existing tenants will often decide to buy a farm for sale. Investors have been hesitant to buy land due to water concerns.

- Increasing population and urban sprawl in the Phoenix Metropolitan Area led to significant speculative investment in nearby agricultural land, increasing land values. However, this trend is slowing and concerns about long-term water supply availability are putting a check on speculative activity.

- In May 2023, Arizona, Nevada and California agreed to shore up water levels by conserving at least three million acre-feet of water through the end of 2026 in exchange for $1.2 billion in federal support.

- Water deliveries in 2023 were cut substantially due to the Tier 2 shortage declared August 2022. Deliveries will improve in 2024 due to wetter conditions last spring/winter in the Colorado River watershed.

- Developers are purchasing older dairy facilities around the Phoenix Metropolitan Area and taking them out of production due to increasing land values. Dairy producers have used funds from property sales and/or leases from vacant facilities to purchase dairies in other locations, which is helping to stabilize facility prices.

- Most participants in the pecan industry expect the market for average- to good-quality orchards to remain stable; however, low prices and higher interest rates may slow sales activity.

- Pistachio orchards are rarely offered for sale due to high profitability and ownership concentration in the industry, keeping land values relatively high.

California

- Water availability, particularly access to surface water, is the primary driver of land values in the San Joaquin Valley. Pumping restrictions and state intervention will increase the importance of groundwater recharge. Secondary drivers include rising interest rates and falling commodity prices.

- Declining commodity prices are beginning to put downward pressure on land values in the San Joaquin Valley, notably in the tree nut and table grape sectors. This trend is also present in tree nut orchard values in the Sacramento Valley.

- Listing times are increasing as supply outpaces demand. This is a trend that has been compounded by the liquidation of a large vertically integrated stone fruit grower/packer based in Fresno and Tulare County, the market exit of a large pistachio grower and a tree nut investor group. Tens of thousands of additional acres are on the market.

- Dairy facility demand is decreasing due to weak domestic markets. There is a limited pool of buyers and they prefer newer, more efficient facilities. Less efficient facilities are typically purchased and redeveloped into feed cropland.

- Increased orchard plantings over the last several years reduced available land for sale in the Sacramento Valley, leading to higher land values. More recently, this trend is slowing as commodity prices fall. Rice ground values are diverging on opposite sides of the valley – west-side values are trending lower due to water supply curtailments while east-side values are trending higher due to relative water security.

- Premium wine grape vineyard values in the Central Coast remain strong despite demand challenges in the U.S. wine industry. However, established winery sales activity appears to be slowing.

- The supply of Central Coast irrigated cropland capable of vegetable and strawberry production is very limited and in high demand, particularly in the Santa Maria Valley. Properties are usually directly marketed to a well-known buyer/lessee pool and typically sell quickly, keeping values elevated.

- Imperial Valley land values remain stable as large, regional growers look to expand operations and investors seek high-seniority rights to the Colorado River to hedge against water risk.

Idaho

- The Idaho Department of Water Resources issued a Methodology Order to determine the impact caused by junior groundwater users pumping from the Eastern Snake Plain Aquifer. Approximately 900 groundwater rights (junior to December 30, 1953) that are not protected by an approved mitigation plan could be subject to curtailment. Discussions and final decisions around this order are ongoing.

- Demand for agricultural properties remains strong with some properties selling above historic highs. Bidding wars for quality properties are not uncommon. Inventory levels remain limited and competitive throughout the state.

- Southern Idaho experienced increased precipitation and snowpack levels during February and March after a dry start to winter. Snowpack levels and reservoir storage throughout the southern part of the state are positive for the upcoming growing season. Central and northern Idaho have seen lower-than-average precipitation levels, which could mean a return to drought-like conditions. Extended drought conditions have the potential to negatively impact agricultural land values.

- The recreational market has slowed and recreational properties are seeing longer listing times. Purchasing power of market participants has decreased due to higher interest rates.

- The rural residential market has slowed across much of the state due to high interest rates. Winter is also a slower time of year for rural residential purchases.

Montana

- Below average year-to-date precipitation levels across the state may hamper operators’ bottom lines and could lead to a downturn in the agricultural land market. Strong demand has buoyed land values despite drought conditions over the previous few years.

- Despite slowing some from previous highs, demand for recreational ranch properties remains strong, particularly those with high amenities (recreational streams and ponds, good habitat for wildlife, access to public land, etc.). The TV show Yellowstone, which romanticizes ranch life in Montana, continues to drive demand from outside buyers for some properties, often referred to as the “Yellowstone Effect.”

- Other good-quality agricultural real estate outside of ranching properties continues to be in high demand. Demand for lower-quality agricultural properties appears to be softening with longer listing times reported.

- Production agriculture still drives land values in many parts of the state, with many transactions taking place privately between landlords and tenants or between neighbors.

- Demand for rural residential properties has cooled from previous highs due to interest rates. Rural residential properties are seeing longer listing times with price reductions becoming more common.

Oregon

- Demand for good-quality agricultural properties remains strong throughout most of the region, with a low inventory of listings reported in most areas. A notable exception to continued demand is properties planted in hazelnuts, one crop that has suffered low prices resulting in lower demand and a softening of prices for the property type.

- Although demand continues to be strong for most property types, buyers tend to be more cautious to ensure the property fits well with their existing operation. Demand is mainly from large operators and institutional investors.

- Upward pressure on agricultural lands in eastern Oregon is coming from market participants in Idaho in search of affordable land.

- Water rights continue to play a big role in property selection, as buyers become more selective about what properties they are willing to purchase based on the quality of the water rights.

- The current outlook for irrigation water throughout the state is positive for the 2024 growing season, easing concerns over drought-related challenges that have the potential to impact land values.

- In areas where recreational properties exist, demand has dropped off considerably due to interest rates, and longer listing times are noted. It is difficult to determine if land values in this market segment have dropped due to a low number of sales, but evidence suggests a possible downturn in recreationally influenced properties.

- Demand for rural residential properties varies depending on location but a lack of inventory is generally holding demand up. Due to continued high interest rates, however, prices have leveled off from previous highs and longer listing times are common.

- Strict zoning laws to limit building have resulted in a premium on properties improved with dwellings or the ability to construct one, especially near population centers.

Washington

- Agricultural land remains in strong demand as low inventories limit transaction levels; however, more properties are being sold through listings rather than word of mouth, which may be an early indicator of a slowing market. When sales occur, they indicate stable to slightly increasing prices.

- The Columbia Basin Irrigation Project is gaining nationwide attention, attracting out-of-area buyers looking for investment in quality farm ground with reliable water availability and a diversity of crop options.

- Year-to-date precipitation levels are below average, which may increase drought stress and reduce yields during the 2024 growing season. Reliable water availability remains a top priority for market participants as extended drought conditions could negatively impact annual returns and land values.

- In areas where a recreational market exists, few sales have occurred and listing prices have seen reductions. Extended listing times are common.

- The rural residential market has slowed significantly due to increasing interest rates; however, demand still exists for good-quality properties outside of larger communities. There is upward pressure on farmland surrounding population centers.

About AgWest Farm Credit Appraisal Services

AgWest appraisers provide appraisal services on rural properties throughout the West. The Appraisal Services team continually researches sales and tracks market data throughout Arizona, California, Idaho, Montana, Oregon and Washington. They compile the market data and analyze it using a central database.

This report provides a high-level look at trends and market characteristics, and does not provide details for specific areas or land types. The report should not be used to identify a value for a specific property. This information is limited only to an analysis of trends in identified land values within the geographic area served by AgWest Farm Credit.

Spokane, WA | April 4, 2024

A complex landscape for Northwest agriculture

posted by AgWest Farm Credit

Spokane, WA | January 24, 2024

Challenging conditions for many ag industries in the Northwest

posted by AgWest Farm Credit

Spokane, WA | October 4, 2023

Outlook mixed for ag industries in the Northwest

posted by AgWest Farm Credit