Need Help

If you need help setting up services or accessing your accounts, please call our Customer Care Team at 866.552.9172 during business hours (7 a.m. — 5 p.m. PST, M-F) or email us at CustomerCare@AgWestFC.com.

Location

If you need help setting up services or accessing your accounts, please call our Customer Care Team at 866.552.9172 during business hours (7 a.m. — 5 p.m. PST, M-F) or email us at CustomerCare@AgWestFC.com.

Location

If you need help setting up services or accessing your accounts, please call our Customer Care Team at 866.552.9172 during business hours (7 a.m. — 5 p.m. PST, M-F) or email us at CustomerCare@AgWestFC.com.

Securely update and exchange balance sheet information with your AgWest team.

Put your idle cash to work with a suite of banking services that sweeps funds between accounts. Fees apply.

The squeeze continues.

The agricultural economy continues to face challenges, with tight profit margins expected to persist for many commodities into 2025. While production costs are anticipated to decrease or stabilize throughout the next year, they will still be the fourth highest on record (following 2022, 2023 and 2024). These high costs, combined with forecasted decade-low commodity prices, will continue to pressure producers' profitability. More than half of farmers expect that financial conditions for the agricultural sector will worsen over the next year. (Exceptions include the cattle and dairy industries which are benefitting from lower feed costs.) Good risk management strategies will be important to producers’ bottom lines in 2025.

In the short-term producers expect the profitability squeeze to continue. However, many remain optimistic about the five-year outlook, with more than 50% expecting a return to more profitable times for agriculture.

.jpg?sfvrsn=68087301_1)

Wednesday, January 15, 2024

January economic headlines, data and trends

by AgWest Farm Credit

Monthly economic trends, data and major industry headlines.

Read moreAgWest Farm Credit’s industry research team covers the state of major agricultural commodities in Alaska, Arizona, California, Idaho, Montana, Oregon and Washington. The market updates are based on various sources, and include boots-on-the-ground insights from AgWest’s own lending, appraisal and crop insurance teams across the West. For industry specific information, news and upcoming events, check out our industry pages below.

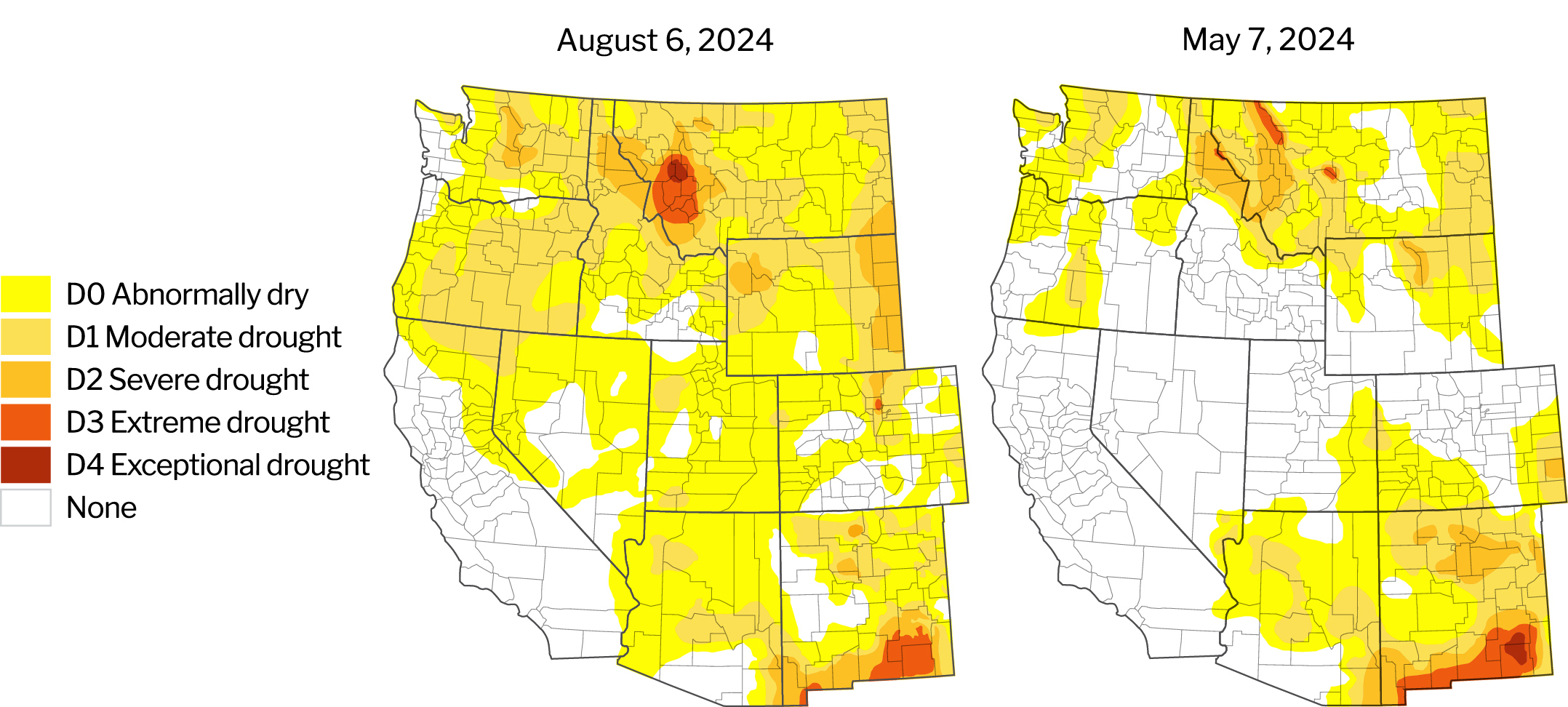

Drought conditions worsened notably in Washington, Oregon, Montana and northern California over the last three months. Hot and dry conditions dominated the West in July and early August, leading to the expansion of multiple drought categories ranging from D0 to D4 (see maps below) and numerous large fires. Wildfire potential for the remainder of August is above normal. For the latest on weather, please see AgWest’s Weekly Weather Updates with Eric Snodgrass.

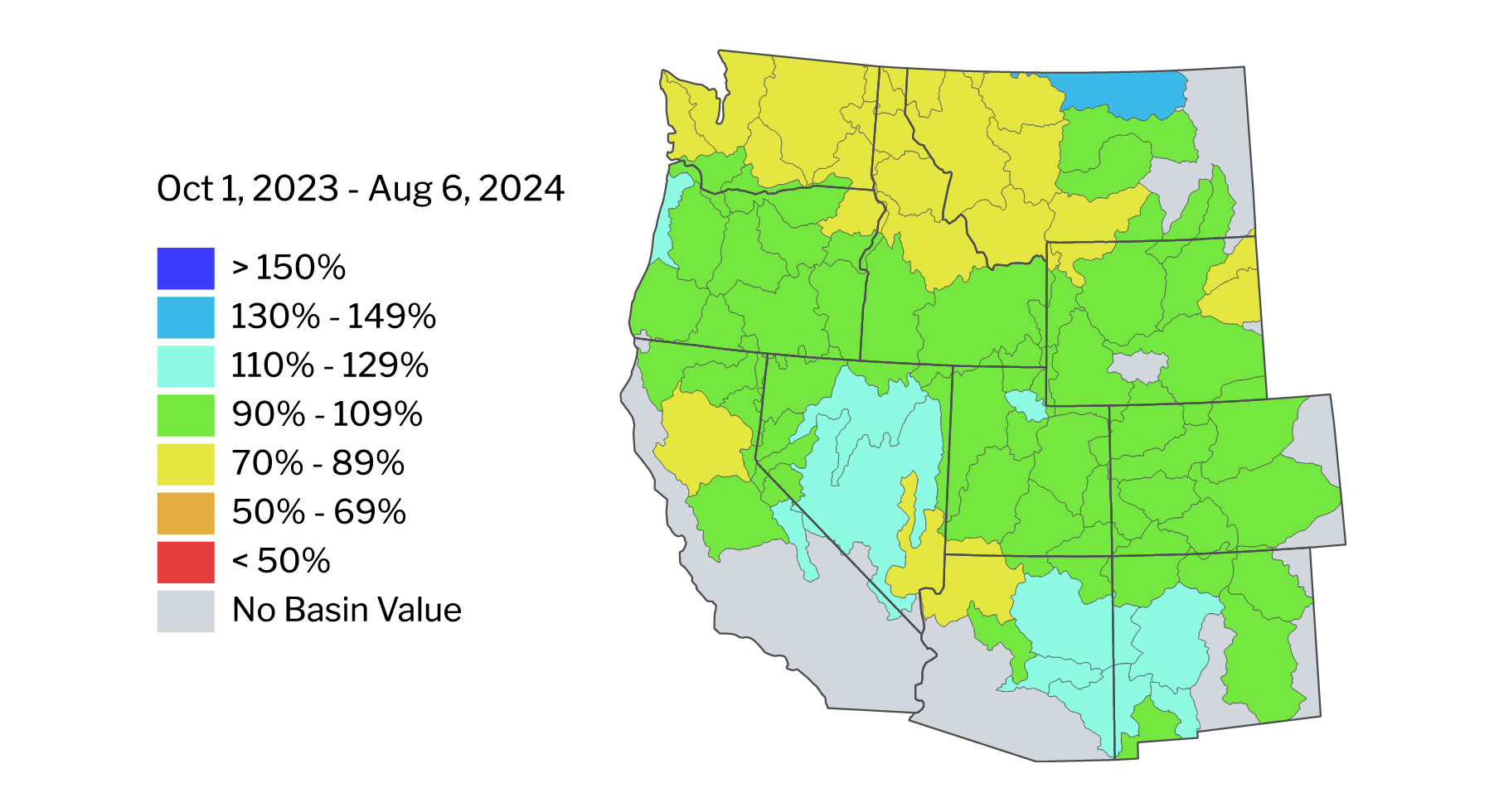

Year-to-date precipitation levels are close to their historical averages across the West, with notable exceptions in Washington, northern Idaho, western Montana, north San Joaquin Valley in California and northwest Arizona.

While reservoir levels across California are strong, Arizona, Oregon and the Yakima River Basin in Washington face challenging conditions.

Reservoirs with water levels below 80% of their historical average

| Location/Region | Reservoir | Percent below average |

|---|---|---|

| Colorado River Basin | Lake Powell | 59% |

| Lake Mead | 55% | |

| Deschutes River Basin, OR | Crescent Lake | 29% |

| Rogue River Basin, OR | Emigrant | 54% |

| Four Mile Lake | 34% | |

| Howard Prairie | 66% | |

| Hyatt | 74% | |

| Southeastern Oregon | Mason Dam / Phillips Lake | 75% |

| Thief Valley Dam | 29% | |

| Upper Snake River, ID - WY | Grassy Lake | 73% |

| Yakima River Basin, WA | Cle Elum | 46% |

| Kachess | 70% | |

| Keechelus | 33% |

Data as of August 8, 2024.

Source: Bureau of Reclamation: Reservoir Storage. California Department of Water Resources. Arizona Department of Water Resources.

Description – Reservoirs are an important source of water for agricultural producers throughout the West. This section identifies those with water levels at 80% or below of their historical average for the given period. Reservoirs at or above 80% of their historical average water levels are not included in this list.

In a new proposal to the federal government, Arizona, California and Nevada collectively agreed to cut their water use when the Colorado River watershed levels dip below certain thresholds. Estimates suggest Arizona would have to cut water use by an average of 27% each year.

The Department of Water Resources (DWR) increased the State Water Project (SWP) allocation from 15% in February 2024 to 40% in April 2024, reflecting favorable water supply and snowpack conditions. Gains were experienced across each region. Attachment A of the Notice to State Water Project Contractors shows allocation by district.

Bureau of Reclamation increased the Central Valley Project (CVP) water allocation for south-of-Delta agricultural contractors from 40% to 50% of their contracted supply. North-of-Delta contractors remain at 100% of their contracted supply.

California’s DWR finalized its first public facing Long-term Drought Plan for California. Proposed actions include modernizing SWP infrastructure in the Delta, identifying and investigating water storage opportunities throughout the state, further planning for drought salinity barriers on the West Fals River, advancement of DWR’s Forecast-Informed Reservoir Operations and seasonal forecasting, and investing in habitat creation, restoration of tidal wetlands, floodplains and rearing habitat for juvenile salmonids.

A temporary agreement was reached between the Idaho Department of Water Resources (DWR) and several groundwater districts to avoid curtailments in the Eastern Snake Plain Aquifer. While this represents a win in that producers will continue to access water this season, negotiations will need to resume to arrive at a long-term solution. Estimates vary, but curtailments could impact 330-500 thousand acres of farmland in eastern and southern Idaho.

Due to a siphon(s) blowout near the head of the Milk River at St. Mary in northern Montana, it is reported that the irrigation districts along the Milk River may have severely depleted irrigation water availability until the new siphon system is completed. The project is slated for completion until August 2025. This will greatly affect producers along the Milk River in north central Montana.

Minimal snowpack this winter has limited irrigated water availability along the eastern front of the Rocky Mountains. The Greenfields Irrigation District (GID) in north central Montana was allocated 1 acre-foot of water, when they normally get 2 acre-feet. Reports suggest that as of August 4, 2024, many of the flood-irrigators in the GID ran out of water two weeks ago, and pivot irrigators may be soon to follow. Pondera County Canal and Reservoir Company (PCCRC) in north central Montana was allocated 4 inches of irrigation water, when they are normally allocated 1 acre-foot. Operators ran out of water very early in the PCCRC. Several irrigation projects/districts in western/northwestern Montana face similar water limitations.

There are some specific areas around Burns, Redmond and Klamath Falls experiencing irrigation water concerns due to historic drought/water table issues and/or environment concerns.

Junior water rights users of the Yakima River will have their access to water cut back to 51% of their normal allocation due to low precipitation and storage in the Yakima Basin Reservoirs.

Drought across Washington is expected to expand due to low snowpack and precipitation levels. On April 16, 2024, the Washington State Department of Ecology issued an emergency drought declaration for the entire state, which may open up tools such as public funding to mitigate the impact of lost crops. Impacted commodities may include hay, wheat and tree fruit.