April 9, 2025

April economic headlines

Government and consumer spending drives economic growth.

Strong employment and rising real wages helped to propel consumer spending by 2.8% in 2024 and while this is expected to continue into 2025, recent declines in the equity market may have a counterbalancing effect (see paragraph below). Government spending expanded at 3.5% in 2024, but this will likely moderate going forward given recent efforts by the Trump Administration to reduce spending.

Correction in equity markets may have downstream impacts.

Equity markets are currently in correction, which may lead to reduced consumer spending due to wealth effects (consumers are less likely to spend when their net worth declines) and lower interest rates as investors seek safety. Lower interest rates could provide a boost to housing markets.

Government reforms may improve business environment.

The Trump Administration is working to improve business conditions by reducing regulations and applying tariffs. While the World Bank ranks the U.S. as sixth in its Ease of Doing Business Index, several subcomponents rate poorly, including the ability to get electricity, start a business, register property and protect minority investors. Many countries have more stringent trade barriers, and some argue that while tariffs may lead to negative short-term consequences (higher inflation, disrupted supply chains, etc.), they will help to create a more balanced competitive environment in the long-term.

Federal Reserve (Fed) holds monetary policy steady.

Persistently high inflation and generally strong economic data led the Fed to hold rates steady at the last two meetings. Current expectations are for 2-3 more cuts in 2025; however, this is subject to change based on market conditions and economic data.

Job openings fall in February.

In February, U.S. job openings fell by 194,000 due to rising economic uncertainty from tariffs on imports. Layoffs increased by 116,000, despite still being relatively low. Some fear the tariffs will lead to higher inflation, slumped business and consumer sentiment, and higher recession odds. However, the labor market still boasts low jobless claims and a relatively low unemployment rate.

Changes in job openings

Source: Bureau of Labor Statistics.

Data and trends

This section presents select economic indicators to help producers gauge the direction of their business. These metrics reflect current market dynamics and their potential impact on operations. Come back each month to stay informed and adapt swiftly to the ever-changing economic landscape.

WTI crude oil and diesel prices

Source: U.S. Energy Information Agency.

Observation: Oil prices found a floor mid-March on higher-than-expected inventory draws and tariff threats against countries who import Venezuelan oil.

About this indicator: The West Texas Intermediate (WTI) crude oil price is a benchmark for oil pricing and influences the cost of fuels like diesel, which is essential for running farm equipment and transporting goods.

DXY Index

Source: Bloomberg.

Observation: The dollar weakened again in March due primarily to the threat and application of tariffs by the Trump Administration.

About this indicator: The DXY index measures the strength of the U.S. dollar against a basket of foreign currencies. The strength of the U.S. dollar impacts the competitiveness of agriculture producers in foreign markets. As the dollar strengthens, U.S. producers & exports become less competitive, and vice versa.

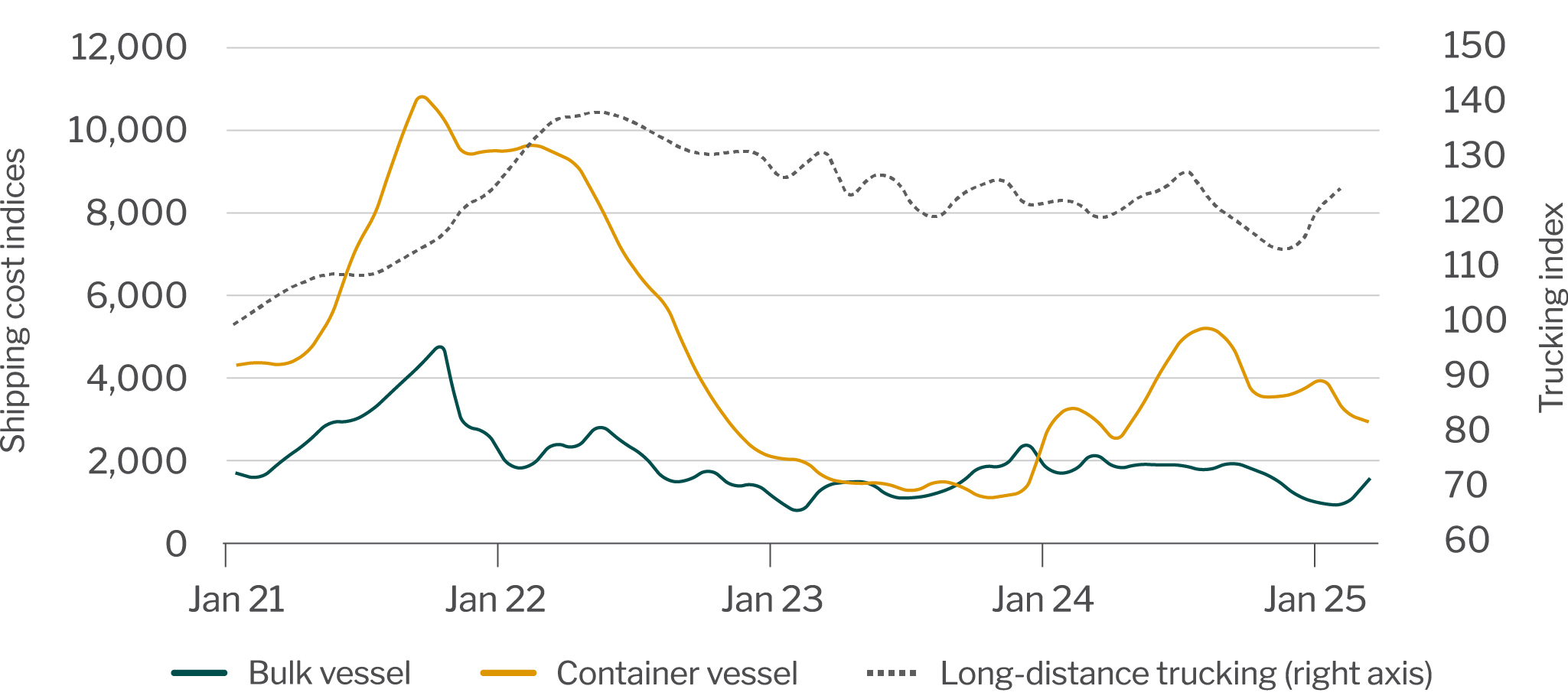

Transportation price indices

Source: Bloomberg. Freightos. U.S. Bureau of Labor Statistics.

Observation: Relatively soft oil prices helped reduce transportation costs overall, though recent oil price gains may stop this trend. Flatbed trucking experienced increased demand as companies sought to build inventories ahead of tariffs. Bulk shipping prices rose notably from mid-February to mid-March on tightening vessel supply and increased demand for coal, mining and minerals. Container rates declined for the third month in a row as new vessel capacity came online while demand slowed.

About this indicator: The long-haul trucking index measures the changes in trucking freight rates over time. The Baltic Dry Index measures the average global cost of shipping bulk materials, including grains, sugar, metals, and others. The container index measures the average global cost of shipping containers. Shipping prices vary by route and carrier size based on market dynamics and may move independently from global averages (i.e., the cost to ship goods from the West Coast to Asia could remain flat even if global rates are increasing).

Go to Industry Insights homepage

IN THIS SECTION

![]()

Quarterly Economic Update

Economic growth has exceeded most expectations over the past several quarters as consumers maintain spending levels.

Learn more.jpg?Status=Master&sfvrsn=bc72c53a_1)

Industry Insights

Access monthly updates on top commodities and the economy, plus special reports on profitability, land values and drought.

Learn more