Need Help

If you need help setting up services or accessing your accounts, please call our Customer Care Team at 866.552.9172 during business hours (7 a.m. — 5 p.m. PST, M-F) or email us at CustomerCare@AgWestFC.com.

Location

If you need help setting up services or accessing your accounts, please call our Customer Care Team at 866.552.9172 during business hours (7 a.m. — 5 p.m. PST, M-F) or email us at CustomerCare@AgWestFC.com.

Location

If you need help setting up services or accessing your accounts, please call our Customer Care Team at 866.552.9172 during business hours (7 a.m. — 5 p.m. PST, M-F) or email us at CustomerCare@AgWestFC.com.

Securely update and exchange balance sheet information with your AgWest team.

Put your idle cash to work with a suite of banking services that sweeps funds between accounts. Fees apply.

Following an August 2 employment report, economic headlines raised alarm flags about a potential recession signaled by the Sahm Rule. While recession talks have been ongoing for nearly three years, this spotlight will explain the Sahm Rule, its role in predicting economic downturns and the implications for producers.

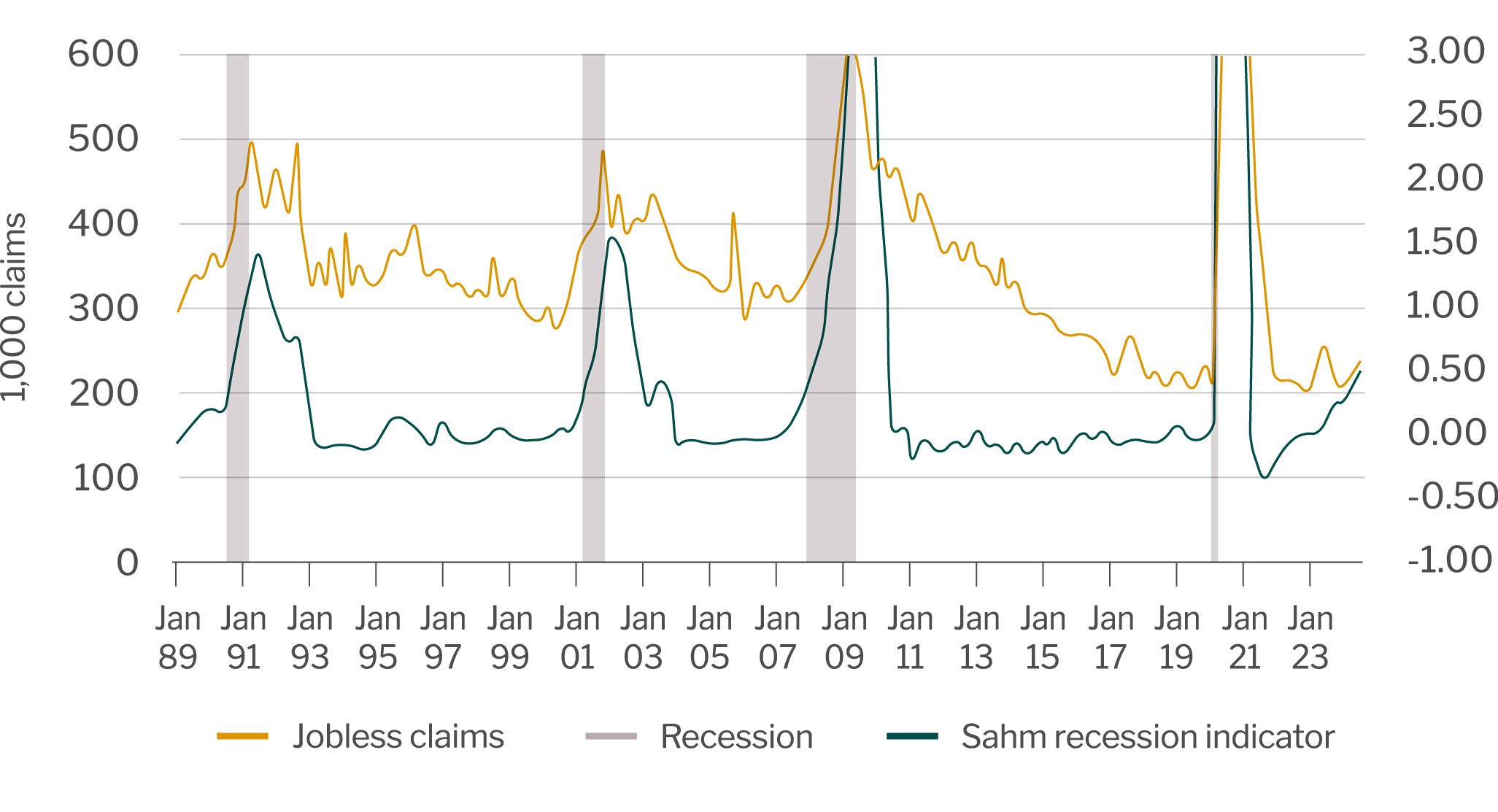

The Sahm Rule is a recession indicator developed by Claudia Sahm, a former economist at the Federal Reserve. It is designed to provide an early warning of U.S. economic downturns by monitoring changes in the unemployment rate. Specifically, the Sahm Rule signals the onset of a recession when the three-month moving average of the national unemployment rate (U3) rises by at least 0.5 percentage points above its lowest point during the previous 12 months. Since its introduction, the Sahm Rule has consistently signaled the early stages of recessions. Jobless claims tend to increase just prior to the Sahm Rule being invoked, or coincide with it. While jobless claims have not risen to a level consistent with the Sahm Rule flag yet, analysts are wondering if the Sahm Rule applies in this economic environment.

Jobless claims vs. Sahm Rule

Source: U.S. Bureau of Labor Statistics

Note: Jobless claims are released weekly, while the Sahm Recession Indicator is released monthly.

While the Sahm Rule is an early indicator, economists are careful not to call a recession this early as it can potentially lead to businesses and financial institutions making further cuts to their labor forces, investments and credit availability. There is a risk of a downward spiral in which such predictions cause actions leading to further economic weakness.

Although the Sahm Rule can reliably indicate economic downturns, even Sahm is not convinced that a recession is inevitable, stating, “We are not in a recession now… but the momentum is in that direction.” The recent trigger of this rule might not indicate an upcoming recession due to a stronger labor supply. Currently, about half of the unemployment increase is coming from new labor force entrants, unlike past recessions dominated by laid-off workers. This rise in unemployment is expected to decrease as job availability catches up with new job seekers, potentially fostering economic growth. With likely interest rate cuts in September, it is possible to mitigate economic pressures and avoid further headwinds. Nonetheless, the situation bears watching as conditions can change quickly, and the risk of a recession remains.

For agricultural producers, recognizing the early warning signs of economic downturns can help in planning and risk management. Having a risk management plan is vital to the success of agricultural producers, ensuring they can navigate economic challenges effectively.

To explore additional indicators used to identify business cycle turning points, visit the St. Louis FRED’s NBER Turning Points dashboard.