Land values - August 2024

Executive summary

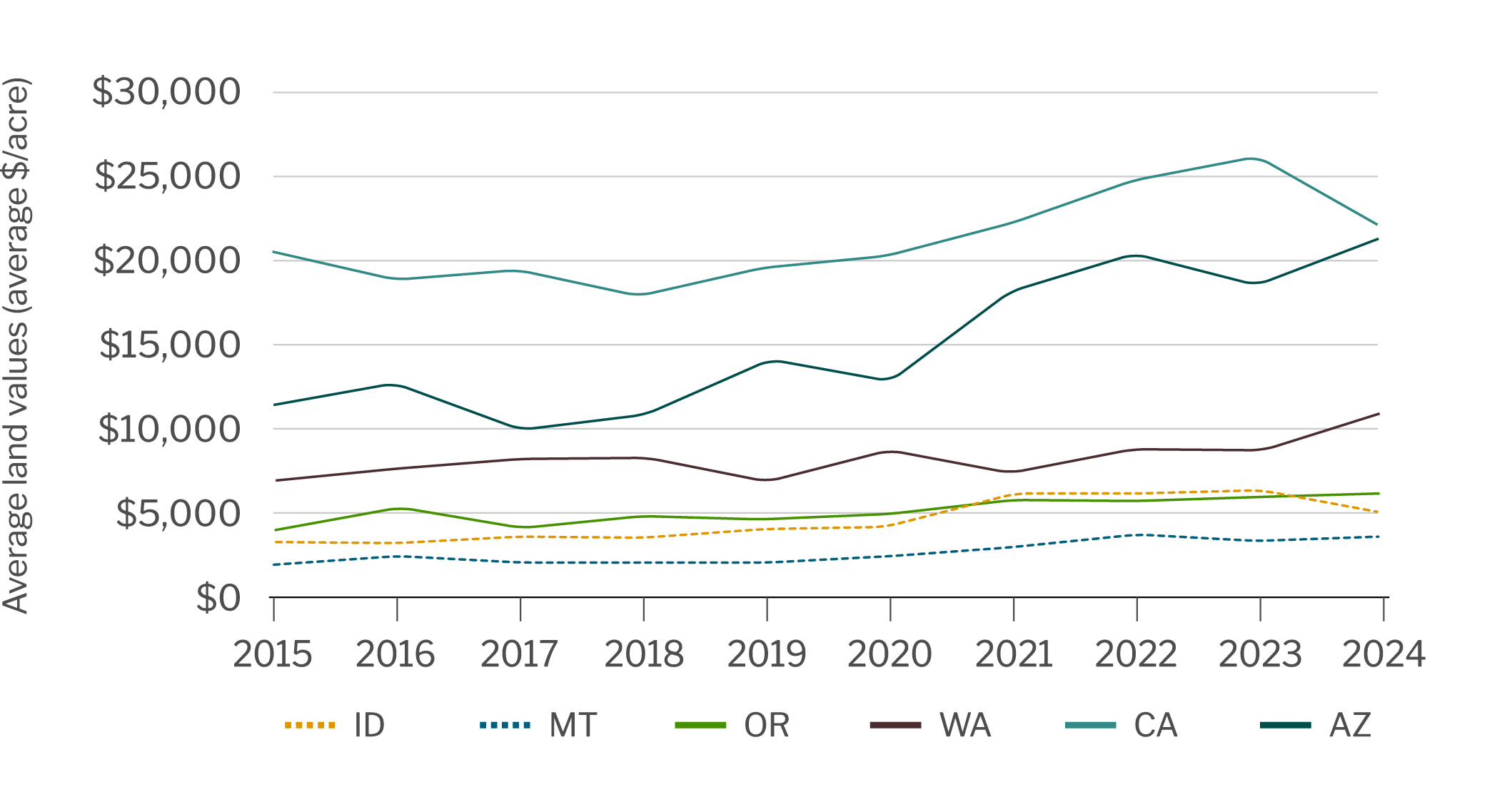

High interest rates, generally low inventories, falling farm income, shifting water availability and regulations are among the main drivers impacting land values in the West. Land values in most of AgWest’s region remain strong as demand outpaces available inventory; however, these drivers have led to decreased buyer interest and/or lower land values for various permanent plantings, including hazelnuts, almonds, walnuts and table grapes. The slight drop in land values in Idaho shown in the chart below is more indicative of fewer high-quality properties being sold rather than an overall decline in property values.

Market participants for land include a combination of local operators, absentee operators and institutional investors. Developers remain a player in the market, but acquisitions for development have decreased due to persistently elevated interest rates. Some areas are reporting longer listing times for properties and decreases in listing prices, although final sales prices indicate stable to increasing land values.

Average land values, thousands of dollars per acre

.jpg?sfvrsn=5f05a5d3_1)

Source: AgWest’s proprietary sales database. Industrial, commercial and site sales excluded. Data represents a 12-month rolling average. Data collection lags about six months and is subject to change.

Land value considerations

Interest rates – High interest rates were one of the most frequently reported deterrents to land acquisition in the first half of 2024. Greater instances of creative financing such as owner-carried notes have been reported. Interest rates are expected to come down over the next several months.

Rural residential/recreational – The rural residential and recreational markets in most areas continue to cool, largely due to high interest rates. Longer listing times are becoming more common and prices appear to be stabilizing.

Farm income/commodity prices –The relationship between land values and commodity prices in recent years has been weak as many perceive land as a stable, long-term investment, with the exception of some permanent planting properties. While the outlook for agriculture industries is mixed, little if any negative impacts on land values have been seen by verified sales outside of certain isolated regions. Visit our Industry Insights webpage for more industry information and market updates.

Drought – Drought concerns are mixed throughout the West, with much of Washington, northern Idaho, Montana, and northern Arizona showing below average year-to-date precipitation levels and similar drought conditions as a year ago. Concerns over future water availability in Arizona are causing hesitancy among some buyers. The remainder of the territory shows at or above average year-to-date precipitation. Although specific areas have water concerns, overall delivery of irrigation water through the remainder of the 2024 growing season is reportedly positive. See our Drought and Water Update for more information.

Arizona

- Agricultural cropland prices are stable to slightly increasing in the Yuma area. Farmers are not actively seeking land to purchase, although existing tenants will often decide to buy a farm offered for sale. Investor activity has slowed due to water concerns and elevated interest rates.

- While land values in and around Yuma have increased, statewide averages have fallen as relatively high interest rates and concerns around water supply reduce investor activity.

- Land values in the Phoenix Metropolitan Area have risen due to its increasing population and urban sprawl; however, this trend is slowing due to concerns about long-term water availability.

- In a new proposal to the federal government, Arizona, California and Nevada collectively agreed to cut their water use when Colorado River watershed levels dip below certain thresholds. Estimates suggest Arizona would have to cut water use by an average of 27% each year.

- Water deliveries in 2023 were cut substantially due to the Tier 2 shortage declared in August 2022. Deliveries improved in 2024 due to wetter conditions last spring and winter in the Colorado River watershed.

- Developers are purchasing older dairy facilities around the Phoenix Metropolitan Area and taking them out of production due to increasing land values. Dairy producers have used funds from property sales and/or leases from vacant facilities to purchase dairies in other locations, which is helping to stabilize facility prices.

- Most participants in the pecan industry expect the market for average to good-quality orchards to remain stable; however, low prices and higher interest rates may slow sales activity. Pistachio orchards are rarely offered for sale due to high profitability and ownership concentration in the industry, keeping orchard values relatively high.

California

- Water availability, particularly access to surface water, is the primary driver of land values in the San Joaquin Valley. Pumping restrictions and state intervention will increase the importance of groundwater recharge. Secondary drivers include elevated interest rates and falling commodity prices.

- Declining commodity prices are beginning to put downward pressure on land values in the San Joaquin Valley, notably in the tree nut and table grape sectors. This trend is also present in tree nut orchard values in the Sacramento Valley.

- Listing times are increasing as supply outpaces demand, a trend that has been compounded by the liquidation of multiple large vertically integrated grower/packers and agricultural investor groups based in the southern San Joaquin Valley. Tens of thousands of additional acres are on the market.

- Dairy facility demand is decreasing due to weak domestic markets. There is a limited pool of buyers and they prefer newer, more efficient facilities. Less efficient facilities are typically purchased and redeveloped into feed cropland or used as heifer facilities.

- Increased orchard plantings over the last several years reduced available land for sale in the Sacramento Valley, leading to higher land values. More recently, this trend is slowing as commodity prices fall. Rice ground values are diverging on opposite sides of the valley – west-side values are trending lower due to water supply curtailments while east-side values are trending higher due to relative water security.

- Premium wine grape vineyards in the Central Coast, with the exception of those located in the desirable western Paso Robles area, are seeing reduced demand due to a glut in the U.S. wine industry. Established winery sales activity appears to be slowing.

- The supply of Central Coast irrigated cropland capable of vegetable and strawberry production is very limited and in high demand, particularly in the Santa Maria Valley. Properties are usually directly marketed to a well-known buyer/lessee pool and typically sell quickly, keeping values elevated.

- Imperial Valley land values remain stable as large, regional growers look to expand operations and investors seek high-seniority rights to the Colorado River to hedge against water risk.

Idaho

- A temporary agreement was reached between the Idaho Department of Water Resources (DWR) and several groundwater districts to avoid curtailments in the Eastern Snake Plain Aquifer. While this represents a win in that producers will continue to access water this season, negotiations will need to resume to arrive at a long-term solution. Estimates vary, but curtailments could impact 330-500 thousand acres of farmland in eastern and southern Idaho.

- Demand for agricultural properties continues to exceed available inventory, resulting in elevated competition and prices.

- Southern Idaho experienced increased precipitation and snowpack levels during February and March following a dry start to winter. Reservoir storage and water availability in the southern part of the state remains favorable. Central and northern Idaho have seen lower-than-average precipitation levels, which could mean a return to drought-like conditions. Extended drought conditions have the potential to negatively impact agricultural land values.

- The recreational market has slowed and properties are seeing longer listing times. Prices in this sector are difficult to track as there is relatively little data. Relatively high interest rates have pushed some prospective buyers out of the market.

- The rural residential market continues to slow across much of the state due to high interest rates. Prices are leveling off and listing times are increasing, but properties still sell in a reasonable timeframe.

Montana

- Following a dry start to the year, much of Montana has received above-average spring moisture and this has eased concerns across much of the state, particularly in eastern Montana. Drought conditions remain a concern among producers with irrigated farmland where mountain snowpack was significantly below-average, such as in the north central region. Overall, agricultural land sales are still strong throughout the state, primarily for higher quality production properties.

- While no longer at peak levels, demand for recreational ranch properties remains strong, particularly those with high amenities (recreational streams and ponds, good habitat for wildlife, access to public land, etc.). The TV show Yellowstone, which romanticizes ranch life in Montana, continues to drive demand from outside buyers for some properties, often referred to as the “Yellowstone Effect.” Lower-amenity recreational properties are starting to stay longer on the market and some are even seeing price decreases.

- Other good-quality agricultural real estate outside of ranching properties continues to be in high demand. Demand for lower-quality agricultural properties has softened, with longer listing times reported.

- Production agriculture still drives land values in many parts of the state, with many transactions taking place privately between landlords and tenants or between neighbors.

- Demand for rural residential properties has cooled from previous highs due to interest rates. Rural residential properties are seeing longer listing times, with price reductions becoming more common.

Oregon

- Demand for good-quality agricultural properties remains strong throughout most of the region, with a low inventory of listings reported. Hazelnut plantings are a notable exception to this trend as low prices have lowered demand and softened land values.

- Although demand continues to be strong for most property types, particularly from large operators and institutional investors, buyers are generally careful to ensure properties fit well within their existing operations.

- Upward pressure on agricultural lands in eastern Oregon is coming from investors and market participants in Idaho in search of more affordable lands.

- The current outlook for irrigation water throughout the majority of the state is positive for the 2024 growing season, easing concerns over drought-related challenges that have the potential to impact land values.

- There are some specific areas around Burns, Redmond, and Klamath Falls experiencing irrigation water concerns due to historic drought/water table issues and/or environmental concerns.

- Elevated interest rates have led to a drop-off in demand and longer listing times of recreational properties. Evidence provided by the limited number of sales in this market segment suggests a possible downturn in recreational properties.

- Demand for rural residential properties varies depending on location but a lack of inventory is generally keeping demand in excess of supply. Due to continued high interest rates, however, prices have leveled off from previous highs and longer listing times are common.

- Strict zoning laws to limit building have resulted in a premium on properties improved with dwellings or the ability to construct one, especially near population centers.

- Wildfires in Oregon have impacted a record-setting 1.4 million acres, and the fires are expected to continue until precipitation arrives in the fall.

Washington

- Agricultural land remains in strong demand as low inventories limit transaction levels; however, more properties are being sold through listings rather than word of mouth, which may be an early indicator of a slowing market. When sales occur, they indicate stable to slightly increasing prices.

- The Columbia Basin Irrigation Project is gaining nationwide attention, attracting out-of-area buyers looking for investment in quality farm ground with reliable water availability and a diversity of crop options.

- Drought across Washington is expected to expand due to below average snowpack and precipitation levels. On April 16, 2024, the Washington State Department of Ecology issued an emergency statewide drought declaration. Reliable water availability remains a top priority for market participants as extended drought conditions could negatively impact annual returns and land values.

- In areas where a recreational market exists, few sales have occurred and listing prices have seen reductions. Extended listing times are common.

- The rural residential market has slowed significantly due to elevated interest rates; however, demand still exists for good-quality properties outside of larger communities. There is upward pressure on farmland surrounding population centers.

Share your feedback! Click here to complete a two-minute survey about this report.

About AgWest Farm Credit Appraisal Services

AgWest appraisers provide appraisal services on rural properties throughout the West. The Appraisal Services team continually researches sales and tracks market data throughout Arizona, California, Idaho, Montana, Oregon and Washington. They compile the market data and analyze it using a central database.

This report provides a high-level look at trends and market characteristics and does not provide details for specific areas or land types. The report should not be used to identify the value of a specific property. This information is limited only to an analysis of trends in identified land values within the geographic area served by AgWest Farm Credit.

Learn more

For more information or to share your thoughts and opinions, contact the Business Management Center at 866.552.9193 or bmc@AgWestFC.com.

To receive email notifications about western and global agricultural and economic perspectives, trends, programs, events, webinars and articles, visit www.AgWestFC.com/subscribe.

Return to Industry Insights home page

IN THIS SECTION

![]()

Drought and water update

Drought conditions have worsened significantly over the past three months, leading to numerous large fires. Reservoir levels are strong in California but challenging in other areas.

Learn more