Quarterly Economic Update: October 2024

Executive summary

Economic growth has exceeded most expectations over the past several quarters as consumers maintain spending levels. Despite choppy data, the growth trend is slowly moderating due to financial headwinds, political uncertainty, fading fiscal tailwinds, increases in the unemployment rate and the accumulated impact of high consumer inflation over the last four years. Rising Federal deficits, weakness in the commercial real estate sector, elevated geopolitical risk and weak global growth remain concerns.

Economic drivers

Federal Reserve (Fed) eases monetary policy.

Fed officials view the risks of rising unemployment and higher inflation as roughly balanced and do not want to see further weakness in the labor market. These developments led policymakers to cut the federal funds target rate range by 50 basis points on September 18 to 4.75-5%. Looking forward:

- Federal funds futures suggest the Fed will cut the funds rate by an additional 75 basis points by year-end and another 100 basis points in 2025. This would bring the federal funds rate range to 3-3.25% by the end of 2025.

- In September, Fed officials suggested trimming the funds rate by another 50 basis points by year-end would be appropriate. The Fed’s Summary of Economic Projections suggests the funds rate will be reduced to 3.25-3.50% by year-end 2025, with the potential for another 50 basis point reduction in 2026.

Equity markets perform well.

Equity markets have performed better than expected in 2024 despite persistently elevated interest rates, softening employment and other concerns. The major indexes have established several new record highs over the last few months. The S&P-500 index is up nearly 34% from a year ago and over 20% year-to-date. Some investors worry growth may have occurred too quickly, and values may be excessive.

Economy stronger than expected.

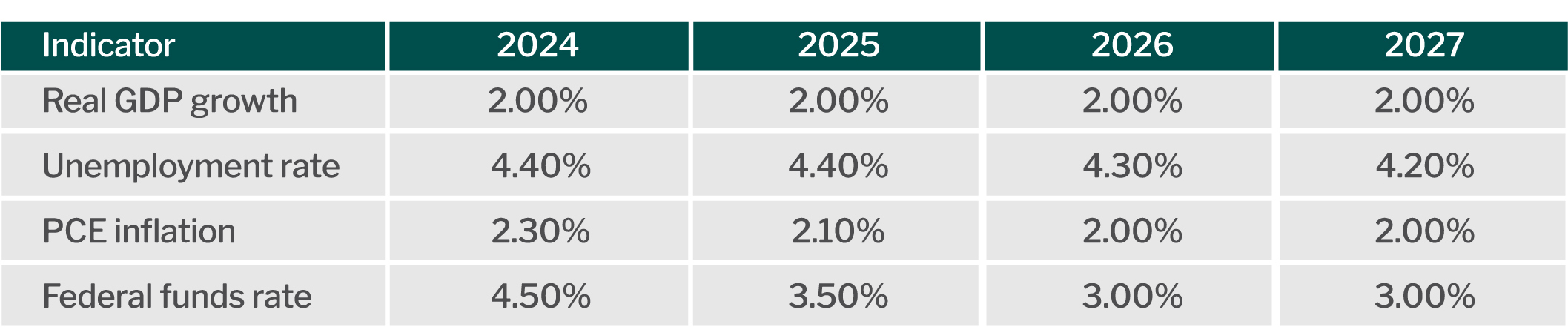

Real Gross Domestic Product (GDP) grew by 1.6% and 3% for the first and second quarters, largely due to strong consumer spending. During this time, the unemployment rate increased from 3.7% in January to 4.1% in September, while total year-over-year Consumer Price Index (CPI) declined from 3.1% to 2.5%. Looking ahead, the table below summarizes the Fed’s most recent projections for the economy. For the next few quarters, look for a gradual slowing in inflation, a gradual increase in unemployment and modest economic growth.

Federal Reserve projections

Source: Federal Reserve Board.

Consumer loan delinquency rates rise.

While consumer spending is projected to expand at decent levels, consumer loan delinquencies for credit card and autos are trending higher. This likely reflects growing financial stress due to rising prices and debt loads.

Fiscal policy is an increasing concern.

Federal debt now represents 120% of Gross Domestic Product (GDP) and is continuing to grow as if the economy needs fiscal support due to a recession. Rising debt levels have the potential to increase both inflation and treasury yields, weaken the U.S. dollar, and reduce the capacity of the U.S. government to respond to an economic crisis as well as international events such as war. Congress is unlikely to respond until a crisis arises or it creates significant hardship on the American people.

Global conditions present risk to economic outlook.

Conflicts in the Middle East and Ukraine continue to disrupt global trade flows and dampen economic growth. Shipping companies continue to adapt to longer trade routes due to disruptions in the Red Sea, while drought concerns with shipping through the Panama Canal have eased. Increasing collaboration among Russia, China, India and Brazil (among other smaller countries) could weaken the U.S. dollar over time. There are reports China is working to spur economic growth via monetary and fiscal policy actions. This may result in higher prices for raw materials, provided their efforts are effective.

Economic data and trends

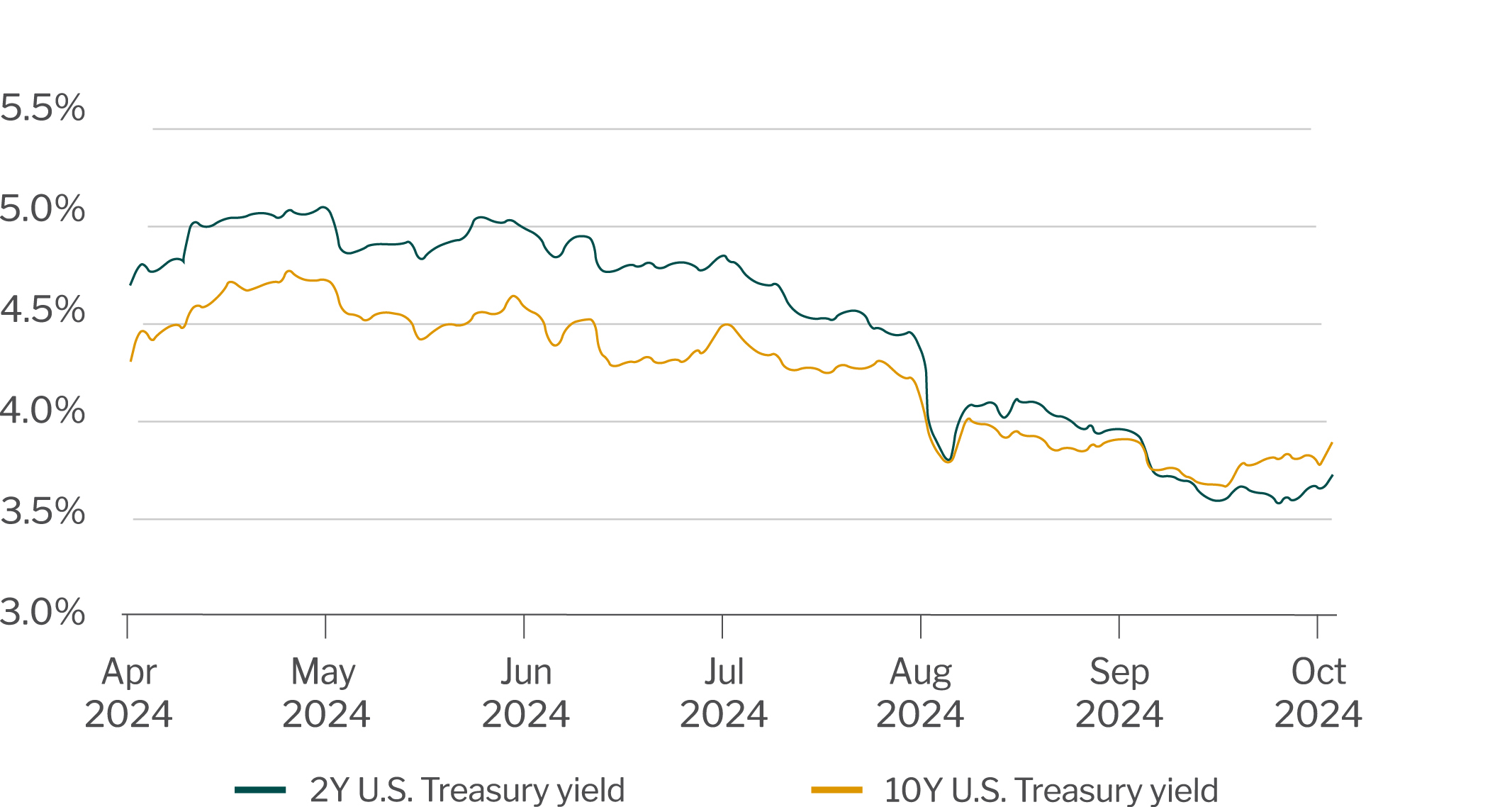

Interest rates

U.S. Treasury yields have declined by 65-115 basis points since July 1 in response to lower inflation levels and weaker labor reports. The 2-year U.S. Treasury security is yielding about 3.6% while the 10-year yields 3.8%. The slope of the 2-year to 10-year yield curve is no longer inverted, which is typical when the Fed shifts from a tightening bias to an easing bias. A shift in policy bias can be a recessionary signal. However, there are many factors that may alter the signal at this time, which include the large amount of fiscal stimulus over the past 3-4 years, immigration flows and extreme monetary policy measures (i.e. quantitative easing and tightening).

Treasury yields

Source: U.S. Department of Treasury.

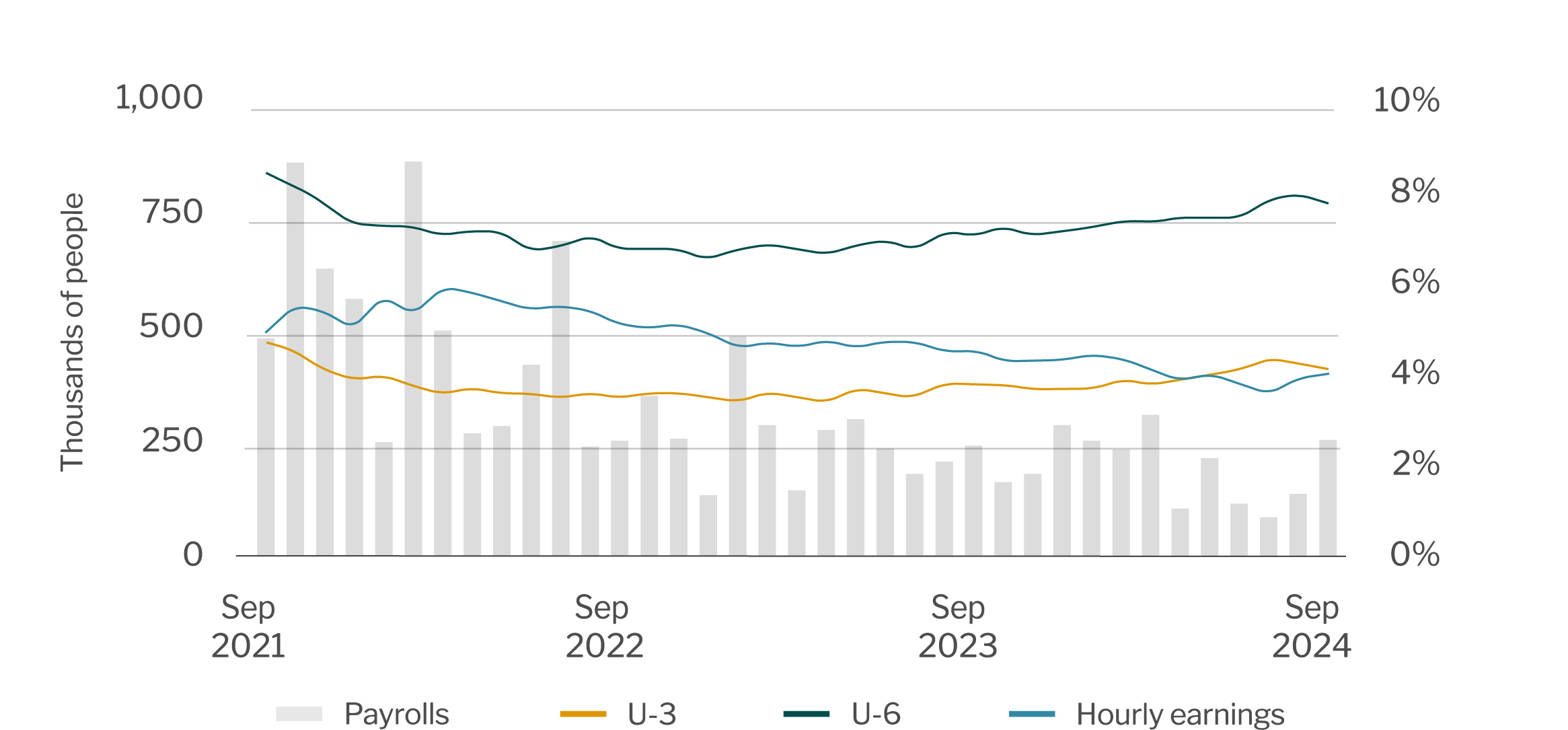

Employment

Nonfarm payrolls rebounded in August and September (see chart below), with September’s reading beating expectations. This follows a downward revision of -818,000 jobs for the year ending March 2024, an average decrease of 68,000 per month. The unemployment rate fell to 4.1% in September, but remains above the low of 3.4% in January 2023. The U-6 unemployment rate, a broader measure that includes marginally attached and discouraged workers, decreased to 7.7% in September, but has been trending higher over the past year. The annual rate of increase in average hourly earnings has slowed and is now growing at about 4%. Jobless claims do not appear to be signaling a recession.

Jobs, unemployment and hourly earnings

Source: U.S. Bureau of Labor Statistics.

Gross Domestic Product

The third estimate for Q2 2024 GDP came in at 3%, somewhat stronger than Q1 2024, but much weaker than Q3 and Q4 of 2023. The Fed expects GDP to expand by an average of 2% over the next couple years. Consumer spending is expected to drive growth with contributions from business spending and government spending. While mortgages rates remain elevated, contributions from housing will likely remain muted. The Federal Reserve Bank of Atlanta forecasts Q3 2024 GDP growth at 2.5%, which is less than the 3% projection by the New York Fed staff.

Real Gross Domestic Product (GDP).jpg?sfvrsn=70ae38_1)

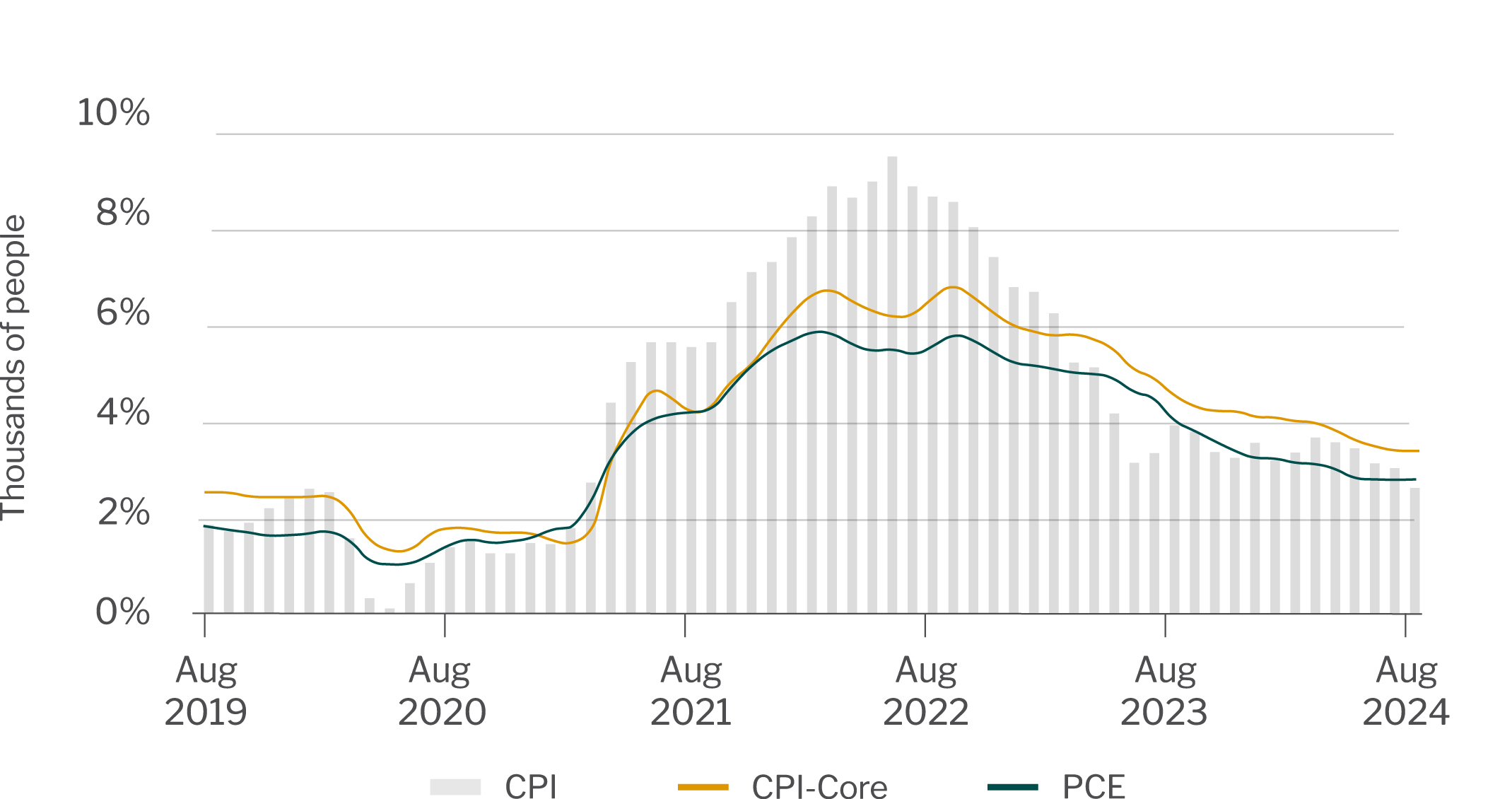

Inflation

Inflation has been trending lower the last two years. The Consumer Price Index (CPI) is down from 9.1% in June 2022 to 2.5% in August 2024. Over the last four years, the CPI is up 21% with the food and shelter components up 23%. Core-CPI (CPI less food and energy) increased 3.2% year over year in August, driven largely by shelter (+4.9%) and transportation (+7.9%). New and used vehicle prices are falling, but only make up 5% of the index. Core-Personal Consumption Expenditure (Core-PCE), the Fed’s preferred inflation metric, increased 2.7% in August. The Fed’s target for core PCE is 2%. Further declines in inflation may be challenging as the Fed shifts toward supporting the labor market.

Consumer Price Index

Source: U.S. Bureau of Labor Statistics. U.S. Bureau of Economic Analysis.

Return to Industry Insights home page

IN THIS SECTION

![]()

.jpg?sfvrsn=68087301_1)

Economic headlines, data and trends

Monthly economic trends, data and major industry headlines.

Learn more