Quarterly Economic Update: January 2025

Executive summary

The U.S. economy continues to expand at a moderate pace despite employment showing signs of cooling and inflation remaining above the Federal Reserve’s target. President elect, Donald Trump, is preparing to assume the political reigns of the federal government, which is adding a layer of uncertainty to the economic landscape. Other concerns for the outlook remain in play, including rising federal deficits, weakness in the commercial real estate sector, elevated geopolitical risk, weak global growth and the accumulated impact of high consumer inflation over the last four years. Despite all this uncertainty, in 2024 the equity markets performed better than expected with the major indexes establishing several new highs and the S&P 500 index gaining over 23%. Some investors worry growth may have occurred too quickly, and values may be excessive, but traders and investors are pushing equities higher as 2025 gets underway.

Economic drivers

Federal Reserve (Fed) eases monetary policy.

The Federal Open Market Committee (FOMC) cut policy rates by 100 basis points in 2024 and while inflation has slowed, it remains above the Committee’s 2% target. Meanwhile, labor market conditions have cooled and unemployment has increased moderately. Fed officials view the risks of rising unemployment and higher inflation as roughly balanced. The December rate cut of 25 basis points reduced the federal funds target rate range to 4.25%-4.50%.

Fed shifts monetary policy.

Fed Chair Jerome Powell indicated monetary policy has moved into a new phase given policy rates are at/near neutral levels, or are neither restrictive nor accommodative. Rather than establishing a predetermined set of rate cuts, the Fed will now wait for economic data to weaken and/or inflation to further slow before acting. Indications of strengthening data in either category could keep the Fed sidelined for an extended time. Looking forward:

- Federal funds futures suggest the Fed will cut rates by an additional 50 basis points in 2025, which matches projections by Federal Reserve Board members and staff. Futures indicate the next rate cut could occur as early as May, with an additional rate cut in the fourth quarter. These projections continuously change based on market conditions and economic data.

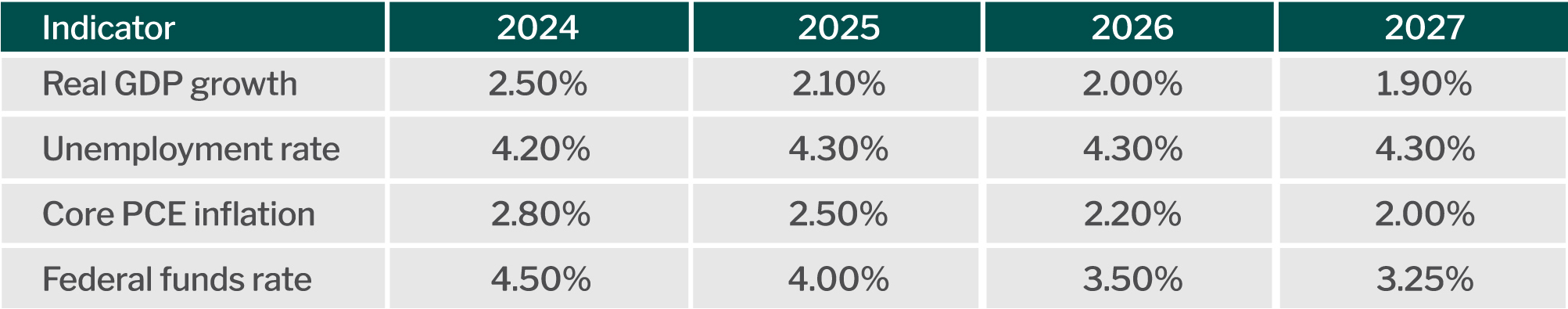

- The latest economic projections for growth, employment and inflation by Federal Reserve Board members and staff lead them to expect the funds rate to decline to 3.25% by 2027, consisting of 50 basis point reductions in 2025 and 2026, and 25 basis points in 2027.

Federal reserve projections

Data as of January 9, 2025 - Source: Federal Reserve Board.

President Trump’s election creates uncertainty.

Pro-growth changes such as tax cuts, reduced regulations and initiatives to improve government efficiency may be offset by higher tariffs and policies that reduce immigrant labor. While forecasters generally see these effects evening out in the long run, there is disagreement as to its short-term impact on Gross Domestic Product (GDP) and inflation. Other factors like lower expected energy costs may help offset the inflationary impact of tariffs. While the economic implications of a Trump presidency are unclear, it will take time to implement various initiatives and programs.

Consumer spending drives economic growth.

Real GDP exceeded expectations and grew by about 2.7% for the second half of the year, largely due to strong consumer spending in Q3. The unemployment rate remains relatively low, and nonfarm payrolls increased by nearly one million despite three catastrophic hurricanes and multiple labor strikes. Strong consumer spending was in part due to rising equity markets, which helped to support consumer confidence and offset the impacts from inflation and higher interest rates.

Positive investor sentiment drives gains in equity markets.

Investors remain optimistic about future growth despite persistently elevated interest rates, softening employment and other concerns. The major indexes have established several new record highs over the last few months. As of Jan. 11, the S&P 500 index is up about 23% year-over-year. Some investors worry growth may have occurred too quickly, and values may be excessive.

Economic and geopolitical headwinds present risk.

There are several risks to economic projections, including:

- Rising prices and debt loads are leading to financial stress, particularly among low wage earners, and this may eventually slow consumer spending. Delinquencies for consumer credit cards and auto loans are trending higher.

- Rising federal debt levels have the potential to increase inflation and treasury yields, weaken the U.S. dollar and reduce the capacity of the U.S. government to respond to an economic crisis and war. The debt to GDP ratio is now at about 124% and continuing to grow. Congress is unlikely to respond until a crisis arises or it creates significant hardship on the American people.

- Conflicts in the Middle East and Ukraine are disrupting global trade flows and dampening economic growth, and an escalation of either would worsen conditions. President Trump appears committed to ending both wars.

- The threat of labor strikes is rising, which leads to disrupted economic activity as businesses adjust their strategies and/or hold off on investments.

- Collaboration among Russia, China, India and Brazil (among other smaller countries) is increasing, which could weaken the U.S. dollar over time.

- There are reports China is working to spur economic growth via monetary and fiscal policy actions. This may result in higher raw material prices, provided their efforts are effective.

Economic data and trends

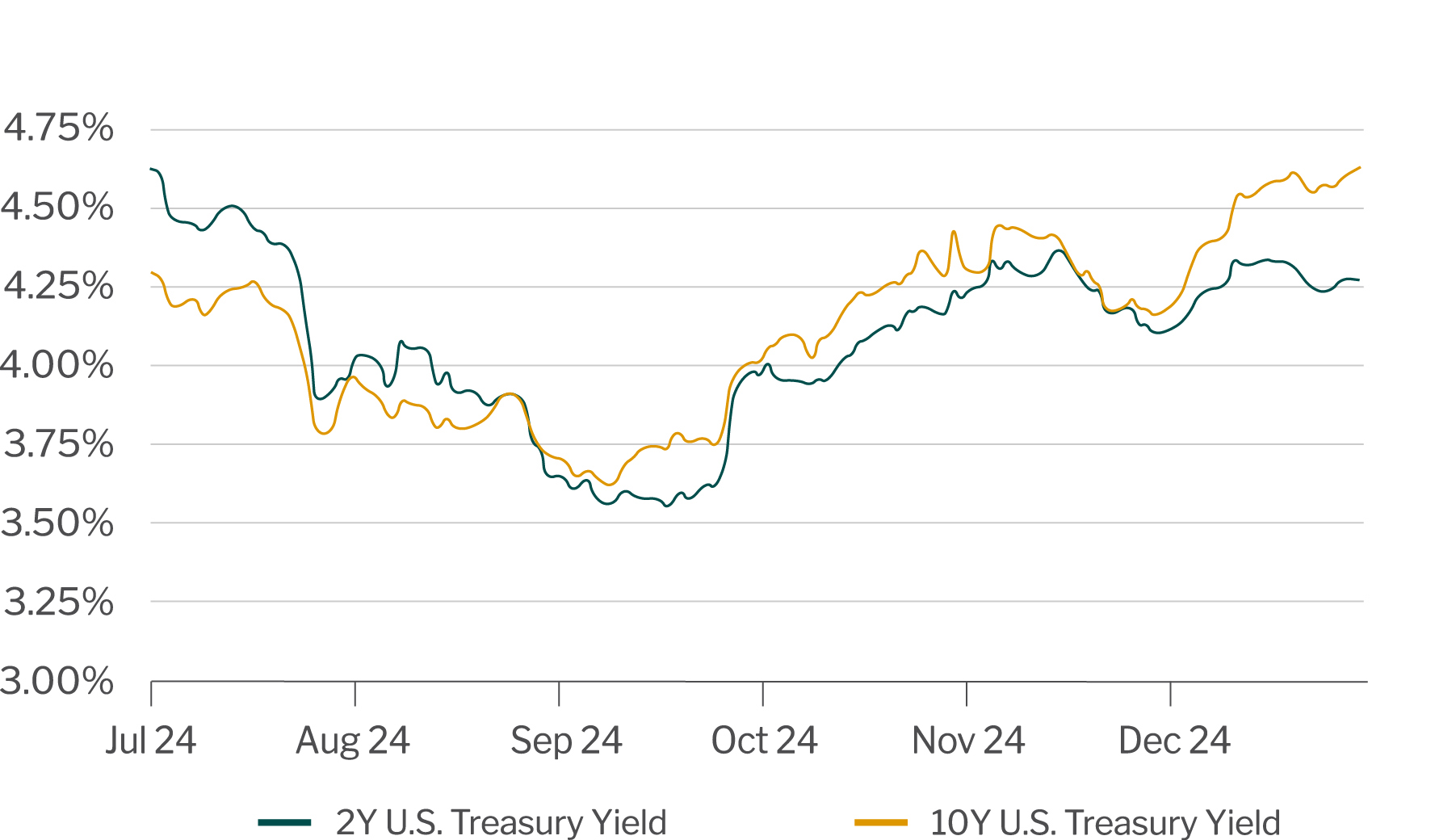

Interest rates

U.S. Treasury yields have increased 75-100 basis points following the Fed’s 50 basis point rate cut in September and guidance that more would be coming, actions that led market participants to worry policymakers may be losing some of their diligence on fighting inflation. Market fears remain given subsequent rate cuts in November and December. Fed Chair Powell’s Dec. 18, 2024 post-FOMC meeting comments related to slowing the pace of rate cuts seemed to ease market worries for a time, but recent employment data is reigniting fears that monetary policy may be too accommodative. The market seems to be comfortable with the current level of policy rates given their outlook for growth, employment and inflation. Look for yields to remain elevated until there is a shift in economic conditions. Adjustment to fiscal policy could impact the outlook for yields.

Treasury yields

Data as of January 9, 2025 - Source: U.S. Department of Treasury.

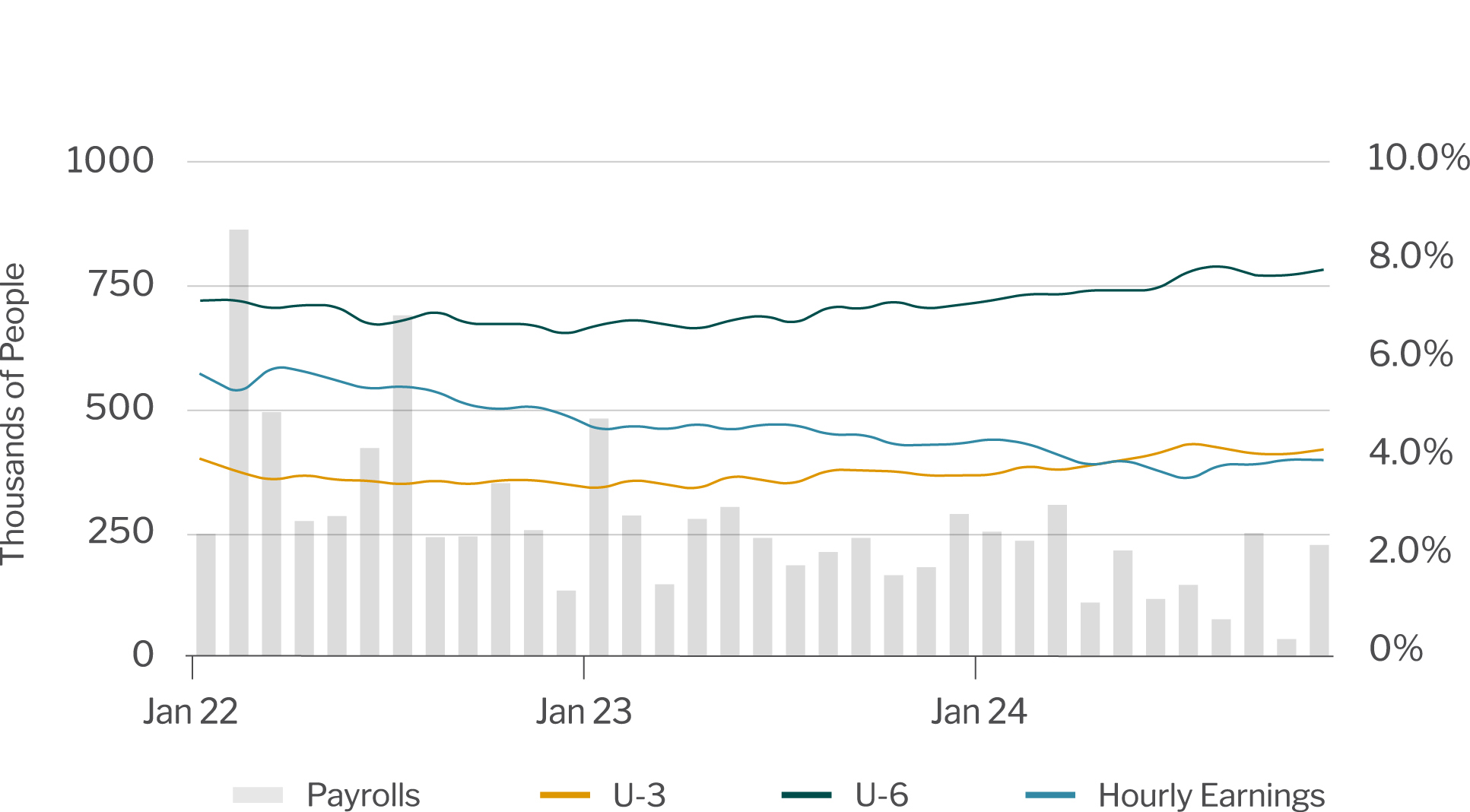

Employment

Nonfarm payrolls had a rough August and October due to Hurricanes Beryl, Helene and Milton. There were both strikes and threats of strike in 2024, which led to increases in real wages for union workers by about 6%. The national U-3 unemployment rate is expected to finish the year at 4.2% with monthly nonfarm payrolls growing by an average of around of 180,000. The U-6 unemployment rate, a broader measure that includes marginally attached and discouraged workers, is expected to end 2024 at 7.8%.

Provided the economy continues to expand at 2.5%-3.0% during 2025, look for a limited increase in the unemployment rate while nonfarm payrolls average around 150,000. In contrast, weaker economic growth will likely translate into higher unemployment. Average hourly earnings will likely grow at a rate of 3.7%-4.0% provided consumer demand remains robust and there is limited negative impact from net immigration flows. Weekly jobless claims data remains well within the range of a solid labor market. An increase to 300,000 to 350,000 in weekly claims would signal material weakness in employment with rising unemployment and the possible onset of a recession.

Jobs, unemployment and hourly earnings

Data as of January 9, 2025 - Source: U.S. Bureau of Labor Statistics.

Gross Domestic Product

The third estimate for Q3 2024 GDP came in at 3.1%, which exceeded Q2 2024 GDP of 3.0%. Fed projections indicate 2024 real GDP expanded by 2.5%. Consumer spending drove most of the economic growth, though a boost also came from business spending and government purchases. Housing was a drag on growth for much of the year with the change in inventories being mostly offset by net exports.

The Fed expects GDP to expand by an average of 2.1% for 2025. Expect consumer spending to drive growth with contributions from business spending and government purchases. Higher mortgage rates will restrict any contributions from housing. With energy prices a factor in transportation and manufacturing costs, cheaper energy could also translate into stronger growth and greater competitiveness in foreign markets. The Federal Reserve Bank of Atlanta forecasts Q4 2024 real GDP growth to be around 2.0% and 2.2% for Q1 2025.

Real Gross Domestic Product (GDP).jpg?sfvrsn=c473c0af_1)

Data as of January 9, 2025 - Source: U.S. Bureau of Labor Statistics.

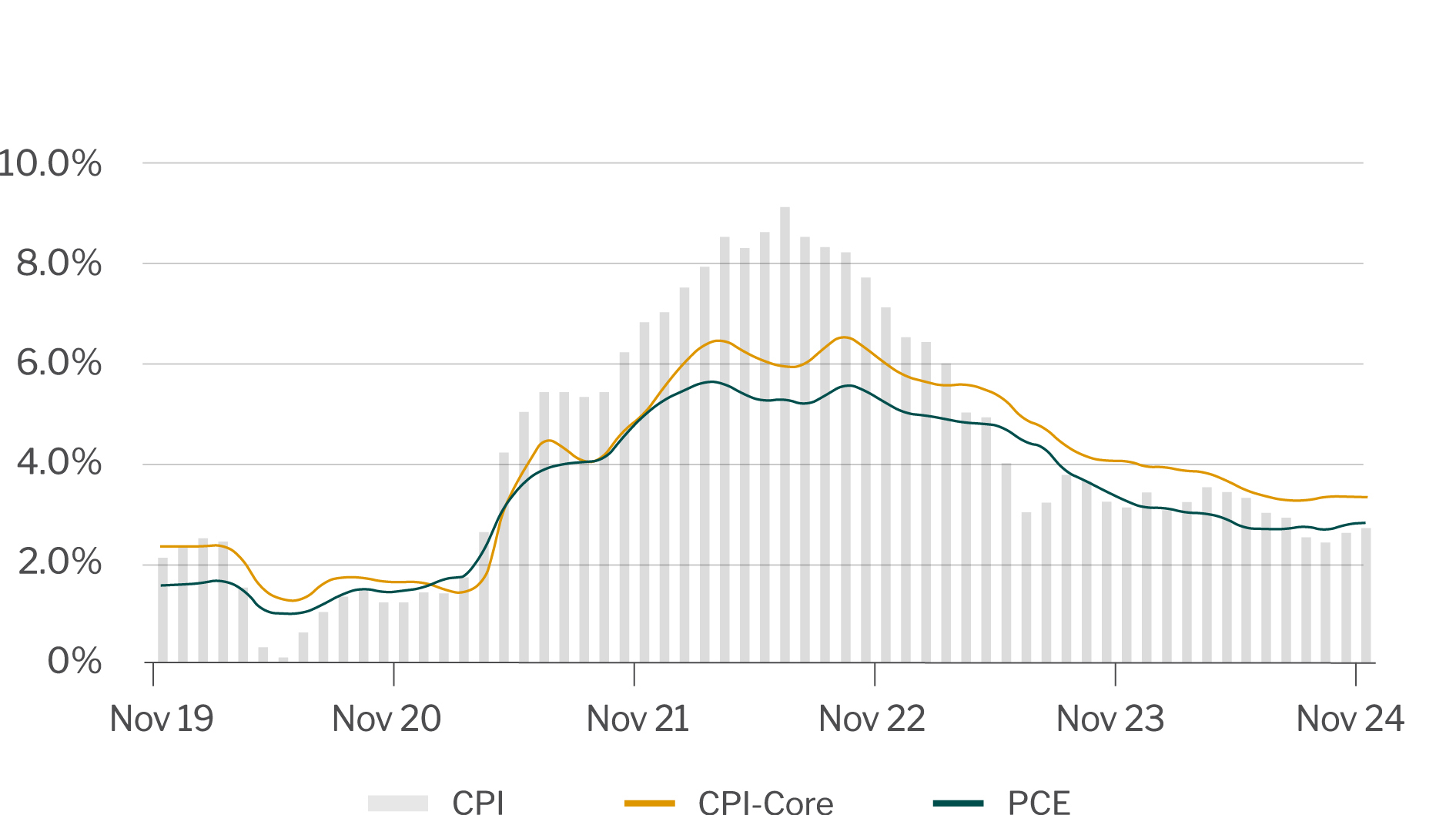

Inflation

Year over year consumer price inflation was 2.7% in November, up from a low of 2.4% in September and a high of 3.5% in March. Although somewhat choppy, inflation remains on a gradual downward trajectory. Continuing the downward trend may be a challenge depending on many factors discussed above. Over the last four years the CPI is up over 20%, including food and shelter components. Most of the upward pressure on prices is due to increases in the cost of services while commodities inflation has remained muted.

Core-CPI (CPI less food and energy) increased 3.3% year over year for September, October and November. The driver for core inflation continues to be shelter (+4.7%) and transportation services (+7.1%). Motor vehicle insurance costs increased 12.7% for the twelve months ending in November, which is likely a one-off event and is expected to be less of a factor going forward.

Core-Personal Consumption Expenditure (Core-PCE, the Fed’s preferred inflation metric), increased 2.8% for twelve months ending November. The Fed’s target for core PCE is 2.0%. Further declines in inflation may be challenging as the economy remains resilient. Slowing consumer demand and increasing unemployment could exert downward pressure on inflation metrics.

Consumer Price Index

Data as of January 9, 2025 - Source: U.S. Bureau of Labor Statistics. U.S. Bureau of Economic Analysis.

Return to Industry Insights home page

IN THIS SECTION

![]()

.jpg?Status=Master&sfvrsn=68087301_1)

Economic headlines, data and trends

Monthly economic trends, data and major industry headlines.

Learn more