Land values - February 2025

Executive summary

Land values are generally stable across the West; however, declines have been observed in California, Idaho, Oregon and Washington largely due to the following reasons:

- California - Rising water constraints and falling prices for certain permanent plantings, including almonds, walnuts, table grapes and wine grapes.

- Idaho and Oregon - Limited availability of high-quality properties (rather than falling demand).

- Washington - Falling prices for certain permanent plantings, including uncontracted wine grapes, apples (low-productive properties) and hops, and limited availability of high-quality properties.

Persistently elevated interest rates and changing regulations continue to pressure demand across the West. Even where values are increasing, they are doing so at a slower rate. Property inventories for sale are increasing in California and Arizona but remain limited across the Northwest. Local operators, absentee operators, institutional investors and developers are active in the marketplace; however, development acquisitions have decreased primarily due to elevated financing costs. Some areas are reporting longer listing times and decreases in listing prices, though final sales prices indicate generally stable values.

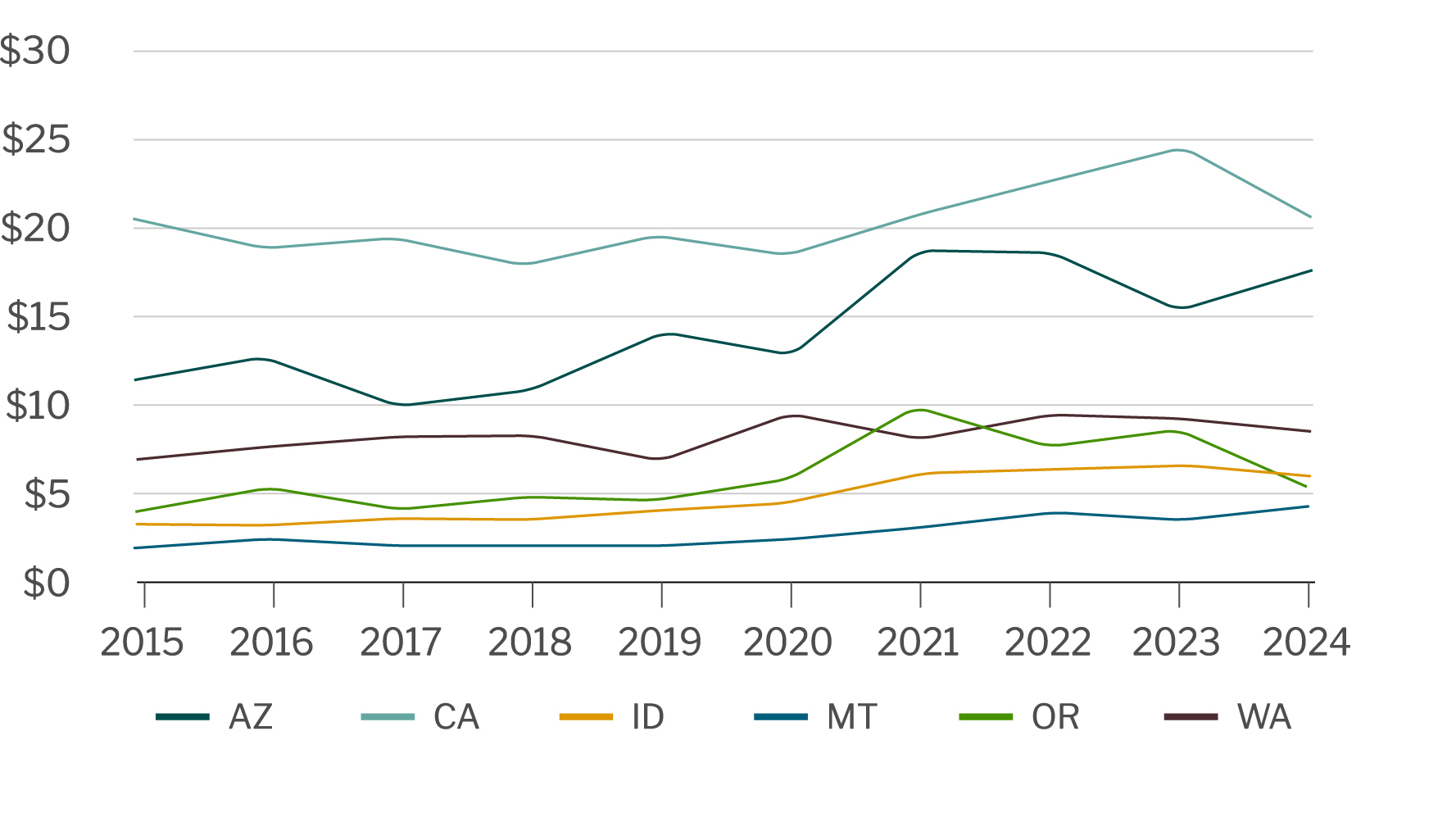

Average land values, thousands of dollars per acre

Source: AgWest’s proprietary sales database. Industrial, commercial, and site sales excluded. Data represents a 12-month rolling average. Data collection lags about six months and is subject to change.

.jpg?sfvrsn=b06daf4_1)

Source: AgWest’s proprietary sales database. Industrial, commercial, and site sales excluded. Data represents a 12-month rolling average. Data collection lags about six months and is subject to change.

Land value considerations

Interest rates – Relatively high interest rates were a frequently reported deterrent to land acquisition. Greater instances of creative financing, such as owner-carried notes, have been reported.

Rural residential/recreational – Most rural residential and recreational markets continue to cool, largely due to high interest rates. Longer listing times are becoming more common and prices appear to be stabilizing.

Availability – Inventories of agricultural land are low in much of AgWest’s territory, which continues to bolster values despite elevated interest rates. A notable exception to this trend is in portions of California and Central Washington, where broker reports and AgWest’s internal market data indicate supply is outpacing demand.

Farm income/commodity prices – The relationship between land values and commodity prices in recent years has been weak as many perceive land as a stable, long-term investment. However, this relationship appears to be getting stronger in areas such as central Washington and California’s Central Valley as commodity prices continue to trend down. Visit our Industry Insights webpage for industry specific updates.

Drought – Precipitation across much of the Pacific Northwest was strong towards the end of 2024 and drought concerns are mixed throughout the West. Extended drought conditions have the potential to negatively impact land values. See our Drought and Water Update for more information.

Arizona

- Agricultural cropland prices are stable to slightly increasing in the Yuma area. Farmers are not actively seeking land to purchase, although existing tenants will often decide to buy a farm offered for sale. Investor activity has slowed due to water concerns and elevated interest rates.

- Land values in southeast and central Arizona remain stable. Investor demand for agricultural land surrounding the Phoenix Metropolitan Area is largely driven by a rising population, though this trend has recently slowed due to elevated interest rates and long-term water concerns.

- Developers are purchasing older dairy facilities around the Phoenix Metropolitan Area and taking them out of production due to increasing land values associated with urban development. Dairy producers have used funds from property sales and/or leases from vacant facilities to purchase dairies in other locations, which is helping to stabilize facility prices.

- Colorado River user states are embroiled in contentious negotiations to decide how to re-allocate water as the 100+ year-old Colorado River Compact expires in 2026. Lower Basin states (Arizona, California and Nevada) are demanding that the Upper Basin states (Colorado, New Mexico, Utah and Wyoming) agree to proportionally larger cuts, creating an impasse.

- Drought and poor Colorado River conditions in recent years have led to reduced Central Arizona Project deliveries and increased water rates for irrigation districts in Central Arizona and Pinal County.

- Declining groundwater levels and expanding groundwater regulations are exerting some negative pressure on agricultural land values in rural Arizona, particularly in Cochise and Graham counties.

- The pecan industry generally expects the market for average to good-quality orchards to remain stable; however, low prices and higher interest rates may slow sales activity.

- Pistachio orchard values remain relatively high as they are rarely offered for sale due to high profitability and ownership concentration.

California

- Water access is the primary driver of values in the San Joaquin Valley, with buyers preferring properties with multiple sources. Secondary drivers include elevated interest rates and falling commodity prices.

- The unfolding implementation of the Sustainable Groundwater Management Act (SGMA) and related pumping restrictions have decreased underlying land value across much of the San Joaquin Valley, particularly in areas without access to surface water deliveries (often referred to as white areas).

- Persistently low prices for almonds, walnuts and table grapes have resulted in lower land values in the San Joaquin and Sacramento Valleys. Except for pistachios, the premium landowners would receive for planted nut trees as opposed to open land has decreased significantly. Some tree nut orchards have been sold for open land value less removal costs.

- Land values in the Sacramento Valley have remained steady overall despite weakness among tree nut orchards. Cling peach and prune orchard values are strong. Rice ground values are diverging on opposite sides of the valley – west-side values are trending lower due to water supply curtailments while those in the east-side are trending higher due to greater water security.

- Listing times across the San Joaquin and Sacramento Valleys are increasing as supply outpaces demand, a trend compounded by the liquidation of multiple large vertically integrated grower/packers and agricultural investor groups. Tens of thousands of additional acres are on the market.

- Dairy facility demand is decreasing due to weak markets. The buyer pool is limited and prefers newer, more efficient facilities. Less efficient facilities are typically redeveloped into feed cropland or used as heifer facilities after purchase. Although once common, purchases for redevelopment to tree nuts have halted due to falling nut prices, water supply concerns and high interest rates.

- Demand for premium wine grape orchards in the Central Coast has fallen due to weakening markets, leading to lower values. An exception to this trend is vineyards located in Paso Robles.

- Irrigated cropland supply in the Central Coast capable of vegetable and strawberry production is very limited and in high demand, particularly in the Santa Maria Valley.

- Rangeland values are stable. Properties are usually directly marketed to a well-known buyer/lessee pool and typically sell quickly.

- Imperial Valley land values and rents remain strong, although market activity is slower due to high interest rates and decreased commodity prices. This region appeals to large regional growers and investors who seek high-seniority rights to the Colorado River to hedge against water risk.

Idaho

- Agricultural land values in Idaho remain stable to slightly increasing when compared with previous years. There continues to be low supply of good quality agricultural ground which helps support demand.

- An agreement was reached in November 2024 between the Idaho Department of Water Resources (IDWR) and several groundwater districts to avoid curtailments in the Eastern Snake Plain Aquifer. To ensure sufficient access to water for surface water users, groundwater users will be subject to updated mitigation and conservation requirements in exchange for long-term water right protections. The agreement will be revisited every 4 years.

- The recreational market has slowed and properties are seeing longer listing times. Prices in this sector are difficult to track as there is relatively little data. Relatively high interest rates have pushed some prospective buyers out of the market.

- The rural residential market continues to stabilize across much of the state, largely due to persistently elevated interest rates. Prices are leveling off and listing times are increasing, but properties still sell in a reasonable timeframe.

Montana

- Agricultural land sales are strong throughout the state, primarily for higher quality production properties.

- While no longer at peak levels, demand for recreational ranch properties remains strong, particularly those with high amenities (recreational streams and ponds, good habitat for wildlife, access to public land, etc.). The TV show Yellowstone, which romanticizes ranch life in Montana, continues to drive demand from outside buyers for some properties, often referred to as the “Yellowstone Effect.” Lower-amenity recreational properties are starting to linger on the market longer and some are even seeing prices decline.

- Other good-quality agricultural real estate outside of ranching properties continues to be in high demand. Demand for lower-quality agricultural properties has softened, with longer listing times reported.

- Production agriculture still drives land values in many parts of the state, with many transactions taking place privately between landlords and tenants or between neighbors.

- Demand for rural residential properties has cooled from previous highs, due primarily to interest rates. Rural residential properties are seeing longer listing times and price reductions are increasingly common.

Oregon

- Demand for good quality agricultural properties remains adequate throughout most of the region, with a low number of listings reported. Values for lower quality agricultural properties have an increased risk of softening. Marketing times are generally increasing.

- Although demand remains strong for most property types, particularly from large operators and institutional investors, buyers are generally careful to ensure properties fit well within their existing operations.

- Elevated interest rates have led to a drop-off in demand and longer listing times for recreational properties. Evidence provided by the limited number of sales in this market segment suggests a possible downturn in recreational properties.

- Demand for rural residential properties varies depending on location but there is a general lack of inventory. Due to continued high interest rates, however, prices have leveled off from previous highs and longer listing times are common.

- Catastrophic wildfires in multiple areas of Oregon will result in widespread operational challenges over the next several years for some producers and this will likely reduce availability of grass/pasture leases on Bureau of Land Management and/or U.S. Forest Service land.

Washington

- Irrigated and dry cropland values are holding stable or increasing throughout the state. Many permanent planting properties, however, are seeing longer listing times and weakening values, particularly for hops, uncontracted wine grapes, and marginal apple orchards in Central Washington.

- The Columbia Basin Irrigation Project, which serves the largest irrigation district in the United States, is attracting out-of-area buyers in search of quality farm ground with reliable access to water and a diversity of crop options.

- Longer listing times and discounts have been seen on marginal quality orchards over the last few months as supply outpaces demand. Demand for orchards has softened, and those with long-term inefficiencies and out-of-date varietals are experiencing the largest change in values.

- In areas where a recreational market exists, few sales have occurred, and extended listing times are common.

- Rental rates are beginning to soften in some areas, which may suggest land prices follow if commodity prices remain depressed.

- The rural residential market has slowed significantly due to elevated interest rates; however, demand still exists for good-quality properties outside of larger communities. There is upward pressure on farmland surrounding population centers.

Share your feedback! Click here to complete a two-minute survey about this report.

About AgWest Farm Credit Appraisal Services

AgWest appraisers provide appraisal services on rural properties throughout the West. The Appraisal Services team continually researches sales and tracks market data throughout Arizona, California, Idaho, Montana, Oregon and Washington. They compile the market data and analyze it using a central database.

This report provides a high-level look at trends and market characteristics and does not provide details for specific areas or land types. The report should not be used to identify the value of a specific property. This information is limited only to an analysis of trends in identified land values within the geographic area served by AgWest Farm Credit.

Learn more

For more information or to share your thoughts and opinions, contact the Business Management Center at 866.552.9193 or CustomerFeedback@AgWestFC.com.

To receive email notifications about western and global agricultural and economic perspectives, trends, programs, events, webinars and articles, visit www.AgWestFC.com/subscribe.

Return to Industry Insights home page

IN THIS SECTION

![]()

.jpg?Status=Master&sfvrsn=68087301_1)

Economic headlines, data and trends

Monthly economic trends, data and major industry headlines.

Learn more