Why aren’t farmer incomes keeping up with food prices?

Profitability in agriculture is largely down despite rising food prices. On average, farmers, processors, packers and retail outlets are receiving less revenue as a percentage of total spent on food by U.S. consumers, whereas food services and advertising are receiving more. Also, food prices have not kept pace with rising input costs over the last several years and this has further compressed producer margins.

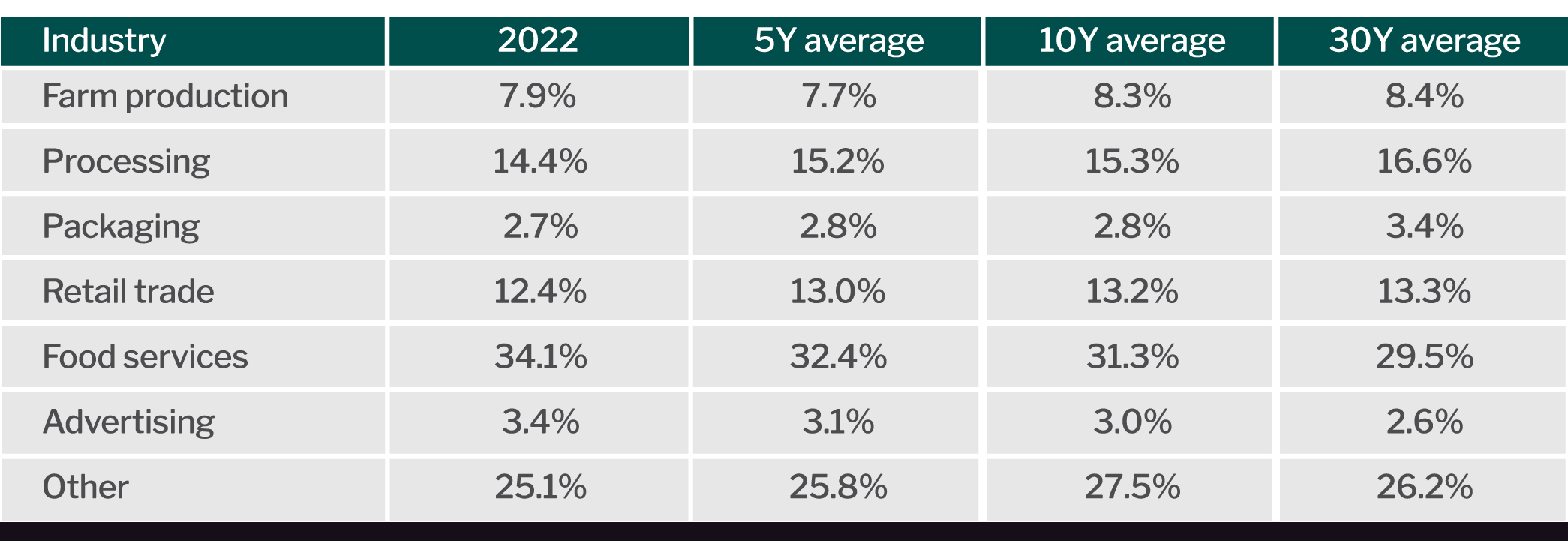

Revenue shifts throughout agriculture supply chain.

The USDA tracks how revenue is spread across agriculture’s supply chain in what it calls the Food Dollar Index (see table below). According to 2022 data, the latest available, the percentage of revenue going to farm production, processing, packaging and retail trade is below historical averages. In contrast, the percentage of revenue has increased for food services (food away from home) and advertising. Since 2022, this trend has likely continued as the impact of pandemic lockdowns on dining out eased.

Revenue by food supply chain sector

Source: USDA, Economic Research Service, Food Dollar Series. Food services include restaurants, limited-service outlets, caterers, some cafeterias, and other places that prepare, serve and sell food to the public. Others include transportation, energy, finance and insurance, and wholesale trade.

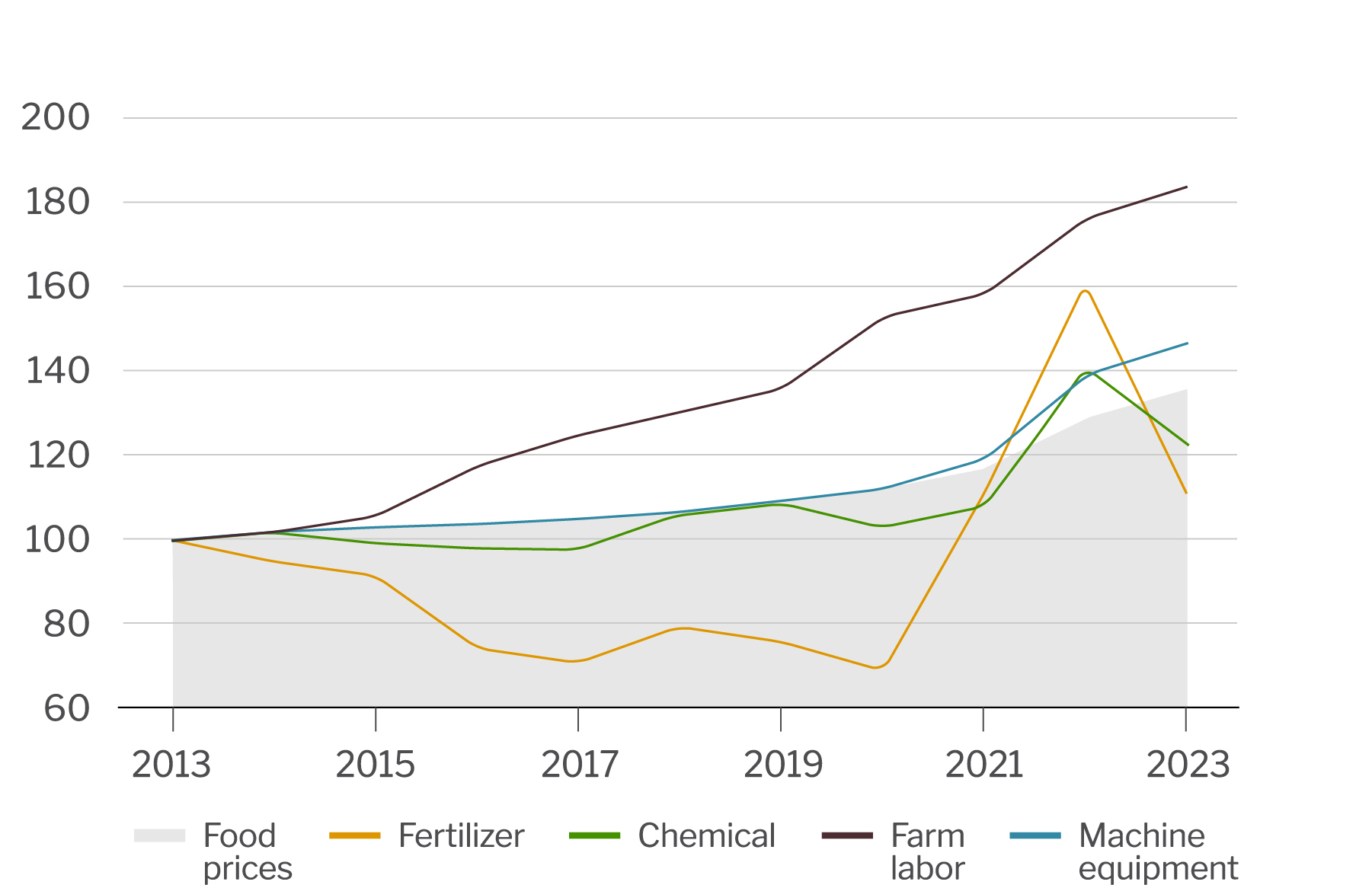

Food prices have not kept pace with input costs.

The cost of inputs, particularly for labor, machinery and equipment, have outpaced the rise in food prices (see chart below). Labor is perhaps the most significant of these inputs as it makes up on average 10-12% of the total cost of production. This percentage is much higher in many cases.

Food price and input costy indices

Source: Consumer Price Index (food). Producer Price Index. Bureau of Labor Statistics. Labor cost index calculated using Farmworker and Laborers median hourly wage.

Implications for producers

Receiving less revenue as a percentage of total spent on food, and input costs rising faster than food prices have reduced producer margins. This trend has several implications, including: 1) less ability for farmers to invest in their operations, 2) greater consolidation to achieve economies of scale, 3) pressure on land values (this has not yet been observed in a notable way in the West), and 4) reduced ability for new producers to enter agriculture. Ultimately, food prices will need to rise to ensure a healthy agriculture sector.

Return to Industry Insights home page

IN THIS SECTION

![]()

Quarterly Economic Update

Economic growth has exceeded most expectations over the past several quarters as consumers maintain spending levels.

Learn more