Rising federal debts and The Department of Government Efficiency

Summary: Efforts by the newly created Department of Government Efficiency (DOGE) to reduce federal spending and streamline/remove regulations will have mixed impacts on the economy, including the agriculture sector.

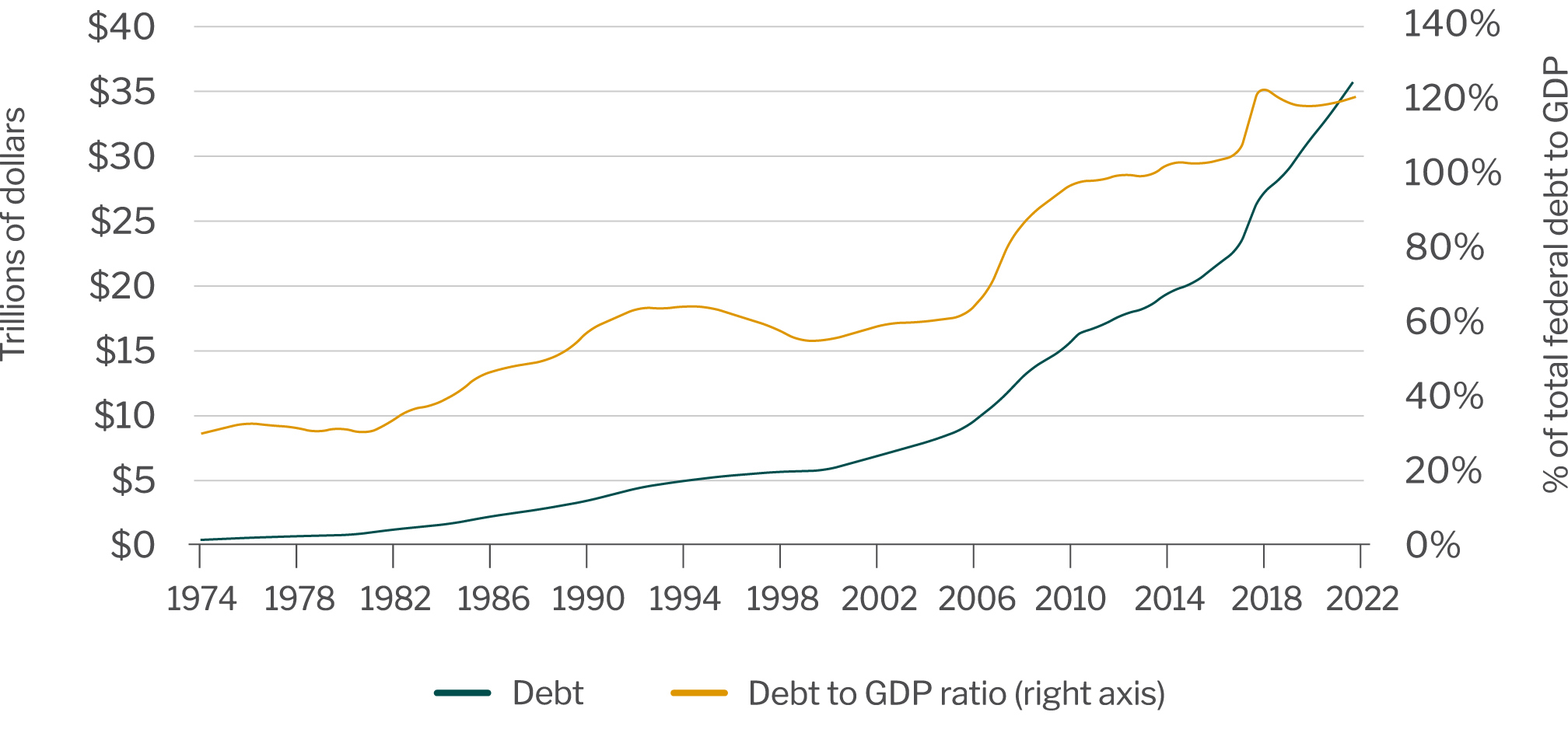

The U.S. federal debt is climbing rapidly (see chart below), which may lead to:

- Higher interest rates: Deficit spending increases the supply of treasury bonds used to fund federal government activity. Increased supply without additional demand puts upward pressure on interest rates.

- Higher inflation: Rising debt levels increase the supply of money. A greater amount of currency spread across the same number of goods and services increases prices.

- Higher taxes: Debt incurred today will need to be repaid. Without cuts to spending, taxes would need to increase.

- Weaker economy: As interest, inflation and tax rates increase, consumers will have less discretionary income to spend on goods and services, assuming wages do not rise at similar levels. Consumer spending makes up about 70% of the U.S. economy.

- Reduced government services: As a greater share of federal expenditures goes toward interest payments, there may be less capacity to fund social services, defense and natural disaster responses.

Federal debt and federal debt to Gross Domestic Product ratio

Source: Department of Treasury. Office of management and Budget.

Debt: Total federal debt.

DOGE was created to address rising debt levels and improve operational efficiency within the federal government. These goals are being met largely by terminating grants, contracts and real estate leases, reducing the federal workforce (currently at about 3 million) and streamlining/removing policies and regulations that inhibit economic activity. DOGE seeks to cut $1 trillion in spending by September 2025 but has not indicated a target debt to GDP ratio. In the short-term, lower federal spending will result in lower GDP readings and higher unemployment levels as federal workers seek new jobs. In the long-term, it should support economic activity by increasing the skilled workforce for the private sector, reducing regulatory compliance costs for businesses and avoiding the negative effects mentioned above.

The full impact of DOGE’s efforts on agriculture is likely to be mixed. In the long-term, producers should benefit from flat to lower interest, inflation, tax and regulatory compliance costs, as well as a stronger economy. However, cuts to both funding and workforces at the U.S. Department of Agriculture (USDA), National Oceanic and Atmospheric Administration (NOAA), U.S. Agency for International Development (USAID) and the Environmental Protection Agency (EPA) may directly impact farmers. Possible outcomes include:

- Longer processing times for crop insurance payments and data reporting, and/or the elimination of specific data reports.

- Reduced support for conservation efforts, technical/extension assistance, academic/government-led research, weather forecasting, forest management and regulatory enforcement.

- Reduced demand for commodities such as corn, soybeans and wheat previously used by USAID to support international development programs.

- Fewer ag-related professions, particularly at the federal level.

The impact of DOGE will be mixed, with economic benefits partially offset by reduced capacity for the government to support the agriculture sector.

Return to Industry Insights home page

IN THIS SECTION

![]()

Quarterly Economic Update

Economic growth has exceeded most expectations over the past several quarters as consumers maintain spending levels.

Learn more